- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Weekly Picks: 📈 PINS' Multiple Tailwinds, BXB Compounds, and STG's Challenging Future

Welcome back to Weekly Picks, where each week our analysts hand pick their favourite Narratives from the community ( what is a Narrative? ).

This week’s picks cover:

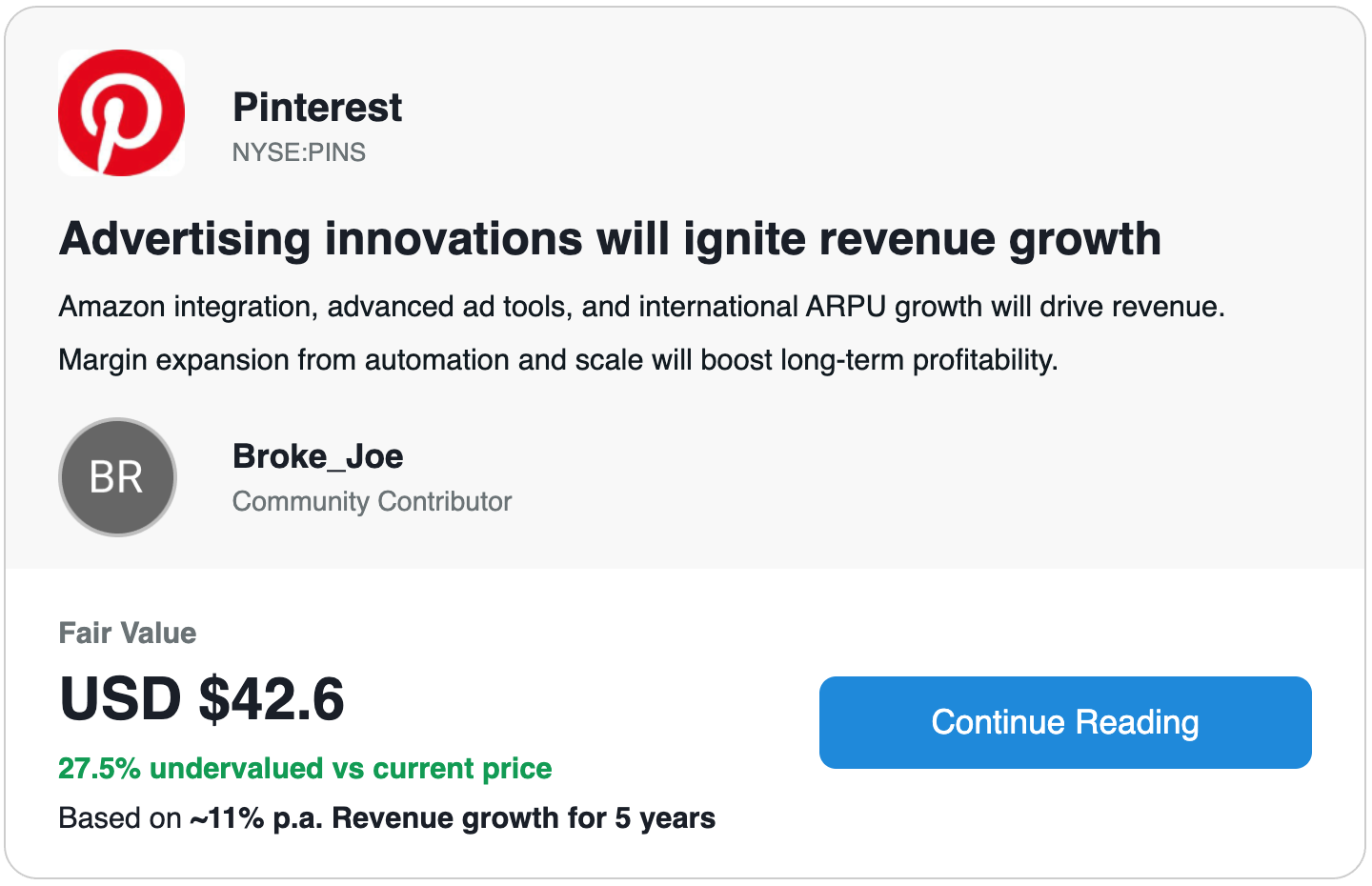

- 📈 Why PINS could be positioned to surge from multiple tailwinds

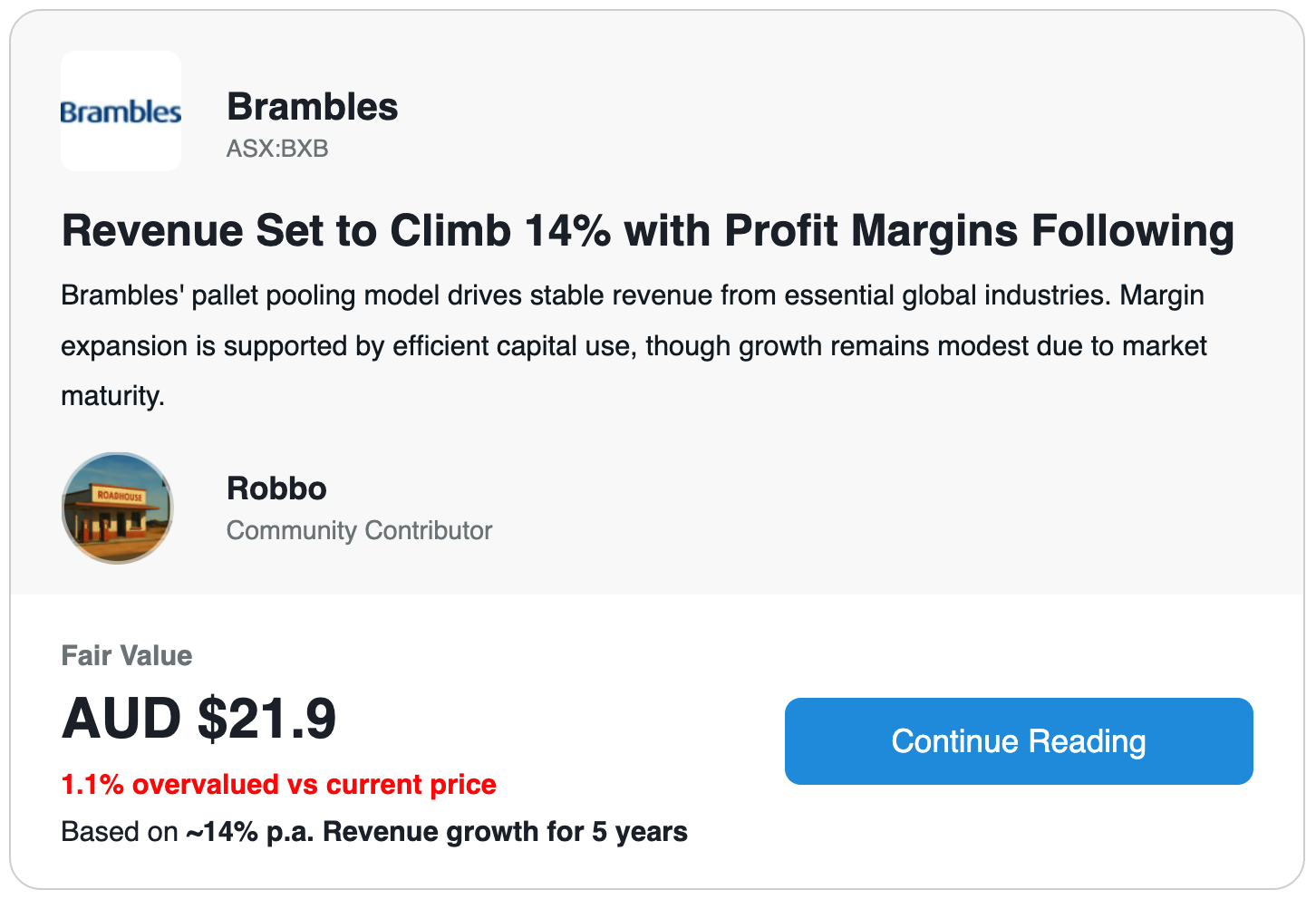

- 💸 How Brambles can continue delivering as a steady compounder

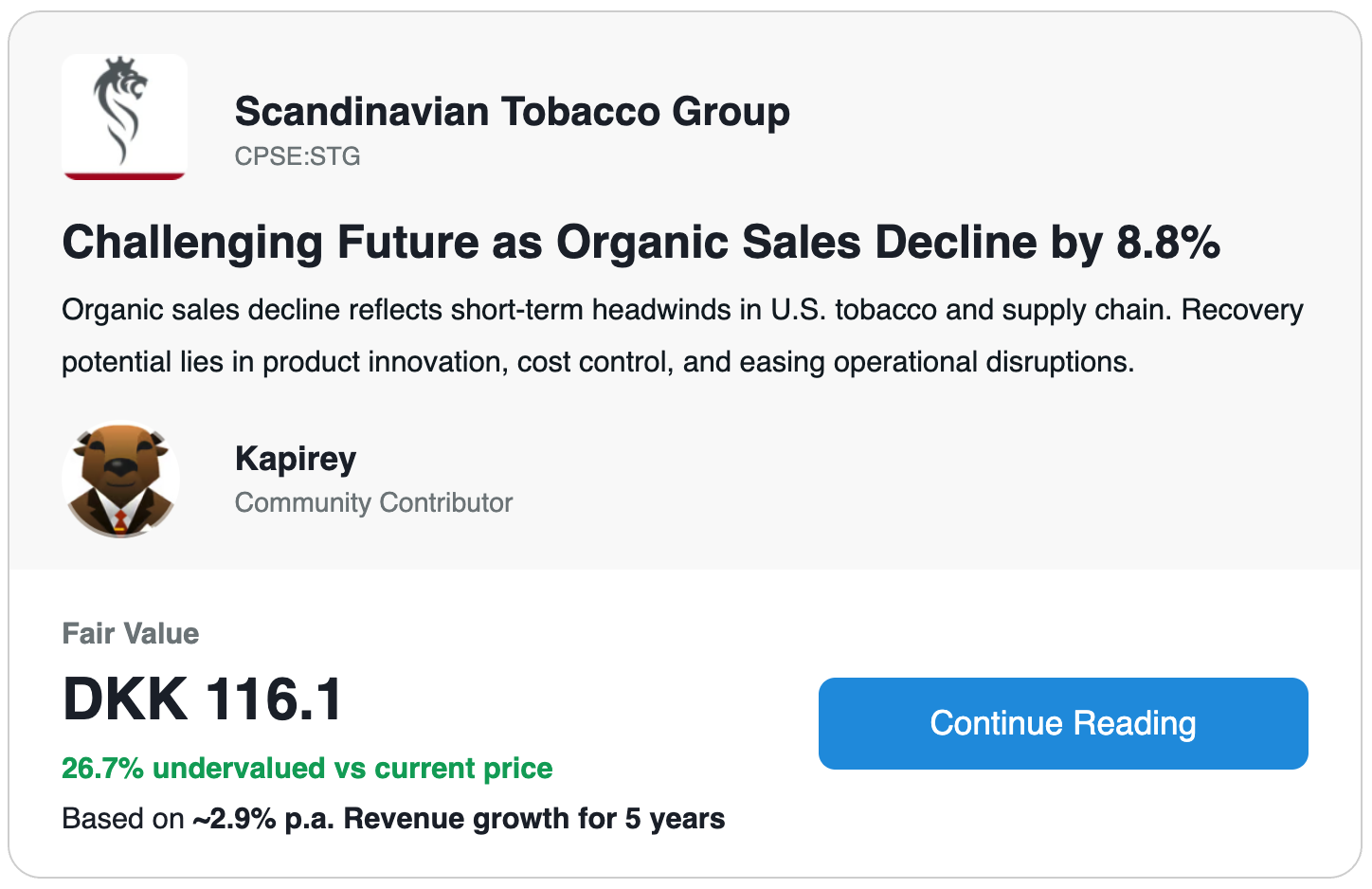

- ⚖️ Why STG faces headwinds, but might still represent good value and yield

💡 Why we like it: This thesis nails Pinterest’s unique position: high-intent users, strong ad tailwinds, and platform leverage. The author blends credible financial projections with a clear upside case, making the risk/reward feel both asymmetric and grounded.

💡 Why we like it: It’s a clear-eyed view of a durable, cash-generative business that wins by doing the basics exceptionally well. It provides a strong case for Brambles as a compounder with ESG tailwinds, stable income, and operational leverage. While trading around fair value, the 3.4% yield from dividends and buybacks would add nicely to the estimated share price growth.

💡 Why we like it: This is a grounded breakdown of a company in transition. It’s clear about where the cracks are (organic sales, margins) but also where there’s still hope (cash flow, new products). The author lays it out without spin, giving investors what they need to assess the risk.

What's next?

-

🔔 Know when to act: Set the narrative valuations as your own fair value to know when to buy, hold or sell the stock.

-

🤔 Get answers: Ask the author any questions in the comments section. Feel free to like as well to support their work.

-

✨ Discover more Narratives: There are hundreds of other insightful stock narratives on our Community page .

-

✍️ Build an audience: Have your narrative seen by millions of investors, simply meet our Featuring criteria to go into the running!

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Michael Paige and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Michael Paige

Michael is the Content Lead at Simply Wall St. With over 9 years of experience analysing and researching companies, Michael contributes to the creation of our analytical content and has done so as an equity analyst since 2020. He previously worked as an Associate Adviser at Ord Minnett, helping build and manage clients' portfolios, and has been investing personally since 2015.

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026