- United States

- /

- Interactive Media and Services

- /

- NYSE:RDDT

Reddit (NYSE:RDDT) Extends Credit Facility, Lowers Commitments To US$500 Million

Reviewed by Simply Wall St

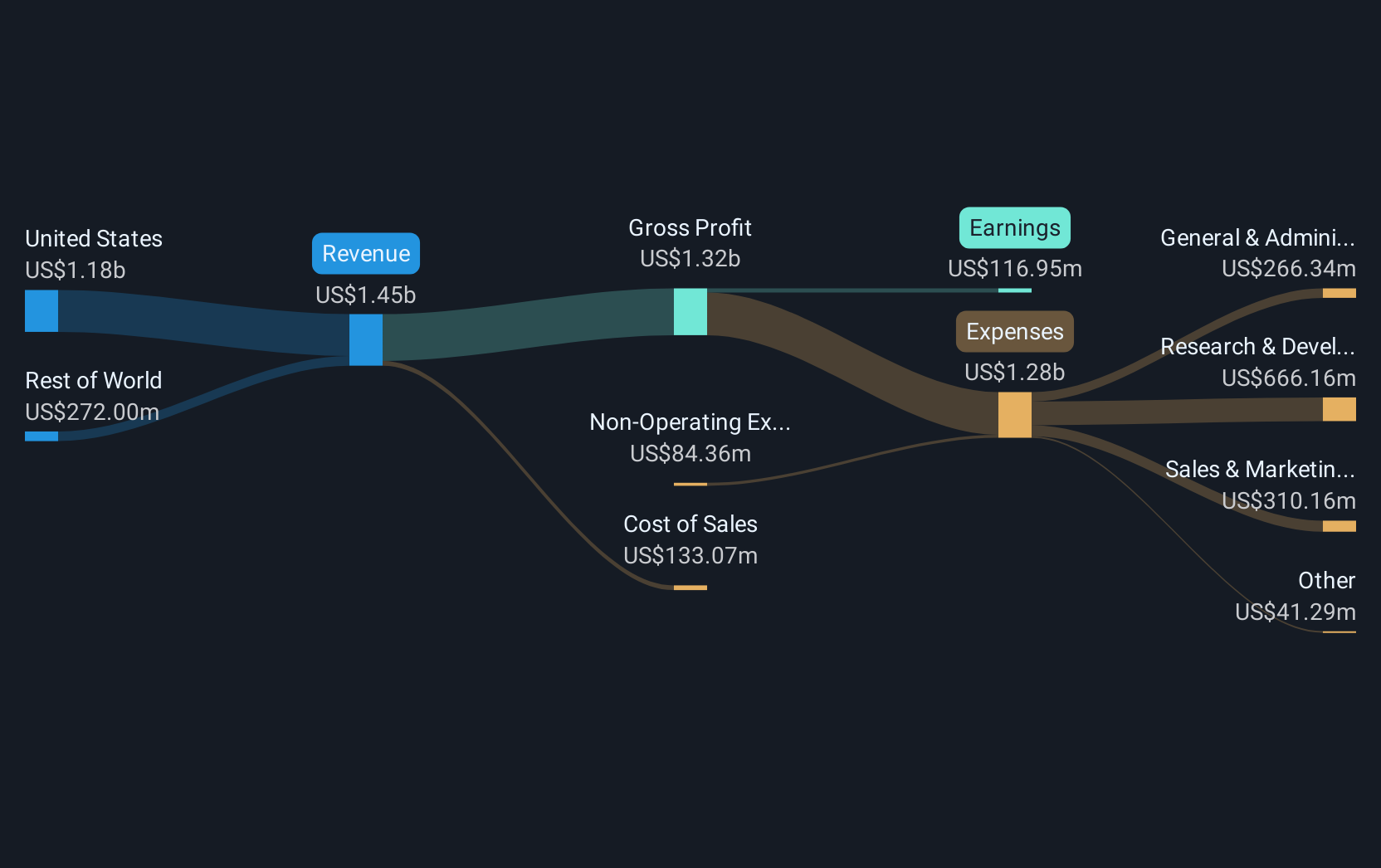

Reddit (NYSE:RDDT) recently entered into a significant Amended Credit and Guarantee Agreement, underscoring its focus on refining its financial strategy. Despite the 39% share price rise over the past quarter, these developments aligned with the broader market trends, where the S&P 500 and Nasdaq experienced overall gains. The extension and adjustment of Reddit's credit facility, along with its appointment to multiple Russell indices, likely added weight to this upward momentum. Moreover, Reddit's impressive Q1 earnings, which reported a stark improvement in profitability, positioned it well amidst a backdrop of high-performing technology stocks within the market.

Be aware that Reddit is showing 1 risk in our investment analysis.

The recent adjustments to Reddit's financial strategy, specifically the Amended Credit and Guarantee Agreement, may fortify its balance sheet and fuel its international, AI-driven, and advertising initiatives. While the shares have surged 39% in the past quarter, the total return including dividends over the last year more than doubled at 107.09%, providing a robust contrast to both the S&P 500's and Nasdaq's gains within a shorter timeframe. Over the past year, Reddit's return also surpassed the broader US market's 13.9% and the US Interactive Media and Services industry's return of 12.7%, underscoring its considerable growth.

The extension of Reddit’s credit facility and its inclusion in several Russell indices could potentially bolster its revenue and earnings outlook. The international expansion and investments in AI and targeted advertising are likely to have a positive influence on these forecasts. However, despite a strong share price rise to US$133.84, it stays just below the analysts’ consensus price target of US$147.97. This current share price reflects a modest 8.9% shortfall from the target, suggesting a belief in fair valuation, yet room for further growth based on anticipated future earnings and revenue developments.

Gain insights into Reddit's historical outcomes by reviewing our past performance report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RDDT

Operates a digital community in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives