- United States

- /

- Media

- /

- NYSE:OMC

What Recent Account Wins Could Mean for Omnicom Group’s Stock in 2025

Reviewed by Bailey Pemberton

- Thinking of buying Omnicom Group but not sure if it is a bargain? Let’s break down what the current numbers say about this media giant’s potential value.

- The stock hasn’t been friendly to shareholders lately, falling 4.5% over the past week and dropping 29.4% in the last year alone.

- Recently, headlines have focused on marketing sector shifts and changing client priorities, stirring up debates about Omnicom’s ability to adapt. News of major account wins along with the strategic push into digital and data-driven advertising have fueled conversations about where the stock could go next.

- Omnicom clocks in with a valuation score of 6 out of 6, which points to the possibility that it may be undervalued on every front. We’ll dig into the details of each valuation method, so keep reading for a fresh perspective that could change how you see stock value altogether.

Find out why Omnicom Group's -29.4% return over the last year is lagging behind its peers.

Approach 1: Omnicom Group Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and then discounting them back to today's dollars. This method evaluates what an investor might reasonably expect to receive, accounting for time and risk.

For Omnicom Group, the latest reported Free Cash Flow (FCF) is $1.7 billion. Analysts forecast that FCF will continue to rise, reaching around $2.0 billion by the end of 2028. Beyond that, cash flow projections are further extrapolated to estimate steady growth for another several years. All projections are measured in US dollars, and these predictions account for factors like business expansion, stability, and industry trends.

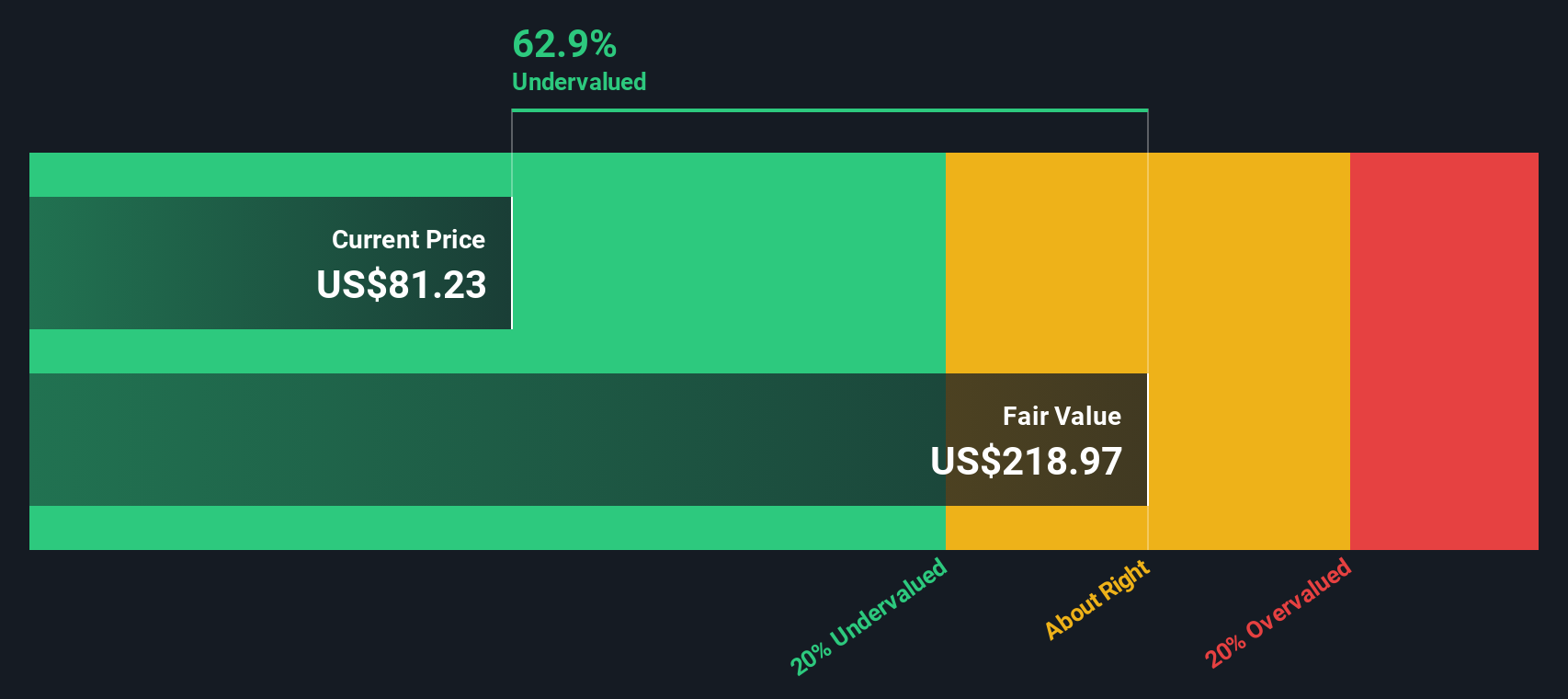

Using this DCF approach, the fair value of Omnicom Group's stock is calculated at $236.83 per share. This figure means the current share price is trading at a 69.8% discount relative to the intrinsic value, which indicates a substantial undervaluation in today's market.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Omnicom Group is undervalued by 69.8%. Track this in your watchlist or portfolio, or discover 927 more undervalued stocks based on cash flows.

Approach 2: Omnicom Group Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used metric for valuing profitable companies because it measures how much investors are willing to pay today for each dollar of a company’s earnings. A lower PE can signal a bargain if the business is stable and growing, while a higher PE often reflects optimism about future profits. However, it is important to remember that what qualifies as a "fair" PE ratio depends on the company's growth prospects and its risk profile. Companies with higher growth and less risk typically justify higher PE ratios, while slow growers or riskier businesses tend to trade at lower ones.

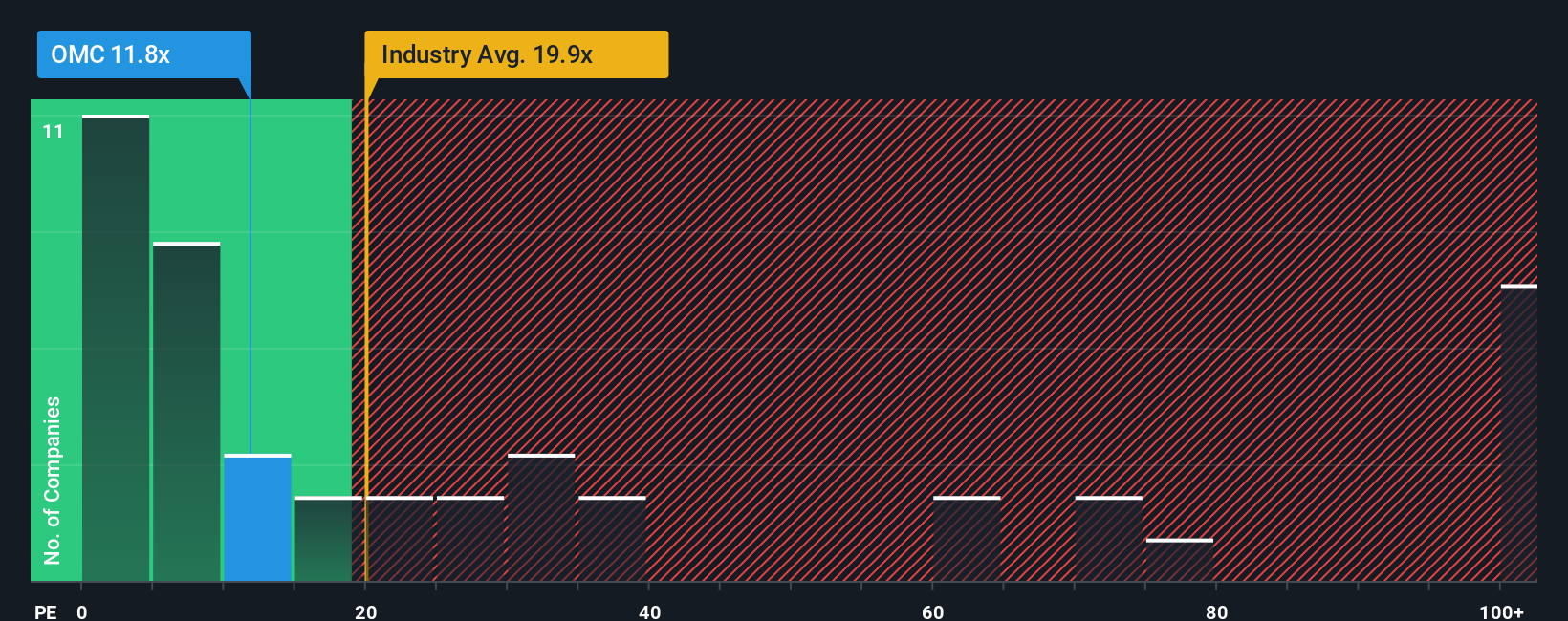

Omnicom Group currently trades at a PE ratio of 10.3x, which stands out compared to the media industry average of 15.3x and a peer average of 33.2x. On the surface, this makes Omnicom’s stock look attractively cheap. But simple benchmarks can be misleading if they do not match the company’s specific circumstances. That is where the "Fair Ratio" comes in, which is Simply Wall St’s proprietary measure that adjusts for Omnicom’s unique blend of expected earnings growth, margins, market cap, and sector risks. Rather than rely solely on basic industry or peer comparisons, the Fair Ratio provides a more nuanced and credible benchmark for valuation.

For Omnicom Group, its Fair Ratio is 19.6x, which means the stock’s current PE is well below what would be considered reasonable given its outlook and fundamentals. This significant gap suggests that the stock may be undervalued by the market right now, hinting at potential upside if sentiment improves or the company delivers on its targets.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1439 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Omnicom Group Narrative

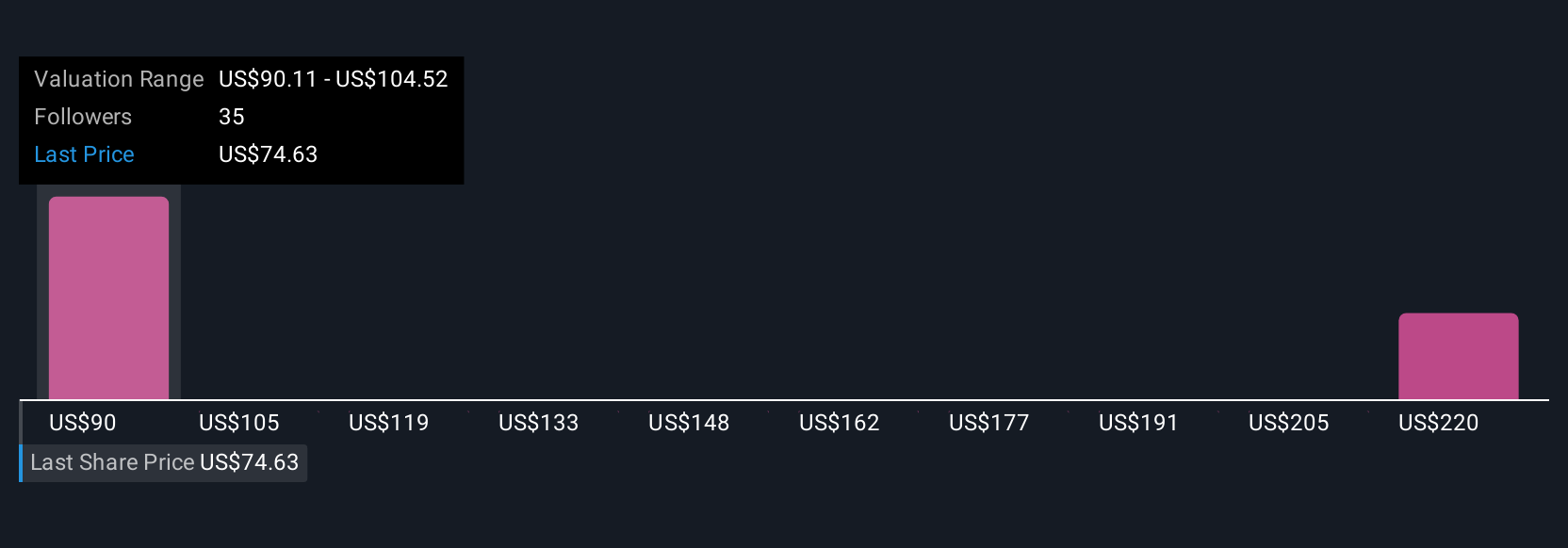

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. At its core, a Narrative is your perspective on Omnicom Group’s future. It is the story you attach to the numbers, defining how you believe revenue, earnings, and margins will grow, and what you consider a fair value for the stock.

Narratives go a step beyond traditional ratios and models by linking Omnicom’s unique business story to a transparent financial forecast and then to a concrete estimate of fair value. Crafting and comparing Narratives is simple and accessible through the Simply Wall St Community page, where millions of investors share and debate their own outlooks.

By using Narratives, investors can compare their Fair Value estimates to the current share price, helping them decide if Omnicom aligns with their own outlook. These Narratives update automatically whenever new news or results come in, so your insights stay relevant.

For example, with Omnicom Group, some analysts see major upside from merger synergies and margin gains and have set a bullish price target of $115, while others, more cautious about sector risks and integration hurdles, see fair value as low as $78. All of these views are based on the same financial framework but reflect different stories about the future.

Do you think there's more to the story for Omnicom Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OMC

Omnicom Group

Offers advertising, marketing, and corporate communications services.

Very undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.