- United States

- /

- Entertainment

- /

- NYSE:RBLX

Roblox (RBLX): Evaluating Valuation as New Mattel Games Expand Major Brand Partnerships

Reviewed by Kshitija Bhandaru

Roblox (NYSE:RBLX) and Mattel are taking their partnership to the next level, rolling out a new wave of games inspired by iconic Mattel brands like Monster High, Barbie, Hot Wheels, and UNO. The announcement highlights Roblox’s approach to increasing user engagement through collaborations with well-known franchises, with the goal of attracting both new and returning players.

See our latest analysis for Roblox.

Roblox is riding a wave of momentum thanks to high-profile collaborations and strong user growth, with its recent Mattel deal only adding fuel to the story. Even after a slight dip in the latest session, the company’s impressive 128.6% year-to-date share price return and a total shareholder return of 237% over the past year have firmly signaled growing optimism about its long-term platform potential.

If this surge in gaming momentum has you curious about other innovators, now is the perfect moment to explore the latest trends in tech and interactive entertainment with See the full list for free.

With the stock boasting strong returns and bullish analyst upgrades, the key question now is whether Roblox remains undervalued at current levels or if its potential is already fully reflected in its price, which could leave little upside for new investors.

Most Popular Narrative: 9.3% Undervalued

With Roblox closing at $134.49 and the most widely followed estimate calling fair value at $148.32, market assumptions are running high. The stage is set for big expectations as investors assess whether growth catalysts can really justify this price gap.

Advancements in platform infrastructure, scalability, and AI-driven content tools are reducing barriers for creators, fueling an acceleration of user-generated content and viral hits; this strengthens engagement, increases DAUs, and supports long-term growth in transaction-based revenue and average bookings per user.

Do you want to know what powers this premium valuation? The narrative hinges on aggressive growth bets and a future profit leap that could surprise even bulls. The story behind the numbers might upend your view of what is possible. Find out which ambitious projections set this fair value apart.

Result: Fair Value of $148.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising developer payouts and intensifying competition could pressure Roblox’s margins and limit the upside if user and monetization growth cannot keep pace.

Find out about the key risks to this Roblox narrative.

Another View: Valuation by Price-to-Sales

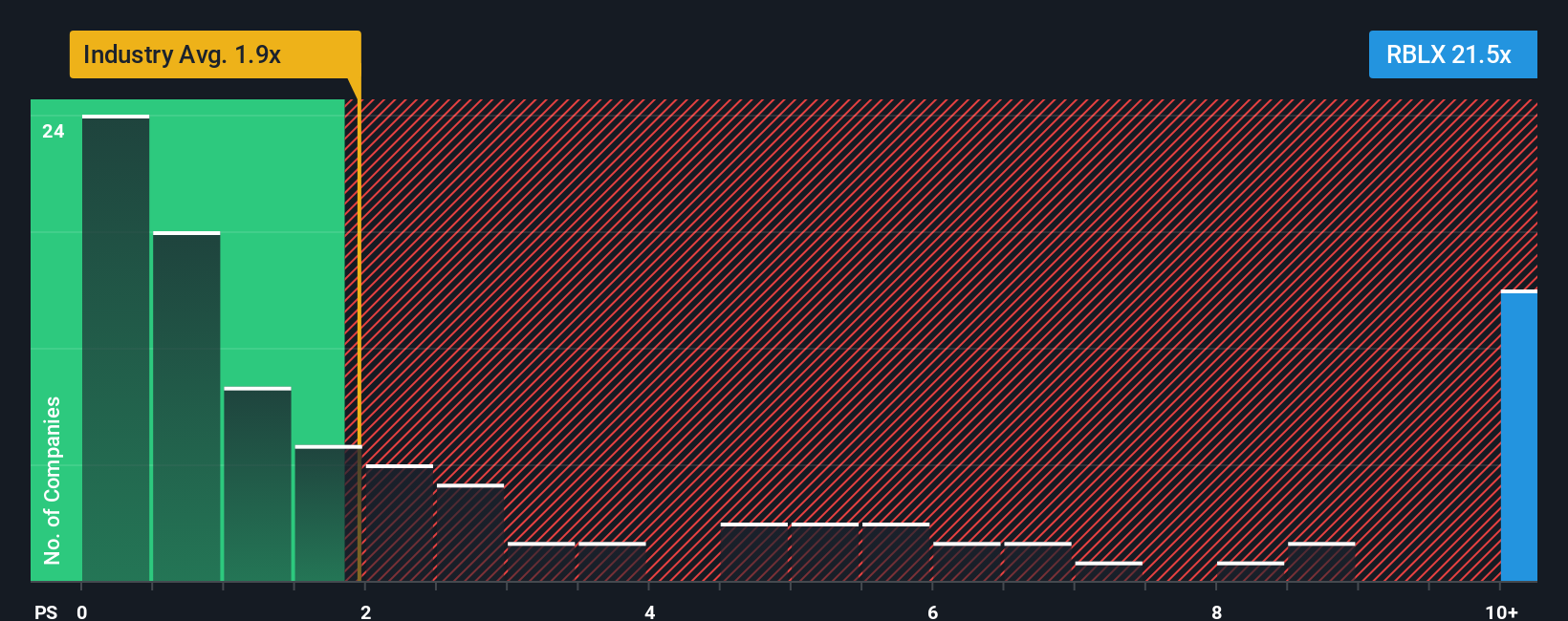

While some see major upside based on future growth, our price-to-sales ratio tells a very different story. Roblox trades at 23.2 times sales, much higher than both the US Entertainment industry average of 1.9 and the peer average of 5.8. Even the fair ratio of 6.3 is far below today’s multiple, meaning the stock looks expensive by this measure. Could Roblox's rapid revenue growth eventually justify this premium, or is there real risk that expectations have gone too far?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Roblox Narrative

If you see things differently or enjoy doing your own digging, you can craft your own analysis in under three minutes: Do it your way

A great starting point for your Roblox research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next trend to pass you by. Power up your watchlist with more potential winners using these selective stock screens from Simply Wall Street:

- Capture long-term growth by targeting quality businesses trading below their estimated value with these 873 undervalued stocks based on cash flows. This screen is designed to spotlight hidden opportunities based on future cash flows.

- Boost your portfolio’s income potential by checking out these 20 dividend stocks with yields > 3%, which features stocks with robust yields over 3% for recurring returns.

- Ride the AI wave and pinpoint trailblazing technology stocks with these 24 AI penny stocks that are influencing tomorrow’s innovations today.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives