- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (NYSE:RDDT) Seeks More Advertisers While Stock Dips 11% Last Week

Reviewed by Simply Wall St

Reddit (NYSE:RDDT) recently announced an active search for more advertisers to bolster its platform, an endeavor led by COO Jennifer Wong, who emphasized the importance of a diverse advertising portfolio. Despite these strategic moves, the stock saw a 10% decline last week, possibly influenced by market conditions affecting tech stocks broadly. This drop comes amid a wider market upswing, as the S&P 500 is on track to halt its four-week losing streak. Concerns also loom over broader economic impacts, such as tariffs, which continue to inject uncertainty into the market landscape.

We've identified 2 warning signs for Reddit that you should be aware of.

Over the last year, Reddit's total shareholder return reached a substantial 115.60%, indicating robust long-term performance. This impressive outcome significantly surpassed both the US Market, which returned 7.6%, and the Interactive Media and Services industry with a return of 11.6% over the same period. Several factors likely played a role in this performance. Key developments include the expansion of partnerships, such as the collaboration with Intercontinental Exchange in February 2025, and the media authentication service launched with DoubleVerify in June 2024. Additionally, the company's active pursuit of mergers and acquisitions, indicated in part by CFO Drew Vollero's remarks in August 2024, may have contributed positively.

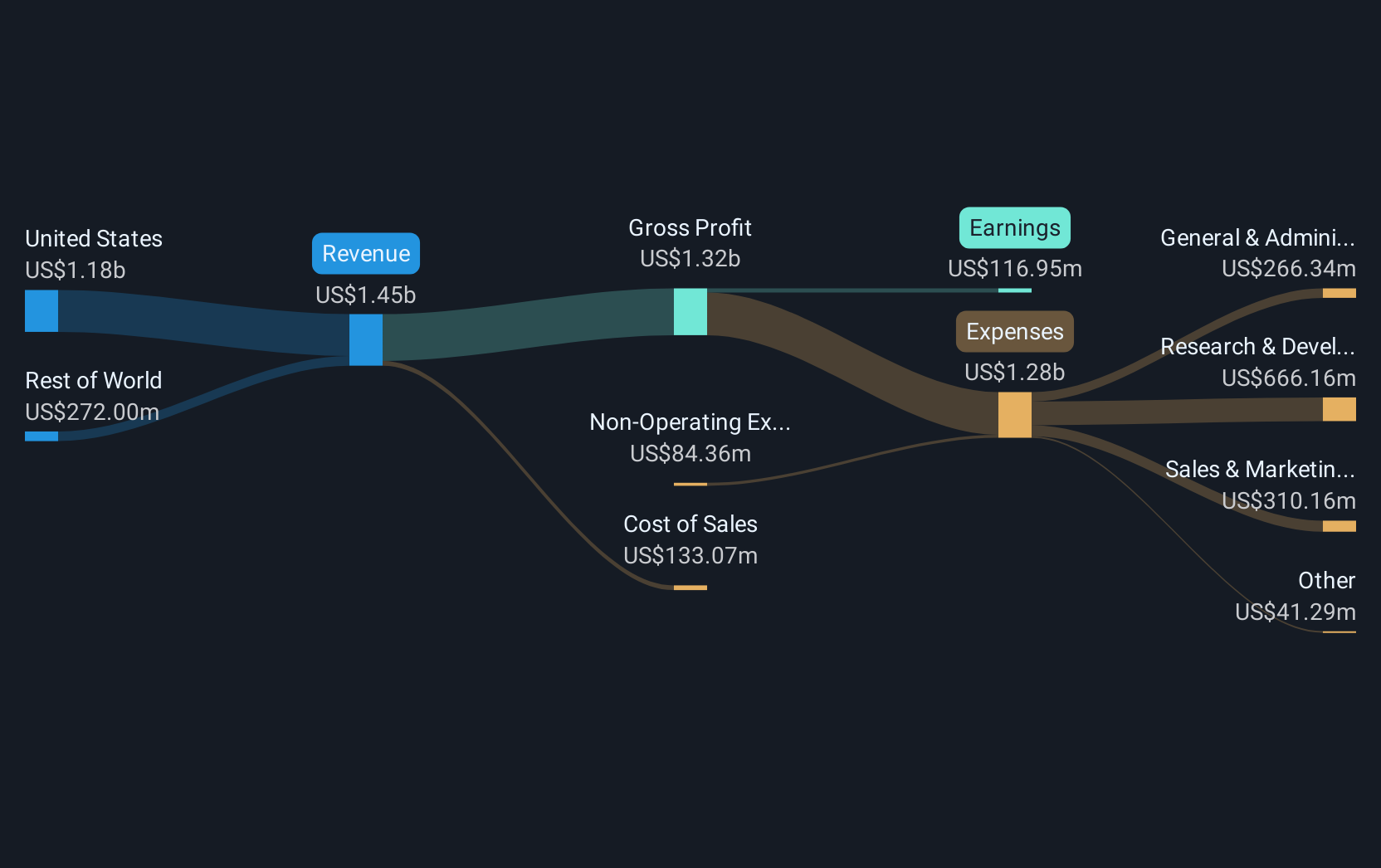

Furthermore, Reddit's inclusion in the S&P Global BMI Index in September 2024 might have enhanced investor perceptions, attracting further investments. Despite facing increased net losses, Reddit reported significant year-over-year sales growth, with full-year 2024 sales reaching US$1.3 billion, a notable increase from the prior year's US$804.03 million. Management's forward-looking revenue guidance for Q1 2025 between US$360 million and US$370 million also underpins the company's optimistic growth trajectory. Overall, these aspects illustrate a promising growth narrative over the past year.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Reddit, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives