- United States

- /

- Entertainment

- /

- NYSE:RBLX

Roblox (RBLX): Valuation Check as New Ad Business and Institutional Buying Signal Long-Term Growth Potential

Reviewed by Simply Wall St

Roblox (RBLX) just put its new advertising unit front and center, rolling out Rewarded Video ads that some on Wall Street think could reshape how the platform makes money over the next few years.

See our latest analysis for Roblox.

The new ad push lands as Roblox’s 1 year to date share price return of 61.81 percent and 1 year total shareholder return of 61.54 percent signal strong, but recently choppy, momentum around a 95.21 dollar share price.

If this kind of ad driven growth story interests you, it could be worth scanning other high growth tech names through high growth tech and AI stocks to see what else matches your risk appetite.

With bookings growing, a bold new ad business, and big name funds still buying, Roblox trades at a steep discount to Wall Street targets. Is this a mispriced growth engine, or is the market already discounting tomorrow’s gains?

Most Popular Narrative: 34.6% Undervalued

Against a last close of 95.21 dollars, the most followed narrative pegs Roblox’s fair value far higher, framing today’s pullback as a potential opportunity.

The evolving digital economy on Roblox, including expanded monetization opportunities like digital goods, Rewarded Video ads, and a systematized IP licensing marketplace, is expected to unlock new high margin revenue streams and enhance net margins as adoption matures.

Curious how a loss making platform can still command a rich future earnings multiple? The narrative leans on rapid top line expansion, improving margins, and aggressive share growth assumptions. Want to see the exact roadmap behind that bullish fair value call?

Result: Fair Value of $145.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, escalating infrastructure and safety costs, along with reliance on a handful of viral hits, could quickly compress margins if engagement trends cool.

Find out about the key risks to this Roblox narrative.

Another View: Rich Multiples Raise the Bar

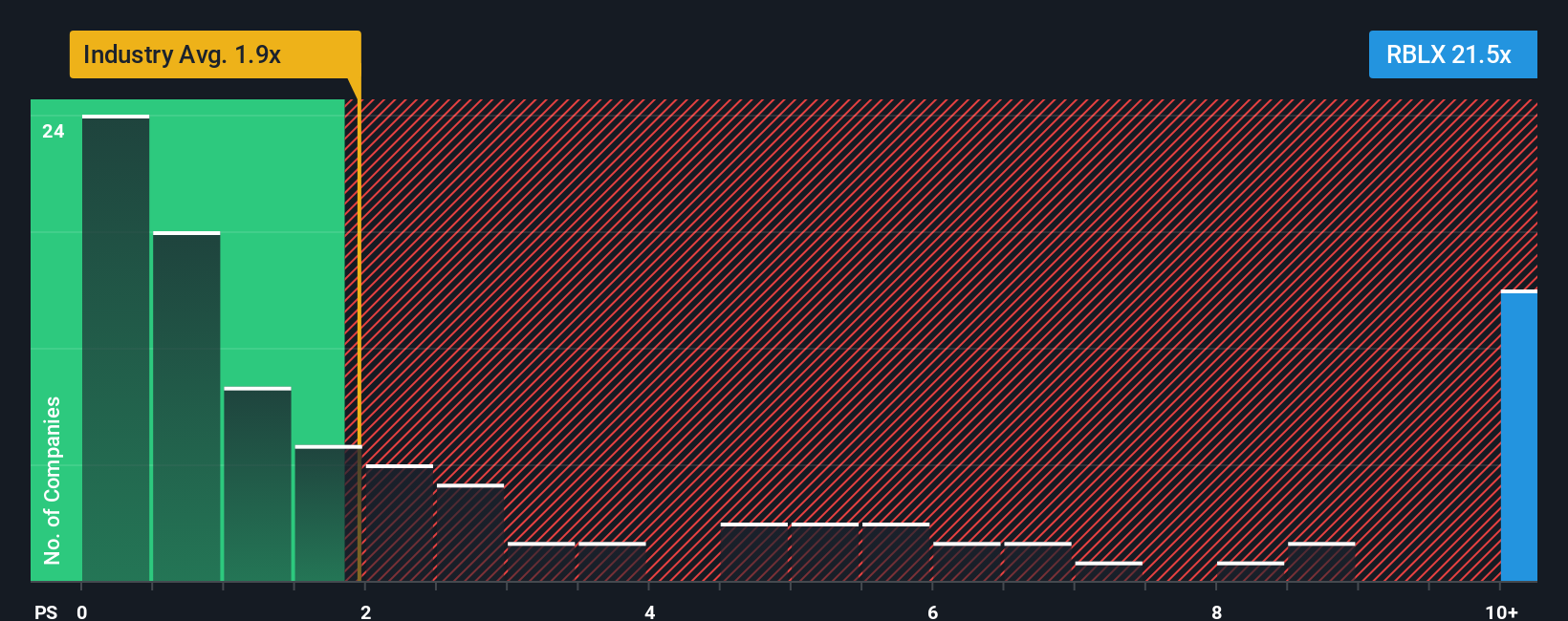

That bullish fair value sits awkwardly beside Roblox’s current price to sales of 15 times, versus 4.1 times for peers, an estimated fair ratio of just 5 times. If sentiment snaps back toward that fair ratio, how much multiple compression are optimistic buyers really prepared to stomach?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roblox Narrative

If you disagree with this angle or would rather dig into the numbers yourself, you can build a personalized narrative in under three minutes: Do it your way.

A great starting point for your Roblox research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before you move on, back yourself with fresh stock ideas from the Simply Wall Street Screener so you are not relying on one story alone.

- Capture potential multi baggers early by scanning these 3574 penny stocks with strong financials that combine tiny market caps with surprisingly solid business fundamentals.

- Target tomorrow’s innovators today by reviewing these 26 AI penny stocks harnessing artificial intelligence to reshape everything from software to hardware.

- Lock in value focused opportunities by filtering for these 907 undervalued stocks based on cash flows where cash flows suggest the price tag still underestimates future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026