- United States

- /

- Entertainment

- /

- NYSE:RBLX

Roblox (RBLX) Share Price Surges 44% Over Last Quarter

Reviewed by Simply Wall St

Roblox (RBLX) recently introduced Roblox Sentinel, an AI tool aimed at enhancing user safety, and a Learning Hub for educational engagement. Despite these positive product developments, the company's share price rose by 44% over the last quarter amidst a backdrop of significant net losses and a legal lawsuit concerning child safety. This remarkable price move reflects the company's potential to innovate and pivot strategically, even as it navigates substantial challenges. Meanwhile, in the broader market, major indices experienced gains but hovered near record highs, suggesting that Roblox's price appreciation was not solely influenced by general market trends.

We've spotted 2 warning signs for Roblox you should be aware of.

As Roblox continues to roll out innovative features like Sentinel and the Learning Hub, the company's efforts seem poised to support its narrative of growth through international expansion and enhanced monetization tools. These developments could potentially bolster user engagement and safety, crucial factors given the ongoing lawsuit concerning child safety. Over the past year, Roblox's total shareholder return, including share price appreciation and dividends, was a remarkable 187.18%, indicating strong market confidence despite ongoing challenges. In comparison, while major indices hovered near record highs, Roblox's performance over the last year far surpassed both the US market return of 16.1% and the US Entertainment industry, which saw an impressive 70.1% return over the same period.

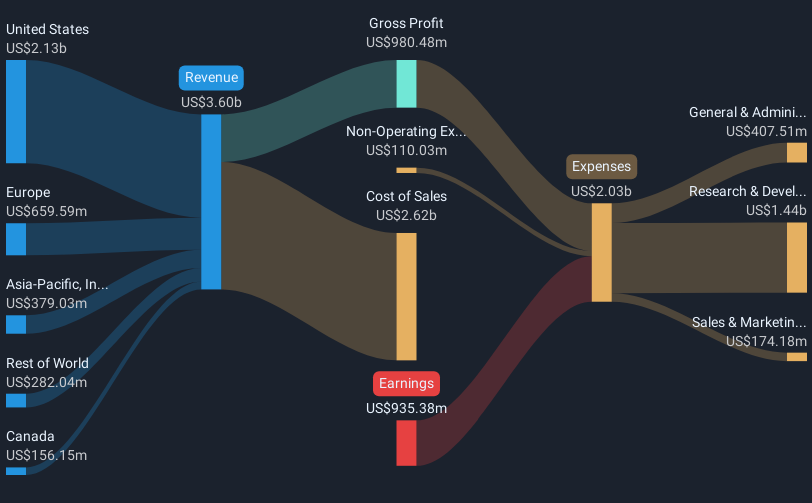

Roblox's strategic focus on growing its older user base and broadening its revenue streams through new monetization opportunities may impact future revenue and earnings forecasts positively. However, with net losses currently at US$952.33 million, a pathway to profitability remains uncertain in the short term. Analysts see potential, with a consensus price target of US$142.32, representing a 10.9% premium over the current share price of US$117.34. While this suggests room for future upside, investors should weigh this against the inherent risks and the analysts' expectations of continued unprofitability over the next three years. The contrast between the current and forecast PE ratios may reflect assumptions of significant growth in earnings and revenue.

Review our historical performance report to gain insights into Roblox's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.