- United States

- /

- IT

- /

- NYSE:CINT

Spotlight On 3 Promising Penny Stocks Under $800M Market Cap

Reviewed by Simply Wall St

Major stock indexes in the United States have recently surged, with investors optimistic about a potential interest rate cut by the Federal Reserve. Amidst this backdrop, penny stocks—though an older term—continue to represent an intriguing investment area, particularly for those interested in smaller or newer companies. By focusing on strong financials and growth potential, these stocks can offer both affordability and opportunity for investors seeking promising ventures.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Here Group (HERE) | $3.08 | $257.24M | ✅ 3 ⚠️ 1 View Analysis > |

| Dingdong (Cayman) (DDL) | $1.77 | $379.32M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.65 | $596.74M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.495 | $588.08M | ✅ 4 ⚠️ 2 View Analysis > |

| FinVolution Group (FINV) | $4.74 | $1.2B | ✅ 4 ⚠️ 1 View Analysis > |

| Puma Biotechnology (PBYI) | $4.89 | $246.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.23 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.38 | $568.6M | ✅ 5 ⚠️ 0 View Analysis > |

| BAB (BABB) | $0.899505 | $6.53M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.77 | $85.41M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 360 stocks from our US Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Real Brokerage (REAX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: The Real Brokerage Inc. operates as a real estate technology company in the United States and Canada, with a market cap of $786.70 million.

Operations: The company generates revenue primarily through its North American Brokerage segment, which accounted for $1.80 billion.

Market Cap: $786.7M

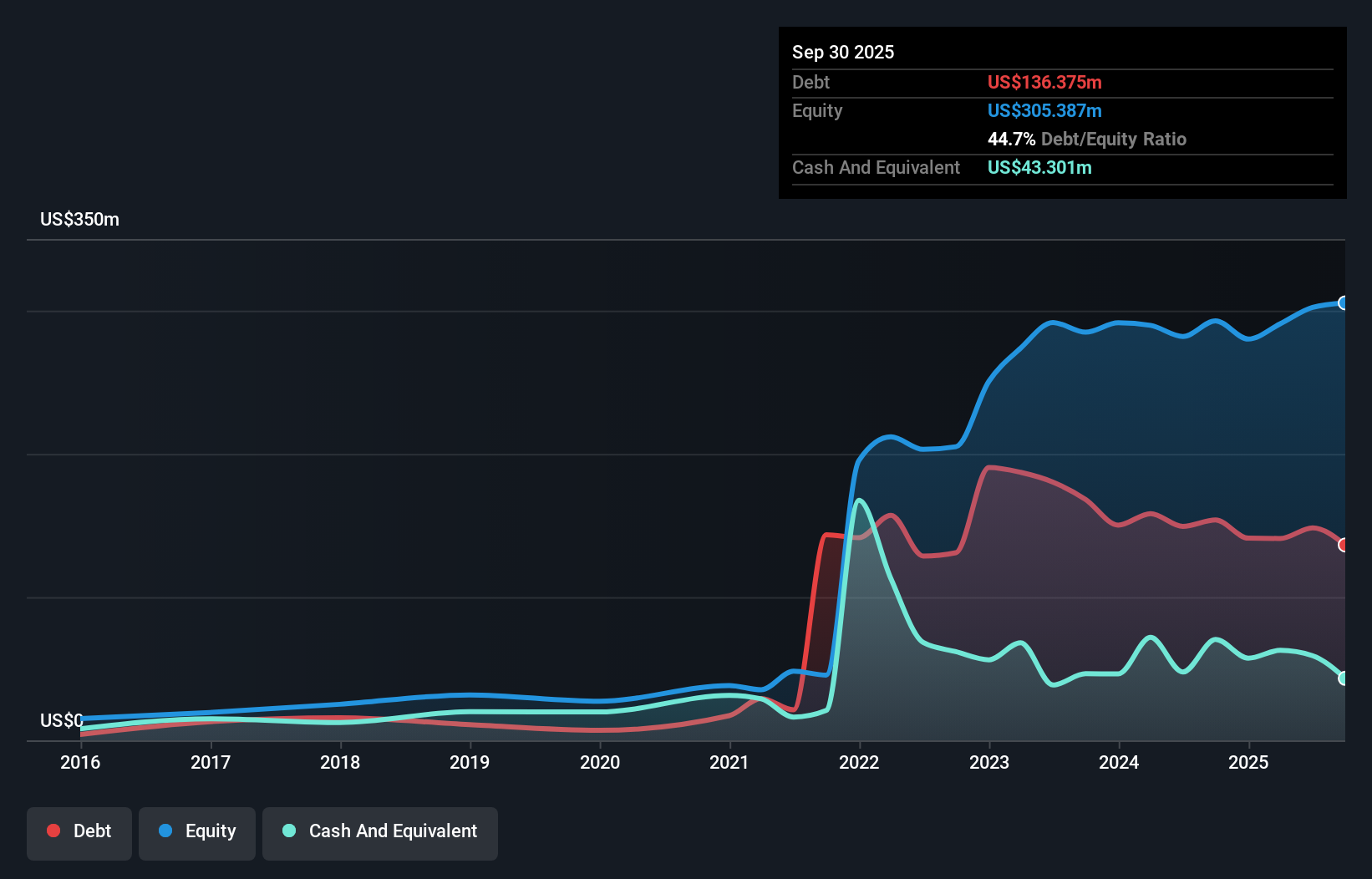

The Real Brokerage Inc. has been making strides with its innovative AI-driven platforms, Leo CoPilot and HeyLeo, enhancing agent support and consumer home search experiences. Despite being unprofitable with a negative return on equity, the company reported significant revenue of US$1.80 billion from its North American Brokerage segment. Recent advancements in AI technology showcase Real's commitment to integrating cutting-edge solutions into real estate operations. While facing challenges like insider selling and increased losses over five years, the firm remains debt-free and maintains a strong cash runway for over three years due to positive free cash flow growth.

- Click here and access our complete financial health analysis report to understand the dynamics of Real Brokerage.

- Learn about Real Brokerage's future growth trajectory here.

CI&T (CINT)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CI&T Inc. offers strategy, design, and software engineering services globally with a market cap of $568.60 million.

Operations: The company generates $467.91 million in revenue from its computer services segment.

Market Cap: $568.6M

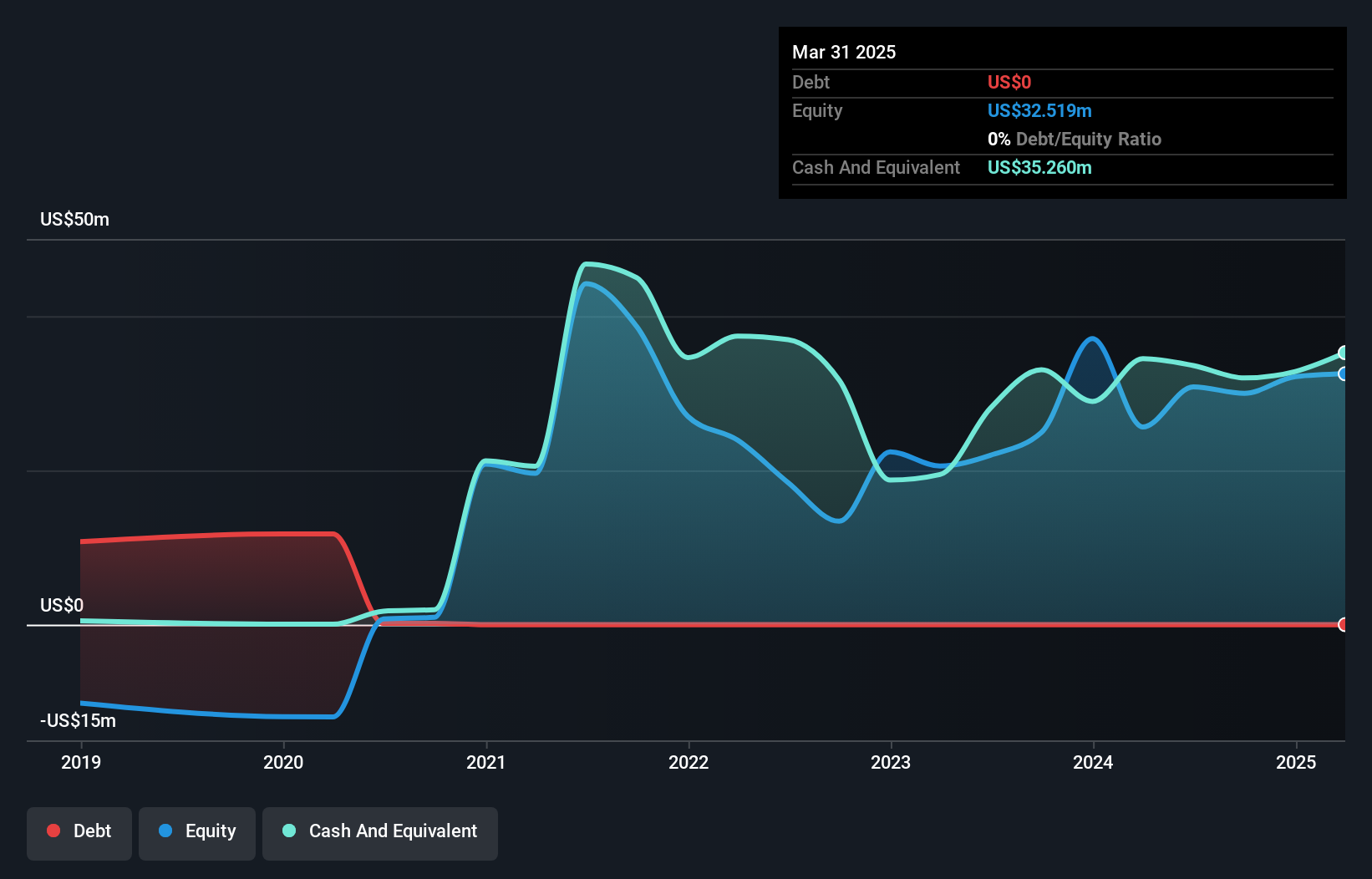

CI&T Inc. has demonstrated robust financial performance, with recent earnings growth of 45% over the past year and net profit margins improving to 7.8%. Analysts expect continued revenue growth, forecasting an increase of up to 13% for the full year 2025. Despite a low return on equity of 12%, CI&T's debt is well managed, with operating cash flow covering it adequately. The company is trading below its estimated fair value and has announced a share repurchase program, indicating confidence in its valuation. Recent strategic leadership appointments in EMEA aim to bolster CI&T’s technological capabilities and market presence globally.

- Take a closer look at CI&T's potential here in our financial health report.

- Explore CI&T's analyst forecasts in our growth report.

Nextdoor Holdings (NXDR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nextdoor Holdings, Inc. operates a neighborhood network connecting neighbors, businesses, and public agencies both in the United States and internationally, with a market cap of approximately $662.66 million.

Operations: The company generates revenue of $253.40 million from its Internet Information Providers segment.

Market Cap: $662.66M

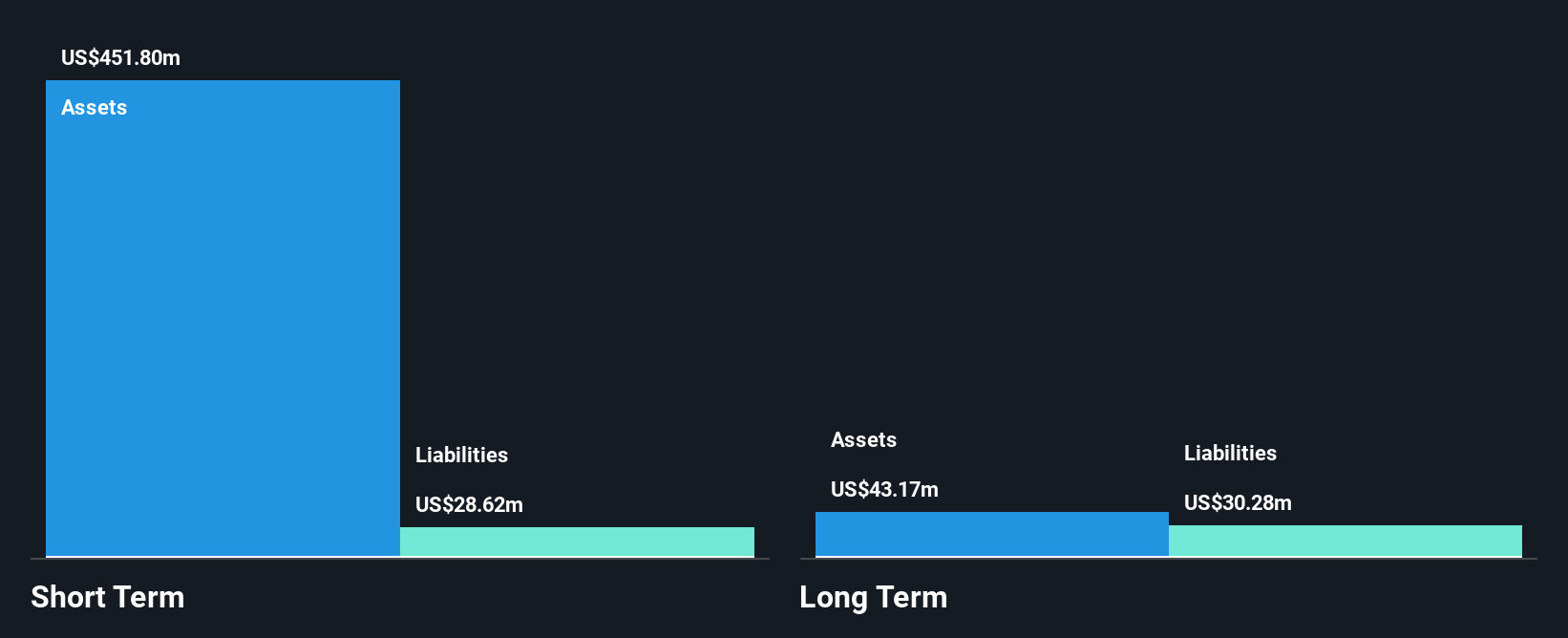

Nextdoor Holdings, Inc. has been leveraging its platform to enhance neighborhood connectivity and advertising effectiveness, with recent innovations in AI-powered ad optimizations and video formats. Despite being unprofitable, it maintains a strong financial position with short-term assets of US$448.4 million exceeding liabilities and no debt burden. The company’s cash runway extends beyond three years due to positive free cash flow growth of 17.5% annually. With a market cap of approximately US$662.66 million, Nextdoor trades at a significant discount to estimated fair value while continuing to expand its hyperlocal advertising reach across 345,000 neighborhoods globally.

- Unlock comprehensive insights into our analysis of Nextdoor Holdings stock in this financial health report.

- Gain insights into Nextdoor Holdings' outlook and expected performance with our report on the company's earnings estimates.

Seize The Opportunity

- Embark on your investment journey to our 360 US Penny Stocks selection here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CINT

CI&T

Provides strategy, design, and software engineering services worldwide.

Very undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives