- United States

- /

- Entertainment

- /

- NYSE:MANU

Manchester United (NYSE:MANU): Weighing Valuation as Shares Drift and Fundamentals Slowly Improve

Reviewed by Simply Wall St

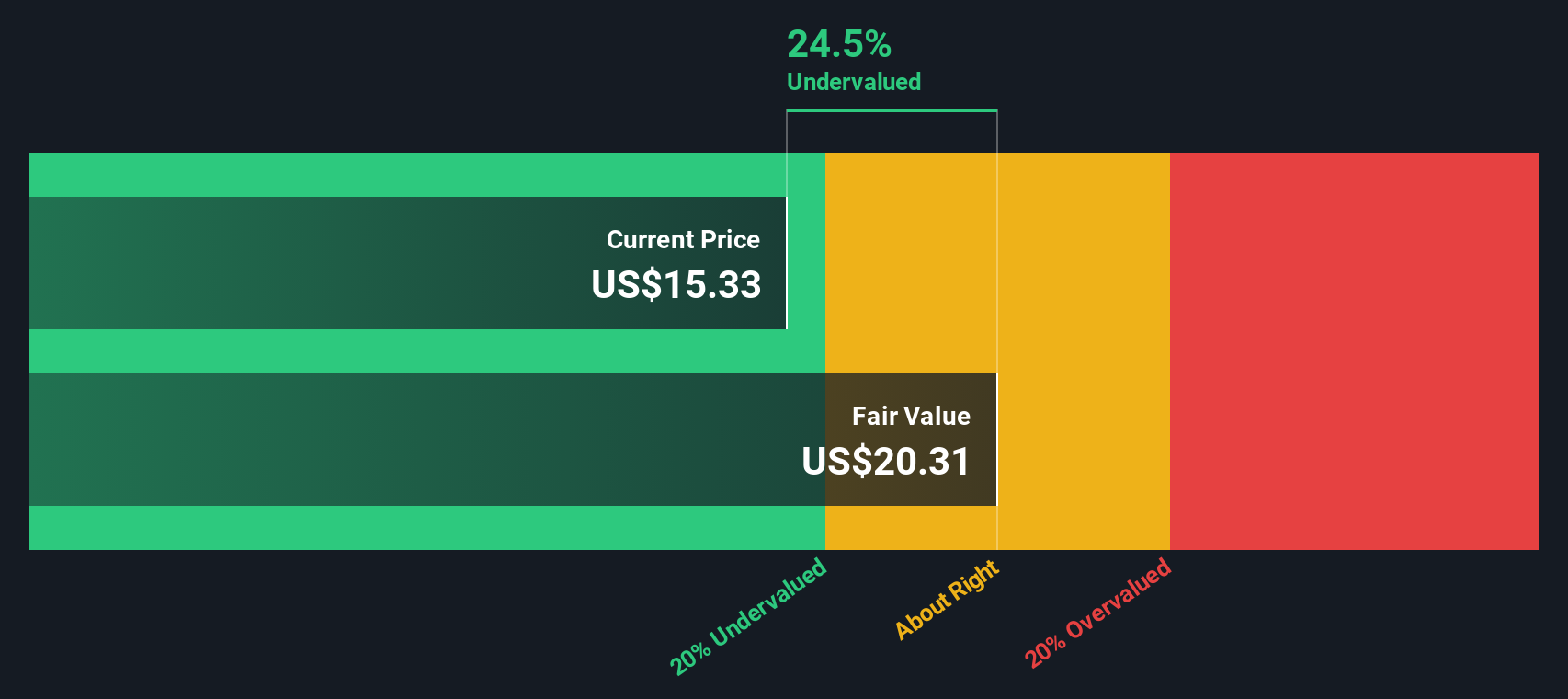

Manchester United (MANU) shares have been drifting lately, with the stock roughly flat over the past month and down about 6% this year, even as the club’s underlying business trends slowly improve.

See our latest analysis for Manchester United.

At around $15.91, the latest share price reflects a modest positive 7 day share price return while the 1 year total shareholder return remains negative. This suggests sentiment is still cautious even as the long term commercial story slowly improves.

If you are weighing where to put fresh capital next, this could be a good moment to broaden your search and explore fast growing stocks with high insider ownership.

With shares lagging broader markets despite recovering revenues and a sizeable discount to analyst targets and intrinsic value estimates, the key question now is whether Manchester United is quietly undervalued or whether markets already reflect its future growth.

Price-to-Sales of 3.1x: Is it justified?

Manchester United trades on a price-to-sales ratio of 3.1x at the last close of $15.91, putting the shares on a noticeably richer valuation than peers.

The price-to-sales multiple compares the company’s market value to its annual revenue. This can be a useful yardstick for businesses like Manchester United that are not yet consistently profitable but still generate substantial turnover from broadcasting, sponsorship and matchday income.

In this case, the 3.1x price-to-sales ratio sits well above both the US Entertainment industry average of 1.5x and the estimated fair price-to-sales ratio of 1.9x. This suggests investors are assigning a premium that the broader market has not yet earned. Those higher levels imply the share price may need either faster growth or improved profitability to catch up with the expectations embedded in today’s valuation.

Explore the SWS fair ratio for Manchester United

Result: Price-to-Sales of 3.1x (OVERVALUED)

However, persistent net losses and a long history of weak shareholder returns could limit upside if revenue growth stalls or commercial momentum fades.

Find out about the key risks to this Manchester United narrative.

Another View: DCF Points the Other Way

While the price to sales ratio looks stretched, our DCF model tells a different story. It suggests fair value of about $36.05 versus today’s $15.91. That implies Manchester United could be meaningfully undervalued, but are the long term cash flow assumptions too optimistic?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Manchester United for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Manchester United Narrative

If you are not convinced by this view or would rather rely on your own analysis, you can quickly build a personalized thesis in minutes: Do it your way.

A great starting point for your Manchester United research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one club when you can quickly scan fresh opportunities on Simply Wall Street’s Screener and stay ahead of the next big move.

- Capture high potential turnarounds by targeting underpriced businesses using these 919 undervalued stocks based on cash flows that still generate strong cash flows.

- Ride powerful innovation trends by focusing on companies at the forefront of intelligent automation through these 25 AI penny stocks.

- Strengthen your income stream by zeroing in on reliable payers with attractive yields via these 14 dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MANU

Manchester United

Operates a professional sports team in the United Kingdom.

Moderate growth potential and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026