- United States

- /

- Interactive Media and Services

- /

- NYSE:PINS

How the Latest Price Target Hike and AI Innovations Could Impact Pinterest’s Value in 2025

Reviewed by Simply Wall St

Wondering What to Do With Pinterest Stock? Here's What You Need to Know

If you have Pinterest stock on your watchlist or already in your portfolio, you are definitely not alone. Investors are watching closely as social media platforms compete for attention in a crowded online world, each striving to establish a unique niche. Pinterest has quietly but consistently rewarded its supporters, posting a 16% return year-to-date and over 68% in total returns over the last three years. However, despite these overall gains, the last month has seen some volatility with the stock dipping more than 6%. This has led some investors to reconsider whether this is a time to hold, buy, or move on.

Recently, Wall Street sentiment has improved slightly. BMO Capital, for example, raised Pinterest’s price target to $41 after strong Q2 earnings, highlighting the company’s progress in rolling out new AI-powered features and its growing popularity with Gen-Z users. Analyst targets currently remain above the last closing price of $35.48. Importantly, both analysts and some financial models see a notable discount to where the stock is perceived to be fairly valued, with estimates placing it over 49% below its calculated intrinsic value. This could indicate possible upside potential.

This is not just optimism. According to standard valuation criteria, Pinterest meets all 6 out of 6 benchmarks for being undervalued, earning it a value score of 6. But what do those checks actually mean for your investment decision? Let’s break down how Wall Street typically values companies like Pinterest. It may turn out that the most meaningful way to evaluate the company’s worth is more nuanced than you think.

Pinterest delivered 9.1% returns over the last year. See how this stacks up to the rest of the Interactive Media and Services industry.Approach 1: Pinterest Cash Flows

The Discounted Cash Flow, or DCF, model estimates a company’s value by projecting its future annual cash flows and discounting them back to today, reflecting their true worth in present dollars. For Pinterest, the most recent figures show Free Cash Flow at just over $1 billion, a healthy starting point for long-term valuation.

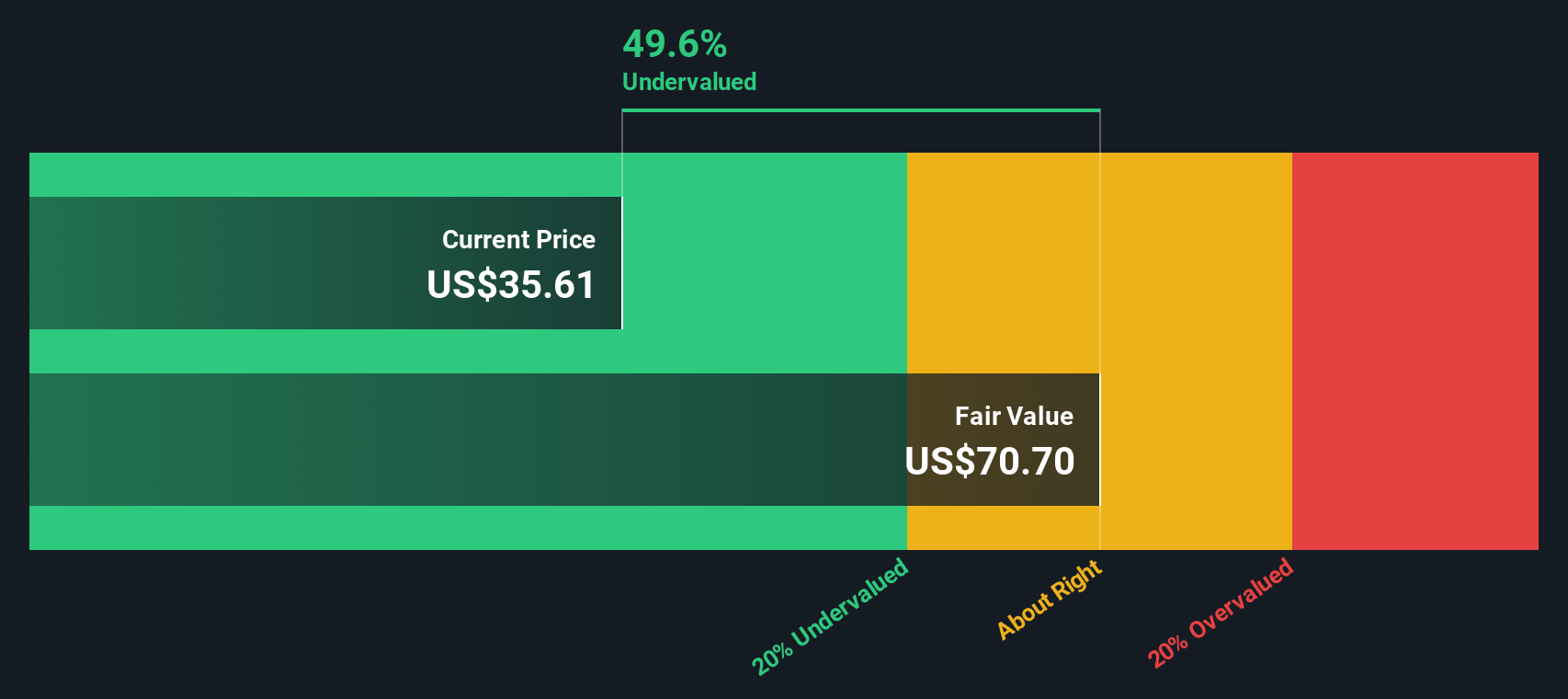

Analysts project continued growth, with Pinterest’s cash flow expected to rise steadily over the next decade and reach approximately $3.28 billion by 2035. Using a two-stage Free Cash Flow to Equity model, these forecasts are translated into an intrinsic value of $70.40 per share.

Compared to the latest closing share price of $35.48, this suggests Pinterest is trading at about 49.6% below its estimated fair value. In other words, it appears to be significantly undervalued according to this approach.

Result: UNDERVALUED

Approach 2: Pinterest Price vs Earnings

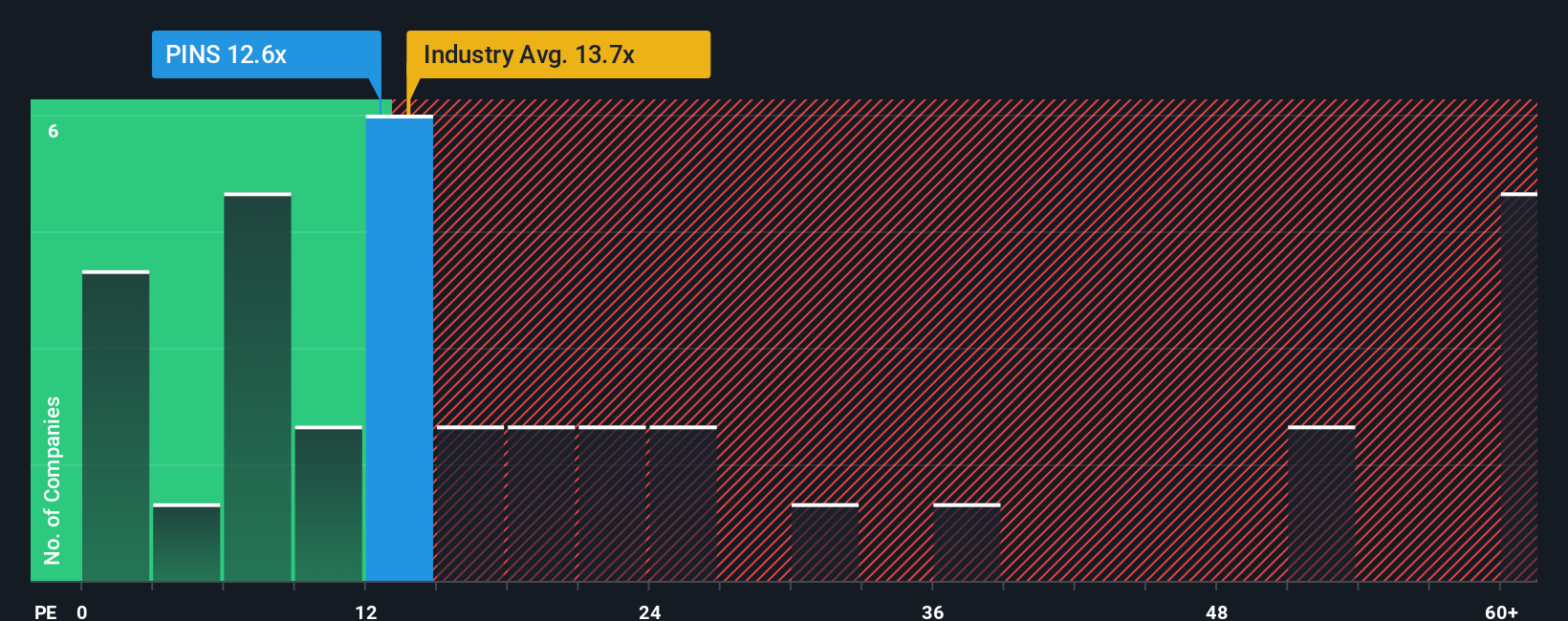

The price-to-earnings (PE) ratio is a reliable method to value profitable technology companies like Pinterest, as it directly compares the price investors pay to the company’s actual earnings. For stocks with consistent profits, the PE ratio helps reflect both their potential for growth and the risks present in the business. Companies expected to grow rapidly or that are perceived as less risky generally have higher PE ratios, while slower growth or greater uncertainty tends to result in lower ratios.

Pinterest currently trades at a PE ratio of 12.5x. For context, the average PE among its industry peers is 19.4x, while the industry overall averages 13.1x. This indicates that Pinterest shares are priced well below both its direct competitors and the broader interactive media sector. In addition, Simply Wall St’s proprietary Fair Ratio for Pinterest is 14.3x, which considers the company’s profitability, growth prospects, market size, and risk profile to estimate what the PE “should” be for a business like Pinterest.

With Pinterest’s actual PE ratio of 12.5x being slightly below its Fair Ratio of 14.3x, the stock appears to be undervalued by this analysis. This suggests that investors currently have the opportunity to buy Pinterest at a price below where neutral valuation models estimate it might trade.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your Pinterest Narrative

Beyond traditional valuation models, a "Narrative" is a clear, story-driven investment perspective that helps you connect what you believe about a company's future to the numbers, such as its fair value, estimated revenues, or profit margins.

Instead of just crunching ratios, Narratives ask you to outline your view on what drives Pinterest’s success or risk by bringing together your assumptions and expectations with objective financial forecasts. On the Simply Wall St platform and within its community, building or exploring Narratives is accessible to all investors and makes analyzing stocks less overwhelming.

Narratives power your decision making by dynamically updating fair value estimates and risk assessments when news, earnings, or market conditions change. This approach makes it easier to decide whether to buy, hold, or sell by comparing your Narrative-driven fair value with the current stock price.

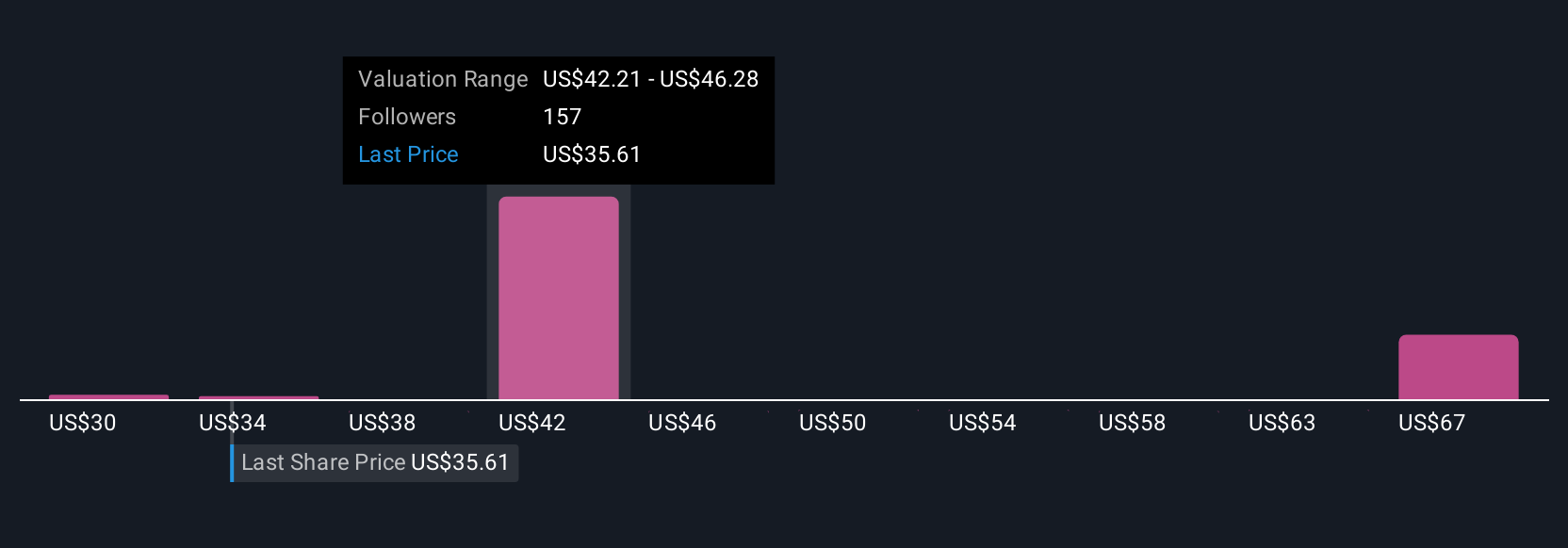

For Pinterest, one Narrative might see explosive advertising innovation and global expansion boosting revenue and margins, justifying a potential fair value of $93 to $109. Another, more conservative view could point to limited user growth or ad pricing pressure and estimate fair value at $26 to $44. No matter your outlook, Narratives turn your ideas into actionable investment plans, making them a smart, story-led way to invest.

Do you think there's more to the story for Pinterest? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PINS

Operates as a visual search and discovery platform in the United States, Canada, Europe, and internationally.

Very undervalued with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives