- United States

- /

- Hospitality

- /

- NasdaqGS:BKNG

3 Prominent Stocks Estimated To Be Trading At Discounts Up To 33.7%

Reviewed by Simply Wall St

As the U.S. stock market rebounds amid optimism for a resolution to the prolonged government shutdown, investors are eyeing opportunities within this volatile landscape. In such times, identifying undervalued stocks can be crucial for those looking to capitalize on potential discounts, as these stocks may offer significant value relative to their current trading prices.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Old National Bancorp (ONB) | $20.99 | $41.03 | 48.8% |

| Nicolet Bankshares (NIC) | $124.37 | $242.17 | 48.6% |

| Huntington Bancshares (HBAN) | $15.82 | $31.03 | 49% |

| Genius Sports (GENI) | $10.32 | $20.58 | 49.9% |

| First Busey (BUSE) | $23.03 | $45.34 | 49.2% |

| Fifth Third Bancorp (FITB) | $42.99 | $83.23 | 48.3% |

| CNB Financial (CCNE) | $25.15 | $48.36 | 48% |

| Byrna Technologies (BYRN) | $17.94 | $35.45 | 49.4% |

| BILL Holdings (BILL) | $46.57 | $92.80 | 49.8% |

| AbbVie (ABBV) | $225.17 | $433.66 | 48.1% |

Let's dive into some prime choices out of the screener.

Booking Holdings (BKNG)

Overview: Booking Holdings Inc., with a market cap of $159.83 billion, operates through its subsidiaries to offer online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Operations: The company's revenue primarily comes from its Travel Services segment, which generated $26.04 billion.

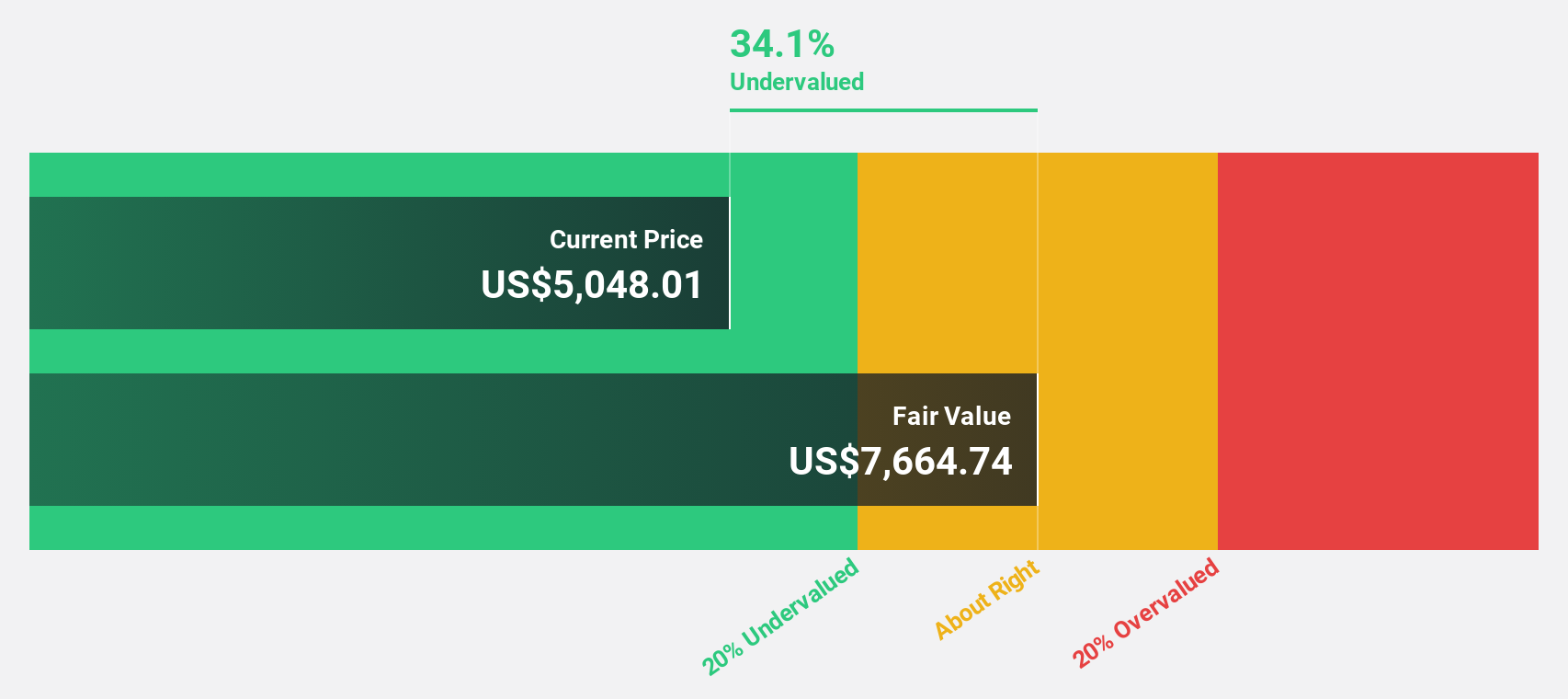

Estimated Discount To Fair Value: 33.7%

Booking Holdings is trading at US$5050.65, significantly below its estimated fair value of US$7613.81, indicating potential undervaluation based on cash flows. Despite high debt levels, earnings are forecast to grow by 20% annually, outpacing the broader U.S. market's growth expectations of 16.1%. Recent financial results show increased quarterly revenue and net income compared to last year, while a recent €749 million fixed-income offering strengthens its financial position amidst ongoing share buybacks and strategic partnerships like Ryanair.

- The growth report we've compiled suggests that Booking Holdings' future prospects could be on the up.

- Take a closer look at Booking Holdings' balance sheet health here in our report.

QUALCOMM (QCOM)

Overview: QUALCOMM Incorporated develops and commercializes foundational technologies for the global wireless industry, with a market cap of $183.75 billion.

Operations: The company's revenue segments include Qualcomm CDMA Technologies (QCT) at $38.37 billion and Qualcomm Technology Licensing (QTL) at $5.58 billion.

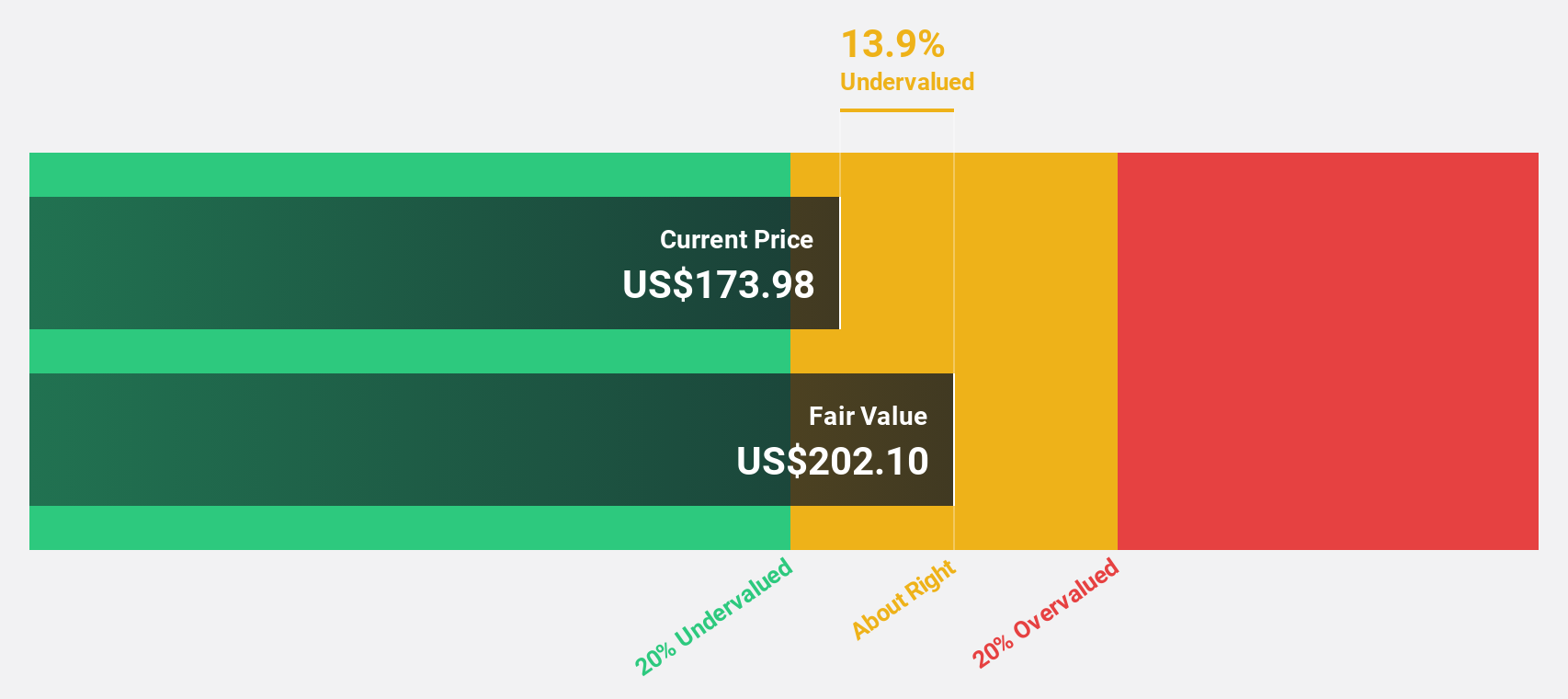

Estimated Discount To Fair Value: 13.7%

QUALCOMM is trading at US$173.98, under its estimated fair value of US$201.66, suggesting potential undervaluation based on cash flows. Despite a recent quarterly net loss of US$3.12 billion, earnings are projected to grow significantly by 20.93% annually over the next three years, surpassing U.S. market expectations of 16.1%. The company anticipates record revenue for Q1 2026 and continues strategic initiatives like share buybacks and AI collaborations with HUMAIN in Saudi Arabia.

- Our expertly prepared growth report on QUALCOMM implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of QUALCOMM with our comprehensive financial health report here.

Reddit (RDDT)

Overview: Reddit, Inc. operates a digital community platform both in the United States and internationally, with a market cap of approximately $38.69 billion.

Operations: The company generates revenue of $1.90 billion from its Internet Information Providers segment.

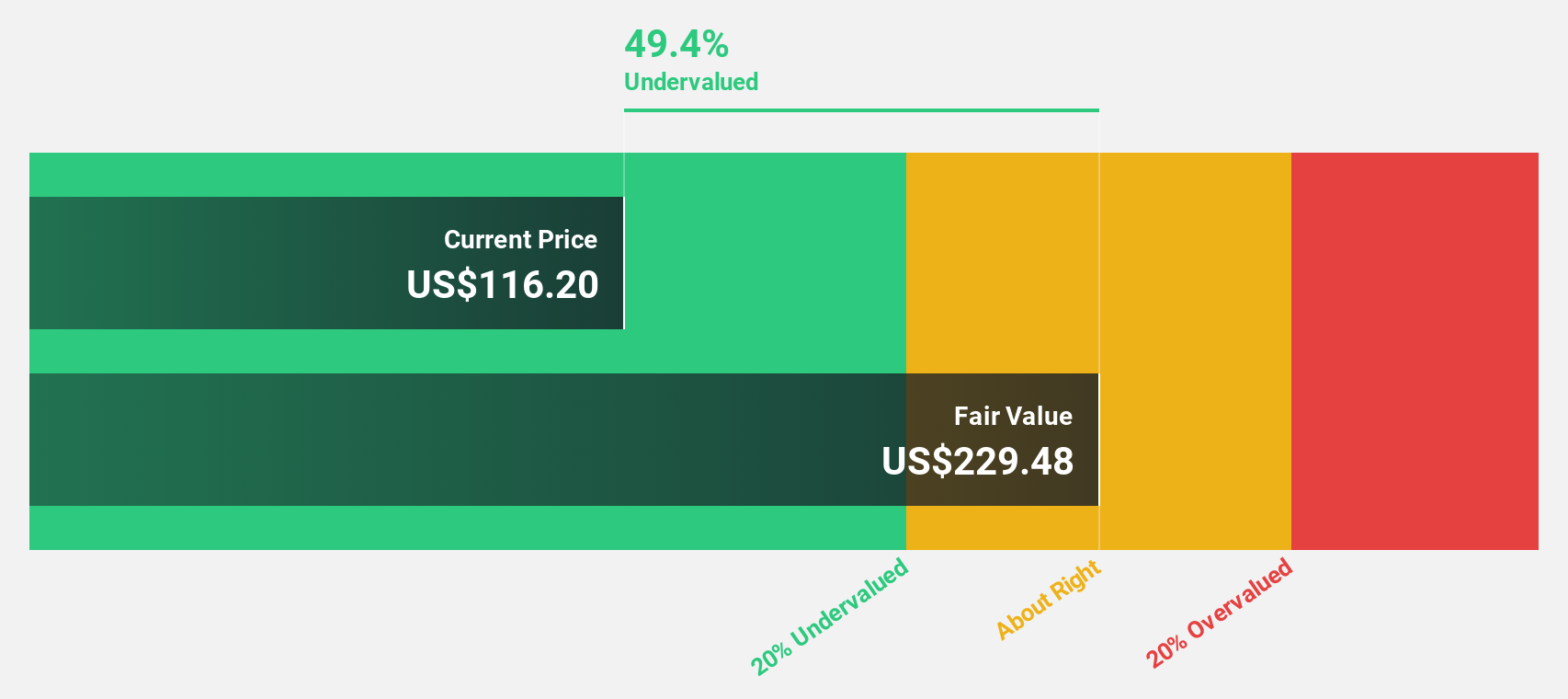

Estimated Discount To Fair Value: 32.1%

Reddit, Inc. is currently trading at US$208.21, below its estimated fair value of US$306.87, highlighting potential undervaluation based on cash flows. The company reported significant growth with Q3 2025 sales reaching US$584.91 million and net income of US$162.66 million, a stark improvement from the previous year’s figures. With revenue and earnings expected to grow substantially over the next three years, Reddit's financial outlook appears robust despite a forecasted low return on equity in three years' time at 18.6%.

- Our earnings growth report unveils the potential for significant increases in Reddit's future results.

- Click here to discover the nuances of Reddit with our detailed financial health report.

Taking Advantage

- Investigate our full lineup of 181 Undervalued US Stocks Based On Cash Flows right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Booking Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:BKNG

Booking Holdings

Provides online and traditional travel and restaurant reservations and related services in the United States, the Netherlands, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives