- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

Pinterest (NYSE:PINS) Jumps 16% Post Q4 Earnings With Sales Surpassing US$1B

Reviewed by Simply Wall St

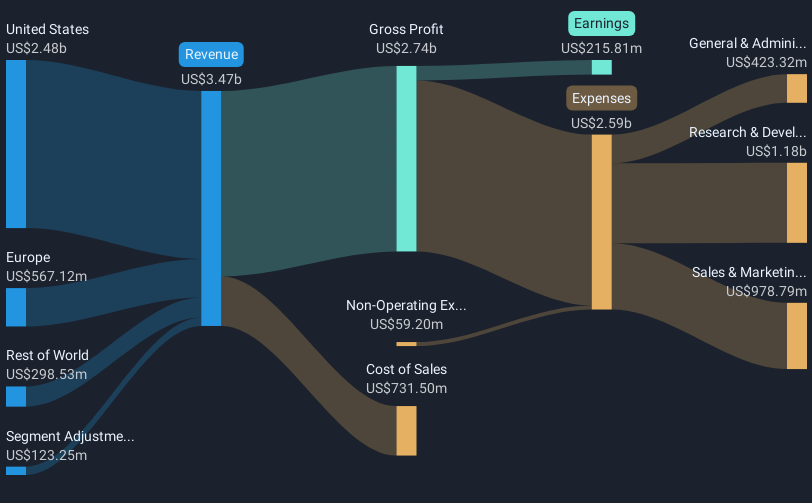

Pinterest (NYSE:PINS) announced a partnership with Taste of Home on March 6, 2025, for an exclusive video series, boosting its content reach and engagement on the platform. Over the last quarter, the company saw its share price rise by 15.82%, possibly influenced by this exciting collaboration and robust financial results. The significant year-on-year growth in Q4 2024 earnings, with sales reaching over $1.15 billion and net income jumping to $1.85 billion, underscored its financial strength. This performance occurred despite broader market fluctuations, including tech sector selloffs, yet Pinterest's strategic maneuvers seem to have resonated positively with investors.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Pinterest has experienced a remarkable total return of 124.29% over the past five years. This performance is underpinned by several key developments. A crucial factor has been the company's strategic focus on AI and partnerships to enhance user engagement and drive revenue. Noteworthy collaborations include the partnership with VTEX initiated in June 2024, aimed at boosting social commerce capabilities. Additionally, a significant share buyback worth US$465.67 million concluded in September 2024, reflecting confidence in Pinterest's long-term value. Executive leadership also saw shifts, with former Levi Strauss CEO Chip Bergh joining as a board member in May 2024.

Aligning with its growth strategies, Pinterest reported full-year 2024 sales of US$3.65 billion, transitioning from a net loss to a net income of US$1.86 billion. While the firm's stock underperformed both the broader US market and the Interactive Media and Services industry over the last year, these strategic moves and financial results illustrate its ongoing efforts to bolster long-term shareholder value.

Understand Pinterest's track record by examining our performance history report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives