- United States

- /

- Entertainment

- /

- NYSE:RBLX

Is Now the Right Moment for Roblox After Target Raised to $125 on User Surge?

Reviewed by Bailey Pemberton

Wondering whether now is the time to buy or hold Roblox stock? You are definitely not alone. With the share price surging an eye-catching 126.9% year-to-date and a breathtaking 216.5% over the past year, Roblox has gotten a lot of investors talking. It is one of those stocks that seems to be either dazzling the market with growth, such as when it hit record concurrent user highs, or stirring up nerves, as with recent headlines pointing to potential SEC scrutiny or legal challenges related to child safety.

Still, the stock seems to maintain serious momentum. Even just in the past week, Roblox gained 1.1%, and over the last month it is up 3.9%. Some of that confidence likely ties to Wall Street’s rosy outlook. Just last month, Roblox’s price target was bumped up by a major analyst, with usage metrics breaking new ground and content creators seeing real money roll in.

Of course, the story is not all positive buzz. Fresh legal issues could introduce uncertainty, and valuation is a sticking point. If you are hoping for a case that Roblox is a hidden bargain, the numbers are clear: on the six major checks analysts use to spot undervalued companies, Roblox actually scores a zero out of six. None of the traditional value signals flash green right now.

That may sound harsh, but don't tune out yet. A lot of investors make the mistake of stopping at basic valuation screens. Instead, let us walk through the usual valuation approaches, then look beyond them, toward a smarter way to judge Roblox’s true worth.

Roblox scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Roblox Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model works by forecasting a company’s future cash flows, then discounting them back to today’s value. This method aims to estimate the true, intrinsic worth of a business based on real cash it could generate over time.

For Roblox, analysts report a latest twelve months free cash flow of approximately $720.6 million. Looking ahead, professional forecasts suggest substantial growth, with free cash flow projected to reach nearly $3.8 billion by the end of 2029. The projections for years beyond analyst estimates are extrapolated, and they reveal a strong upward trend based on rising user engagement and monetization.

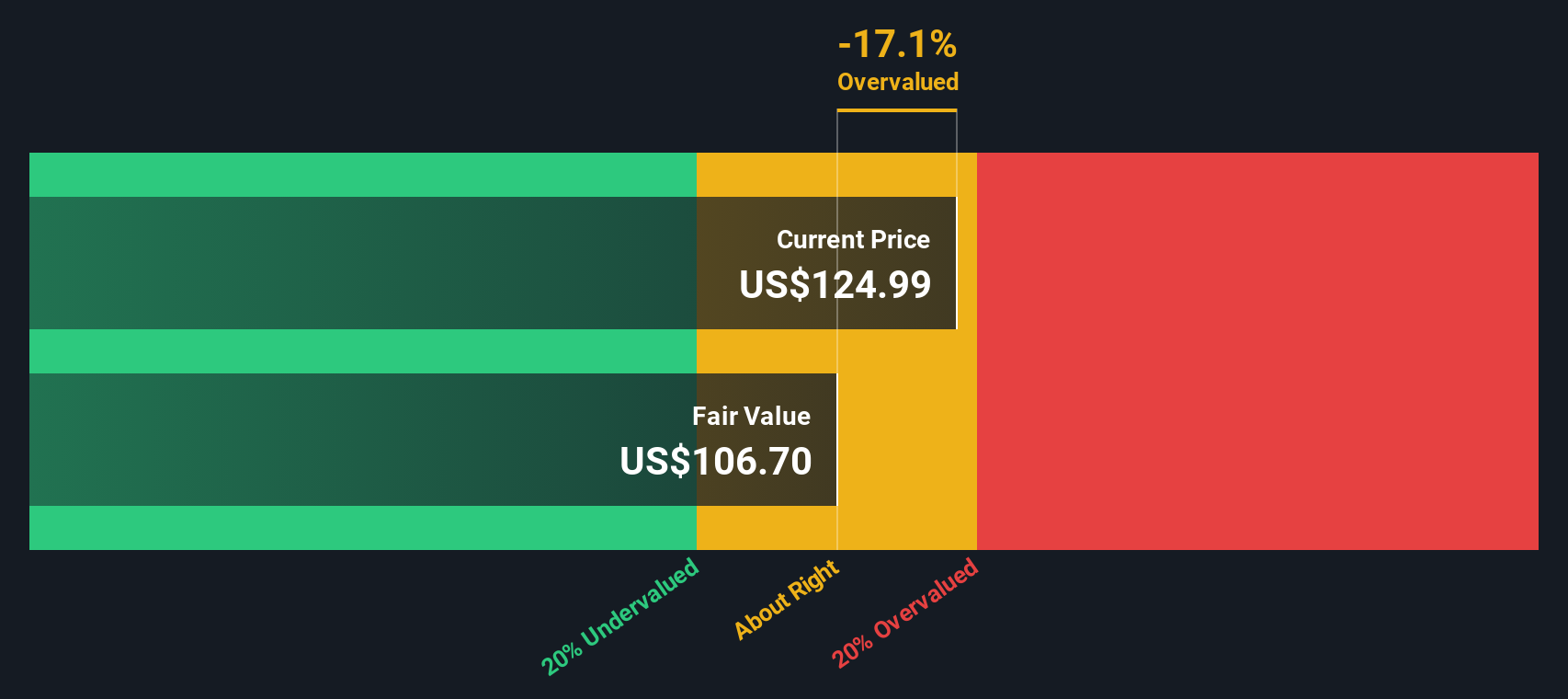

Using these figures, the DCF model puts Roblox’s fair value at $106.65 per share. Comparing that to the current share price, however, the model signals that the stock is about 25.2% overvalued. While Roblox’s future cash flows are expected to expand rapidly, the recent run-up in the stock appears to have left it trading well above its calculated intrinsic value.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Roblox may be overvalued by 25.2%. Find undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Roblox Price vs Sales

The Price-to-Sales (P/S) ratio is a widely used metric for valuing companies that are not yet profitable but are demonstrating strong revenue growth, like Roblox. It helps investors compare the value the market puts on a company’s sales relative to others, making it a practical choice when earnings are not positive or consistent.

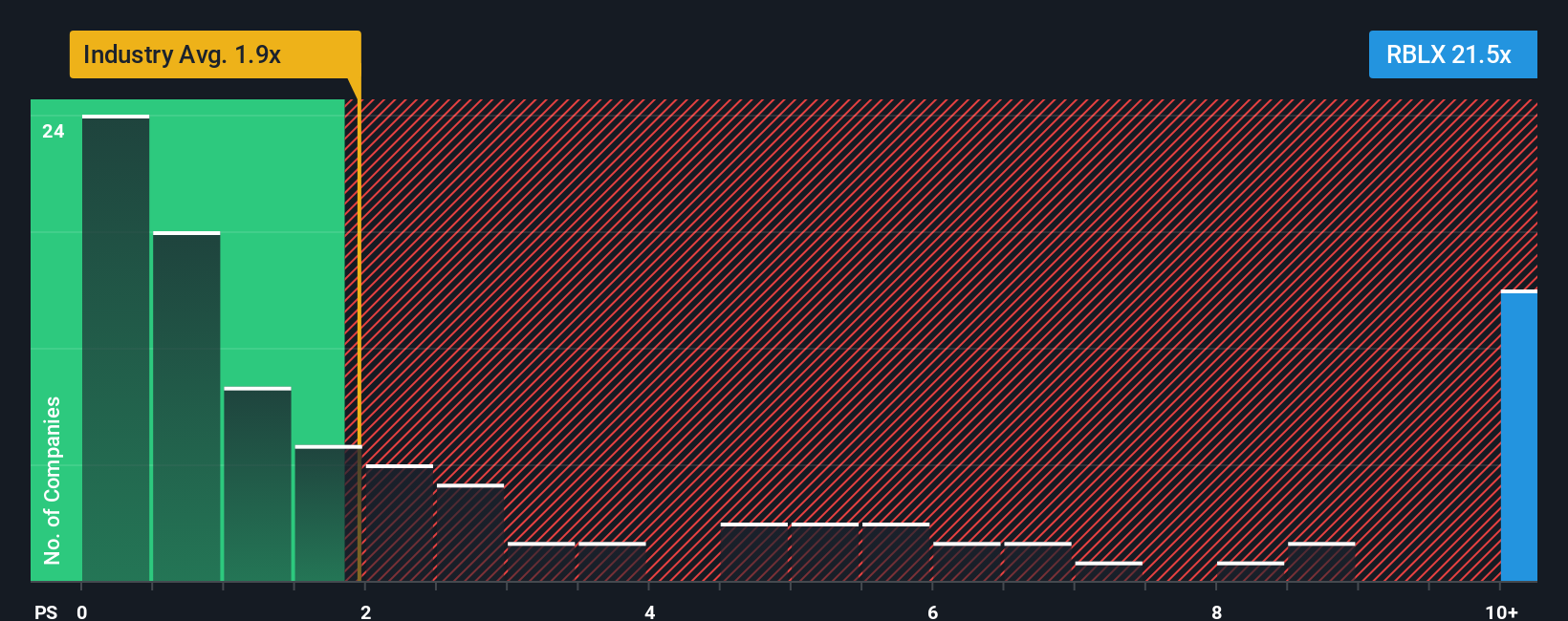

Generally, companies with higher growth expectations or lower risk can command a higher P/S ratio. Conversely, businesses in mature industries or those facing more risk will often have lower ratios. For Roblox, the current P/S ratio stands at 23x. This is notably higher than the entertainment industry average of 1.89x and the peer average of 5.90x. This elevated multiple reflects the market’s excitement around Roblox’s growth and user engagement, but also brings questions about sustainability.

To provide better context, Simply Wall St calculates a bespoke “Fair Ratio” for the stock. This approach goes beyond basic peer or industry comparisons by factoring in Roblox’s expected revenue growth, risk profile, profit margins, market capitalization, and its place within the industry. The Fair Ratio for Roblox is 6.15x, a figure that more closely reflects the company’s genuine prospects and risks than a simple comparison.

Looking at the overall picture, with Roblox trading at 23x sales compared to a Fair Ratio of 6.15x, the stock appears priced well above what you might expect for its fundamentals. This indicates a substantial premium is already reflected in the shares.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Roblox Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, an accessible approach that empowers investors to connect real stories and expectations about a company directly with financial forecasts and fair value estimates.

A Narrative is simply your perspective or story about Roblox, what you believe about its opportunities, risks, and future growth, and it links those beliefs to concrete numbers like projected revenue, earnings, and margins, resulting in your version of fair value.

On Simply Wall St’s Community page, used by millions of investors, Narratives are easy to explore and update. They are automatically refreshed with new information, such as earnings results or news headlines, so you always have the latest insights.

Narratives help you make smarter buy or sell decisions by comparing your fair value (from your story) to today’s market price, giving you clarity rooted in both data and personal conviction.

For example, some investors’ Narratives for Roblox predict as much as $175 per share based on robust global user growth and monetization, while others who are more cautious about margins or competition set their fair value as low as $62. This demonstrates how beliefs lead to different numbers and actions.

Do you think there's more to the story for Roblox? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RBLX

Roblox

Operates an immersive platform for connection and communication in the United States and internationally.

Adequate balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives