- United States

- /

- Entertainment

- /

- NYSE:RBLX

Is There Still Upside for Roblox After Its 232.9% Surge in the Past Year?

Reviewed by Bailey Pemberton

If you’ve been watching Roblox lately and wondering whether it’s the right moment to buy, sell, or just hold tight, you’re not alone. Investors everywhere are buzzing about its sharp rise this year. Roblox stock has climbed 125.9% year-to-date and an impressive 232.9% over the past twelve months. Even after some short-term turbulence, like the recent 1.8% dip in the past month, the long-term story has been about notable growth.

So, what’s behind all these swings? Part of it is Roblox’s unique position in the gaming and digital experiences world, which keeps it in the spotlight as the market evolves. News about shifts in consumer habits, major technology collaborations, or broader moves in digital platforms often send ripples through Roblox’s price and reflect changing investor perceptions about risk and opportunity. Despite all the excitement, there is an important question: is Roblox truly undervalued, or is the market simply caught up in the growth story?

According to traditional valuation measures, Roblox scores 0 out of 6 on the undervaluation checklist. This suggests that, strictly by the numbers, there is little evidence it is a bargain at current levels. But before making any big moves, it is important to break down exactly how these valuation checks work and why understanding them is just the starting point for seeing the bigger picture on Roblox.

Roblox scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Roblox Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company’s future cash flows are worth today. This is done by projecting how much cash Roblox will generate in the coming years and then discounting those figures back to the present using a reasonable rate. This process provides a calculation of the business’s underlying value in today’s dollars.

For Roblox, the most recent data shows Free Cash Flow (FCF) of $720.6 Million. Looking ahead, analysts forecast steady growth in FCF with projections rising to around $3.8 Billion by 2029, and longer-range estimates, even those that extend beyond what analysts typically provide, reach over $6.3 Billion by 2035 based on Simply Wall St’s methodology. These projections, while partly extrapolated, suggest significant scaling in cash-generating ability over time.

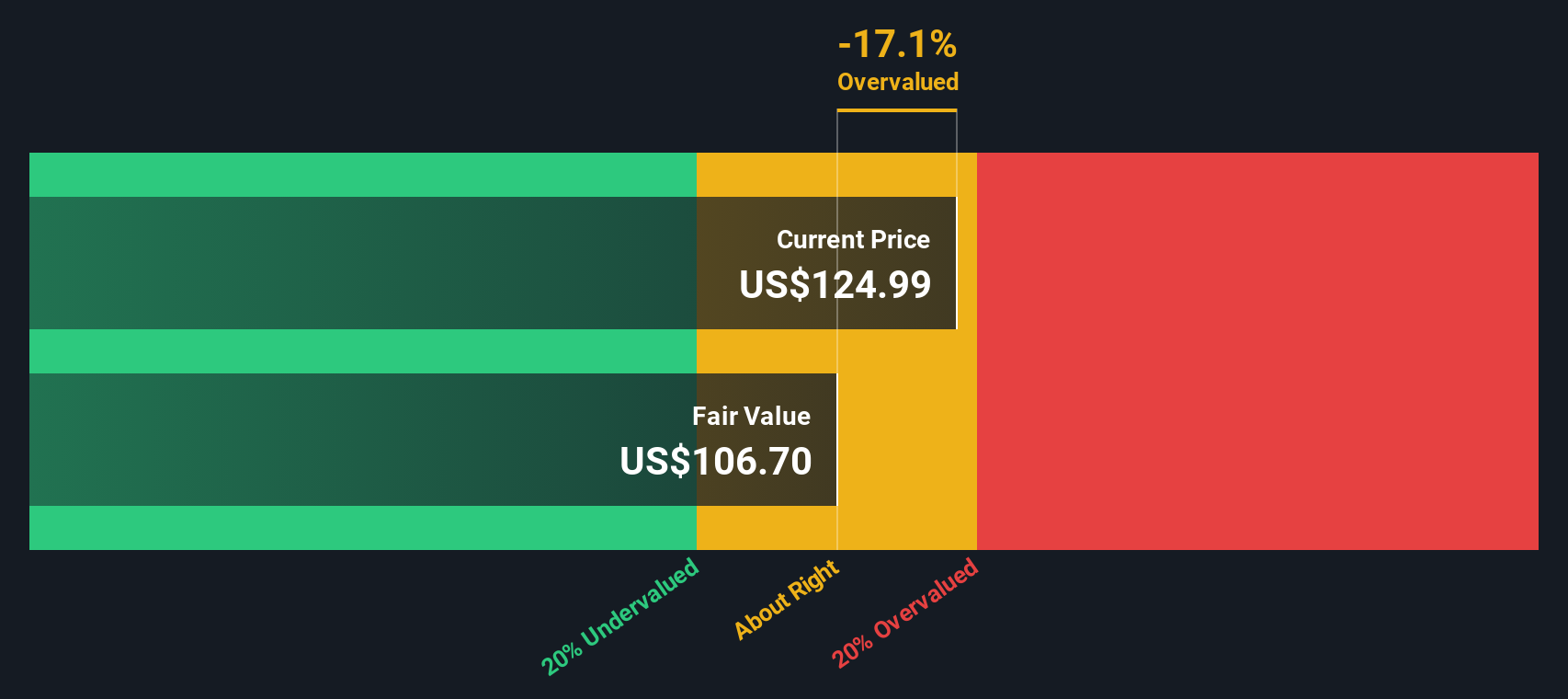

When all of these future cash flows are discounted back to today’s dollars, the resulting intrinsic value comes in at $106.63 per share. That means Roblox’s current price is roughly 24.7% above what this DCF suggests as fair value, indicating a notable premium in the market right now.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roblox may be overvalued by 24.7%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Roblox Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used valuation tool, particularly for companies like Roblox that are still building profitability or reinvesting heavily for growth. The P/S ratio helps investors judge whether a stock’s price accurately reflects the revenue the company generates. This makes it valuable for evaluating growth-stage businesses and firms operating in innovative markets.

Higher P/S ratios are often seen in companies expected to deliver rapid sales growth or those enjoying stronger margins relative to peers. At the same time, investors should remember that higher risks, slower expected growth, or fierce competition can justify a lower "normal" P/S ratio. Deciding what counts as "fair" requires balancing these expectations against the company’s actual and forecasted performance.

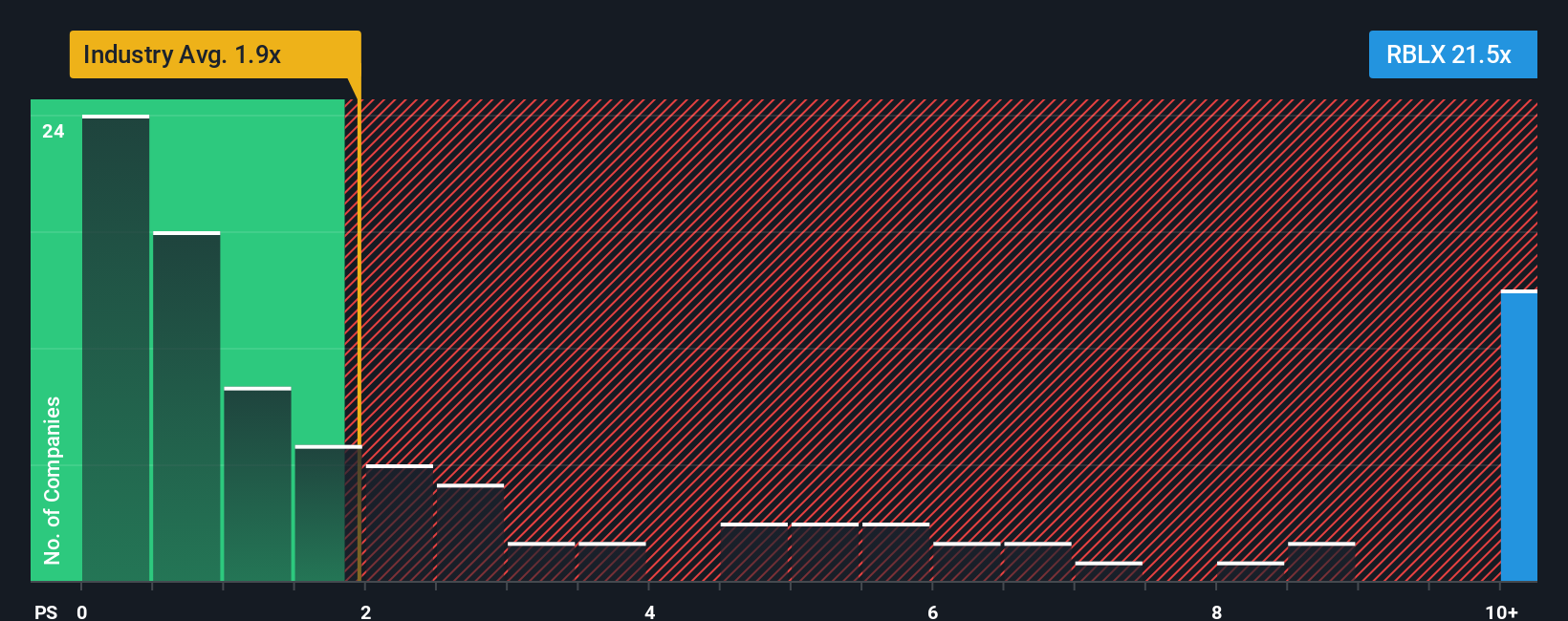

Roblox is currently trading at a lofty 22.90x P/S, significantly higher than both the industry average of 1.84x and the peer group average of 5.82x. However, to gain true perspective, it is important to consider the "Fair Ratio," a proprietary metric from Simply Wall St that blends factors like Roblox’s sales growth outlook, profit margin quality, its size, industry risks, and the broader entertainment sector landscape. This approach goes further than standard industry or peer benchmarks and offers a more tailored measure of fair value that adjusts for growth prospects and business risks.

Comparing Roblox’s current P/S of 22.90x to its Fair Ratio of 6.28x, the stock still appears significantly overvalued, even when considering its growth profile and market position.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roblox Narrative

Earlier, we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal story about a company; it connects your view of Roblox’s future (like sales growth, profit margins, or international expansion) with a specific financial forecast and a fair value estimate. Narratives link the "why" behind your expectations to what that means for the numbers, making investment decisions more intuitive and grounded.

Narratives are available for everyone on the Simply Wall St Community page, giving millions of investors a simple and dynamic tool to frame their own opinion. You can clearly see whether your version of Roblox’s story suggests it is time to buy, hold, or sell, by directly comparing your Fair Value with today’s share price.

Unlike static models, Narratives automatically update whenever new data is released. For example, news headlines, company announcements, or earnings surprises instantly adjust your Narrative’s forecast and valuation, helping you stay in sync with the latest market realities.

For Roblox, some investors see the path to $175 per share, driven by global expansion and monetization. Others focus on execution risks and set a far lower target of $62, so your Narrative helps you define your own expectation, grounded in your understanding of the business.

Do you think there's more to the story for Roblox? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives