Brokers Are Upgrading Their Views On MediaAlpha, Inc. (NYSE:MAX) With These New Forecasts

MediaAlpha, Inc. (NYSE:MAX) shareholders will have a reason to smile today, with the analysts making substantial upgrades to this year's statutory forecasts. Consensus estimates suggest investors could expect greatly increased statutory revenues and earnings per share, with analysts modelling a real improvement in business performance. Investor sentiment seems to be improving too, with the share price up 9.5% to US$22.18 over the past 7 days. Could this big upgrade push the stock even higher?

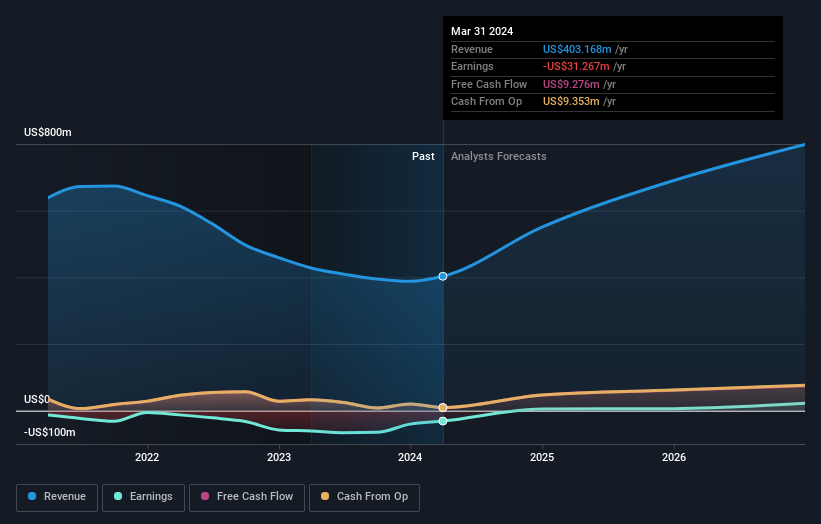

Following the upgrade, the most recent consensus for MediaAlpha from its seven analysts is for revenues of US$550m in 2024 which, if met, would be a substantial 37% increase on its sales over the past 12 months. The losses are expected to disappear over the next year or so, with forecasts for a profit of US$0.098 per share this year. However, before this estimates update, the consensus had been expecting revenues of US$498m and US$0.32 per share in losses. It looks like there's been a definite improvement in business conditions, with a revenue upgrade supposed to lead to profitability sooner than previously forecast.

See our latest analysis for MediaAlpha

With these upgrades, we're not surprised to see that the analysts have lifted their price target 21% to US$25.60 per share.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the MediaAlpha's past performance and to peers in the same industry. One thing stands out from these estimates, which is that MediaAlpha is forecast to grow faster in the future than it has in the past, with revenues expected to display 51% annualised growth until the end of 2024. If achieved, this would be a much better result than the 22% annual decline over the past three years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue grow 10% per year. So it looks like MediaAlpha is expected to grow faster than its competitors, at least for a while.

The Bottom Line

The most important thing to take away from this upgrade is that there is now an expectation for MediaAlpha to become profitable this year, compared to previous expectations of a loss. They also upgraded their revenue estimates for this year, and sales are expected to grow faster than the wider market. Given that the consensus looks almost universally bullish, with a substantial increase to forecasts and a higher price target, MediaAlpha could be worth investigating further.

Analysts are clearly in love with MediaAlpha at the moment, but before diving in - you should be aware that we've identified some warning flags with the business, such as dilutive stock issuance over the past year. You can learn more, and discover the 1 other concern we've identified, for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MAX

MediaAlpha

Through its subsidiaries, operates an insurance customer acquisition platform in the United States.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives