Exploring Three High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.2%, and in the past year, it has climbed an impressive 32%, with earnings expected to grow by 16% per annum over the next few years. In this context of robust market performance, identifying high growth tech stocks involves assessing their potential for innovation and scalability within a dynamic economic landscape.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 20.86% | 27.98% | ★★★★★★ |

| Sarepta Therapeutics | 23.67% | 44.28% | ★★★★★★ |

| TG Therapeutics | 28.39% | 43.54% | ★★★★★★ |

| Ardelyx | 27.19% | 66.44% | ★★★★★★ |

| Invivyd | 42.91% | 70.39% | ★★★★★★ |

| Amicus Therapeutics | 20.32% | 62.45% | ★★★★★★ |

| AsiaFIN Holdings | 60.53% | 81.55% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| Travere Therapeutics | 27.16% | 69.88% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 253 stocks from our US High Growth Tech and AI Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Neurocrine Biosciences (NasdaqGS:NBIX)

Simply Wall St Growth Rating: ★★★★★☆

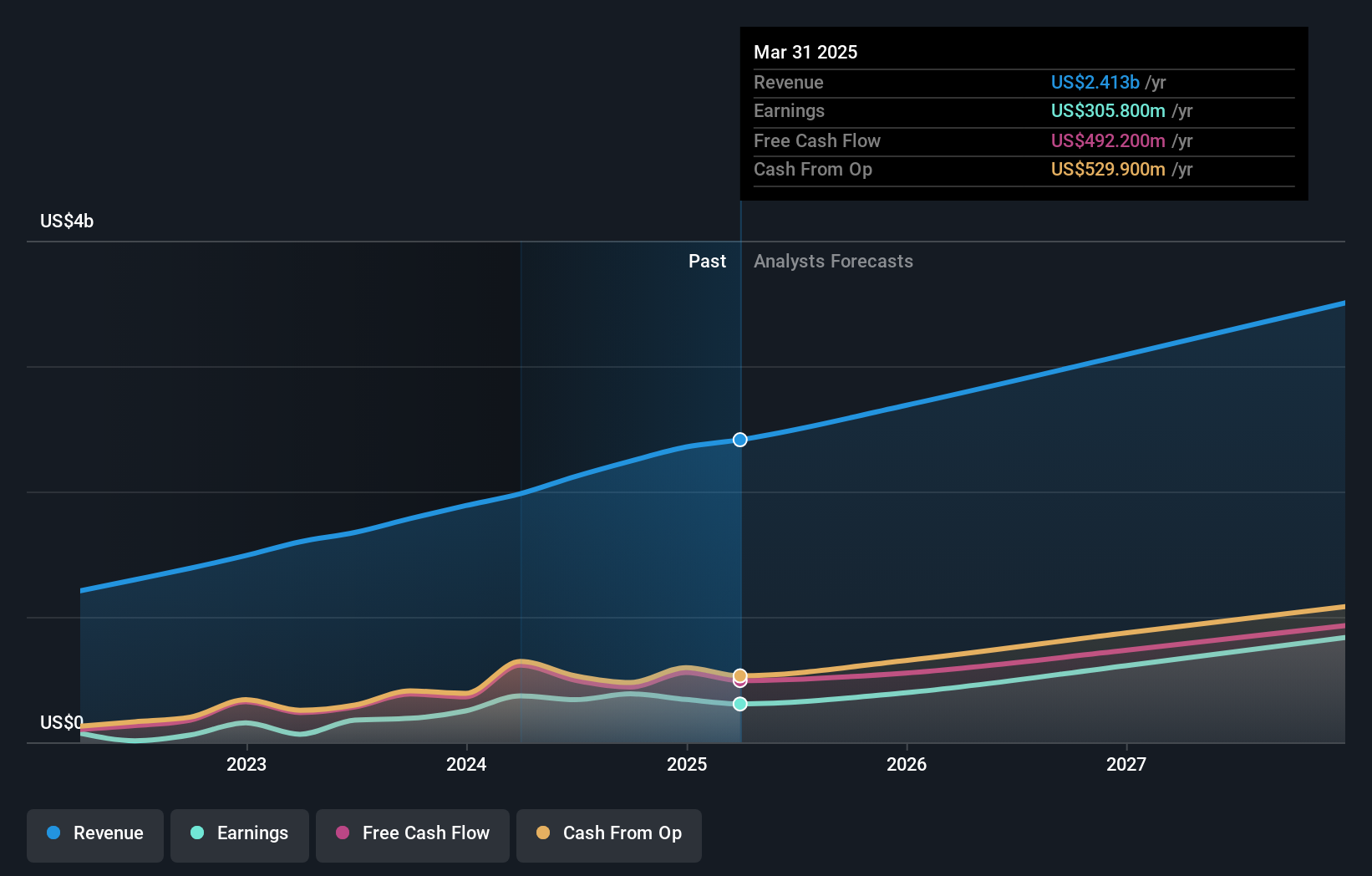

Overview: Neurocrine Biosciences, Inc. discovers, develops, and markets pharmaceuticals for neurological, neuroendocrine, and neuropsychiatric disorders in the United States and internationally with a market cap of approximately $11.27 billion.

Operations: Neurocrine Biosciences generates revenue primarily from the research, development, and commercialization of pharmaceuticals, amounting to $2.12 billion. The company focuses on addressing neurological, neuroendocrine, and neuropsychiatric disorders across various markets.

Neurocrine Biosciences has demonstrated a robust trajectory in high-growth tech through significant R&D investment and strategic product development. In 2024, the company allocated 14.2% of its revenue towards R&D, underscoring its commitment to innovation, particularly in treatments for neurological disorders. This focus is reflected in their recent announcement of positive interim results from their KINECT-HD2 study, enhancing Neurocrine's profile in the biotech industry. Moreover, with an expected annual earnings growth rate of 29.4%, Neurocrine not only outpaces the broader US market but also solidifies its position by addressing unmet medical needs through advanced therapeutic solutions.

- Unlock comprehensive insights into our analysis of Neurocrine Biosciences stock in this health report.

Gain insights into Neurocrine Biosciences' past trends and performance with our Past report.

Cars.com (NYSE:CARS)

Simply Wall St Growth Rating: ★★★★☆☆

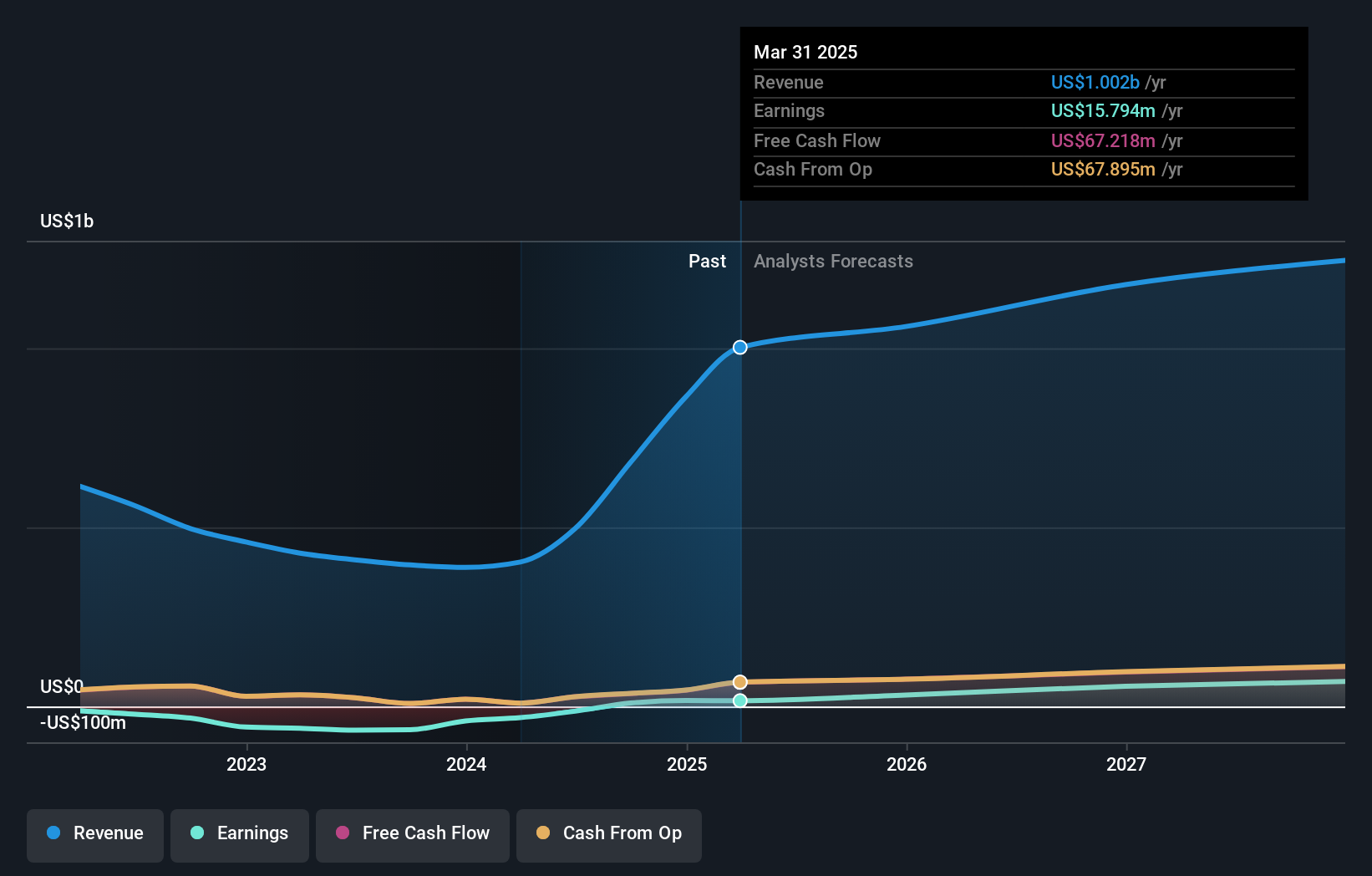

Overview: Cars.com Inc. is an audience-driven technology company offering solutions for the automotive industry in the United States, with a market cap of approximately $1.03 billion.

Operations: Cars.com generates revenue primarily from its Internet Information Providers segment, amounting to $713 million. The company focuses on delivering technology solutions tailored for the automotive industry in the U.S.

Despite a challenging year with a 77.9% drop in earnings, Cars.com has shown resilience with its strategic share repurchases, buying back 273,359 shares for $4.94 million in the latest quarter, reflecting strong confidence from management in the company's value proposition. The firm's commitment to innovation is evident from its R&D investments which are crucial for staying competitive against industry giants. Notably, Cars.com forecasts an impressive 29.8% annual growth in earnings and has adjusted its revenue growth outlook to 4.5%-5.5%, considering current market dynamics and product launch delays due to external disruptions like the CDK cyber incident. This proactive approach in navigating headwinds while bolstering their tech infrastructure positions them as a noteworthy contender in the evolving online automotive marketplace.

- Take a closer look at Cars.com's potential here in our health report.

Gain insights into Cars.com's historical performance by reviewing our past performance report.

MediaAlpha (NYSE:MAX)

Simply Wall St Growth Rating: ★★★★★★

Overview: MediaAlpha, Inc. operates an insurance customer acquisition platform in the United States and has a market cap of $1.14 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to $496.67 million. It focuses on facilitating insurance customer acquisition through its platform in the United States.

MediaAlpha's strategic positioning in the high-growth tech sector is underscored by its robust R&D spending, which reflects a commitment to innovation and market adaptability. With a notable increase in revenue forecast at 22.7% annually, the company is set to outpace the US market average growth of 8.8%. This growth trajectory is complemented by an impressive expected earnings surge of 61.3% per year, highlighting its potential for scalability and profitability in a competitive landscape. Recent partnerships, like the extended agreement with Insurify, enhance MediaAlpha’s service offerings to high-intent insurance shoppers, leveraging advanced technology to meet consumer demands effectively.

- Dive into the specifics of MediaAlpha here with our thorough health report.

Explore historical data to track MediaAlpha's performance over time in our Past section.

Make It Happen

- Dive into all 253 of the US High Growth Tech and AI Stocks we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MAX

MediaAlpha

Through its subsidiaries, operates an insurance customer acquisition platform in the United States.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives