- United States

- /

- Media

- /

- NasdaqGM:TTD

Exploring 3 High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has shown robust performance, climbing 1.2% in the last week and 21% over the past year, with earnings projected to grow by 15% annually. In this environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation and potential for scalability in line with these positive market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.32% | 24.20% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Blueprint Medicines | 23.52% | 55.74% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

PowerFleet (NasdaqGM:AIOT)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PowerFleet, Inc. offers Internet-of-Things solutions across the United States, Israel, and internationally with a market cap of $786.54 million.

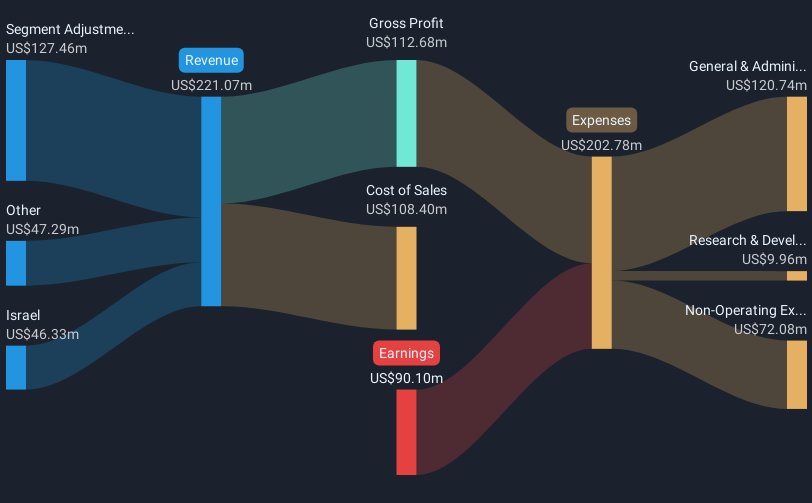

Operations: The company generates revenue primarily from its Wireless IoT Asset Management segment, amounting to $221.07 million.

PowerFleet, a player in the tech sector, is navigating through challenging financial waters with a net loss of $38.55 million over nine months, yet it shows potential with an expected annual revenue growth of 28.6%. The company's recent uplift in its full-year 2025 revenue guidance to over $362.5 million underscores its adaptability and market confidence despite current unprofitability. Notably, PowerFleet's strategic executive shifts aim to harness more innovative technologies and drive future profitability, signaling a proactive stance toward leveraging AIoT for business transformation.

- Dive into the specifics of PowerFleet here with our thorough health report.

Assess PowerFleet's past performance with our detailed historical performance reports.

Trade Desk (NasdaqGM:TTD)

Simply Wall St Growth Rating: ★★★★★☆

Overview: The Trade Desk, Inc. is a technology company that operates both in the United States and internationally, with a market capitalization of approximately $57.89 billion.

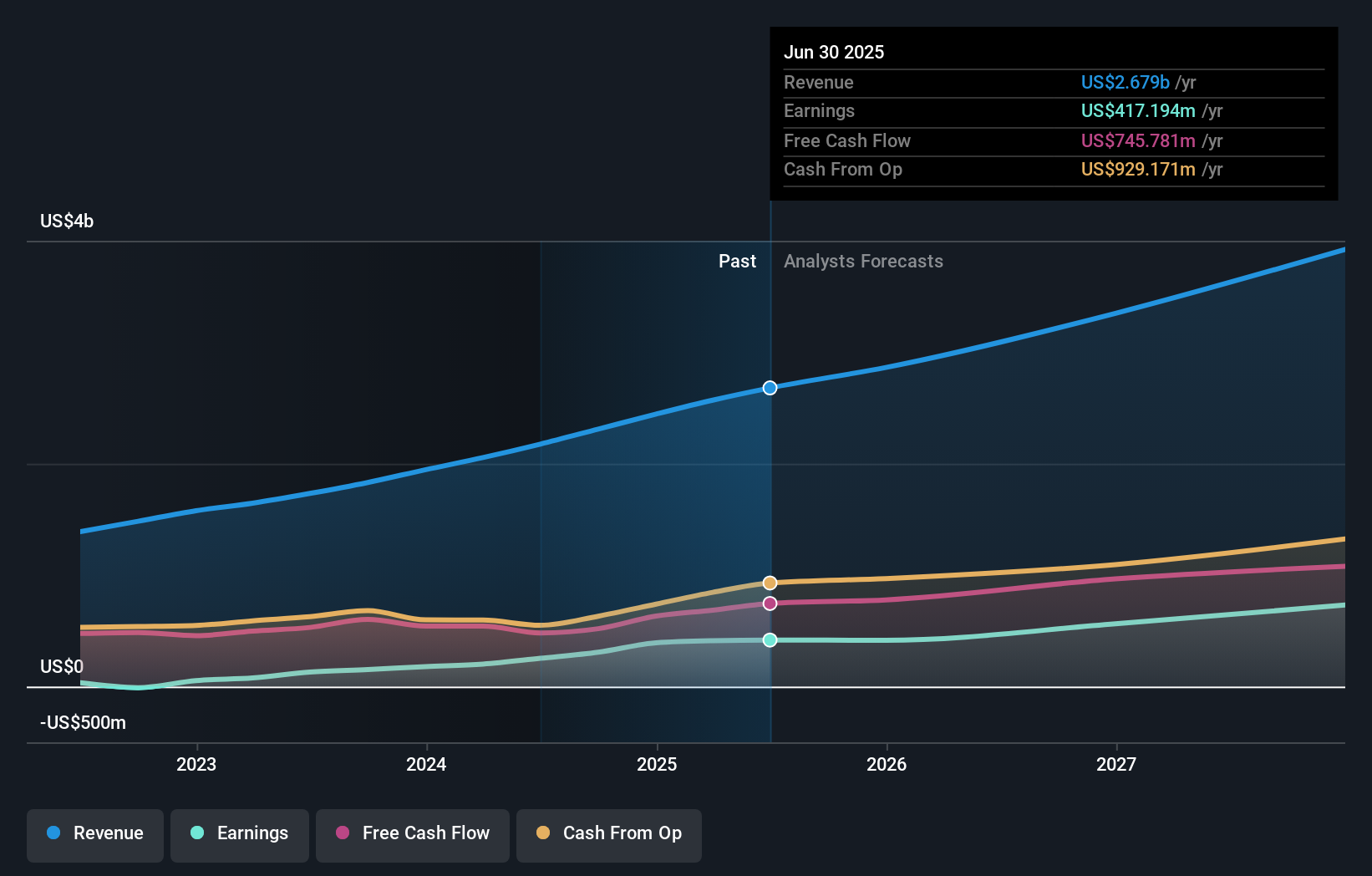

Operations: Trade Desk generates revenue primarily through its software and programming segment, amounting to $2.31 billion. The company focuses on providing technology solutions for digital advertising across various platforms globally.

Amidst a transformative landscape for digital advertising, Trade Desk has emerged as a pivotal player through strategic partnerships and technological advancements. The recent collaboration with Ezoic, leveraging the OpenPath program and Unified ID 2.0 (UID2), underscores Trade Desk's commitment to enhancing transparency and efficiency in ad spending away from traditional walled gardens. This initiative not only bolsters publisher revenues but also fortifies advertiser relationships by streamlining access to first-party data in compliance with privacy standards. Financially, Trade Desk exhibits robust growth prospects with an earnings forecast to surge by 27.6% annually and revenue expected to climb at 17% per year, outpacing the US market average significantly. These figures reflect the company's adeptness at capitalizing on industry shifts towards more accountable and programmable advertising solutions, positioning it well for sustained growth in an increasingly digital economy.

- Get an in-depth perspective on Trade Desk's performance by reading our health report here.

Understand Trade Desk's track record by examining our Past report.

Lions Gate Entertainment (NYSE:LGF.A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lions Gate Entertainment Corp. operates in the film, television, subscription, and location-based entertainment sectors across the United States, Canada, and internationally with a market capitalization of approximately $2.14 billion.

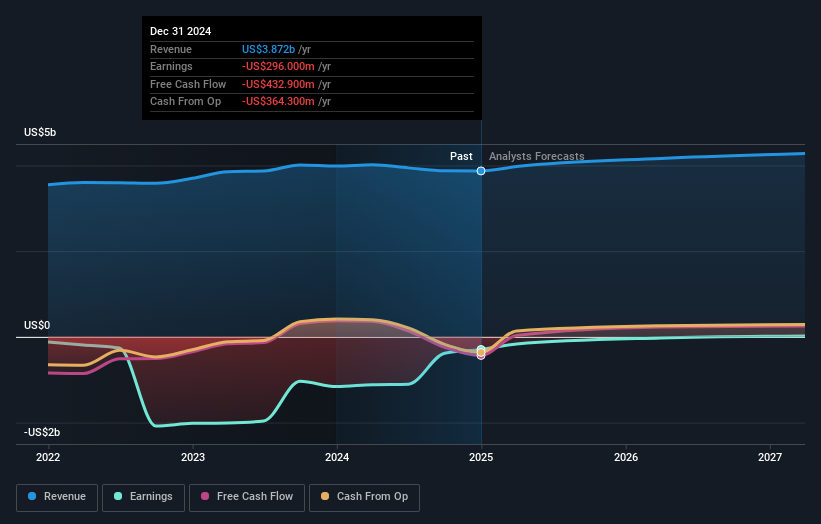

Operations: Lions Gate Entertainment generates revenue primarily from three segments: Media Networks ($1.40 billion), Motion Picture ($1.47 billion), and Television Production ($1.53 billion). The company is involved in various entertainment sectors, including film, television, and subscription services across multiple regions.

Lions Gate Entertainment, navigating through a challenging landscape, has shown resilience with a notable reduction in net losses to $21.9 million from the previous year's $106.6 million for Q3 2024. Despite a slight dip in sales from $975.1 million to $970.5 million in the same period, the company's strategic maneuvers, including securing a significant credit facility backed by intellectual property rights, underscore its efforts to stabilize financially and fuel future growth initiatives. This approach is further bolstered by an aggressive buyback strategy that saw the repurchase of 16,558,996 shares for $287.5 million since 2007, reflecting confidence in its long-term value proposition amidst evolving industry dynamics.

- Click here to discover the nuances of Lions Gate Entertainment with our detailed analytical health report.

Evaluate Lions Gate Entertainment's historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 231 US High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives