- United States

- /

- Healthcare Services

- /

- NasdaqGS:CLOV

Top US Penny Stocks To Watch In October 2024

Reviewed by Simply Wall St

As investors navigate a landscape marked by mixed economic signals and fluctuating stock indices, penny stocks continue to capture attention for their unique potential. Although the term 'penny stock' may sound outdated, it remains relevant in identifying smaller or newer companies that could offer substantial growth opportunities. By focusing on those with solid financial foundations, investors can uncover promising prospects within this intriguing segment of the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.7921 | $5.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.25 | $544.21M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.67 | $2.16B | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.54 | $51.81M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.28 | $10.13M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.70 | $2.86M | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.42 | $147.91M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.36M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $3.57 | $136.12M | ★★★★★☆ |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Profire Energy (NasdaqCM:PFIE)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Profire Energy, Inc. is a technology company that specializes in engineering and designing burner and combustion management systems for natural and forced draft applications in the United States and Canada, with a market cap of $80.07 million.

Operations: The company generates revenue primarily from its Oil Well Equipment & Services segment, which accounts for $57.77 million.

Market Cap: $80.07M

Profire Energy, with a market cap of US$80.07 million, has shown significant earnings growth of 47.6% annually over the past five years, though recent growth slowed to 4.1%. The company is debt-free and has strong short-term asset coverage over liabilities. However, its return on equity at 14.6% is considered low and its share price has been highly volatile recently. Profire's board and management are experienced with average tenures of 11.1 and 4.3 years respectively. Recently, CECO Environmental Corp announced plans to acquire Profire for US$2.55 per share in an all-cash transaction valued at approximately US$125 million, pending completion by Q1 2025.

- Take a closer look at Profire Energy's potential here in our financial health report.

- Evaluate Profire Energy's prospects by accessing our earnings growth report.

Clover Health Investments (NasdaqGS:CLOV)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Clover Health Investments, Corp. offers Medicare Advantage plans in the United States and has a market cap of approximately $2 billion.

Operations: The company's revenue is primarily derived from its Insurance segment, which generated $1.31 billion.

Market Cap: $2B

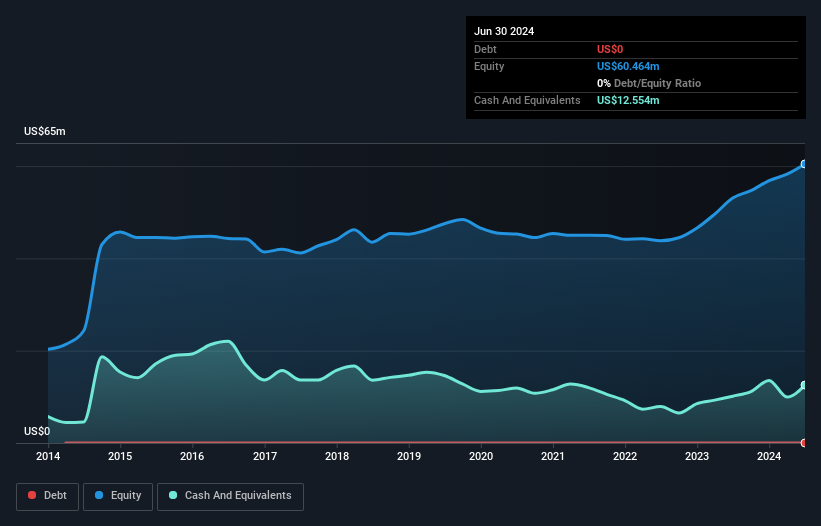

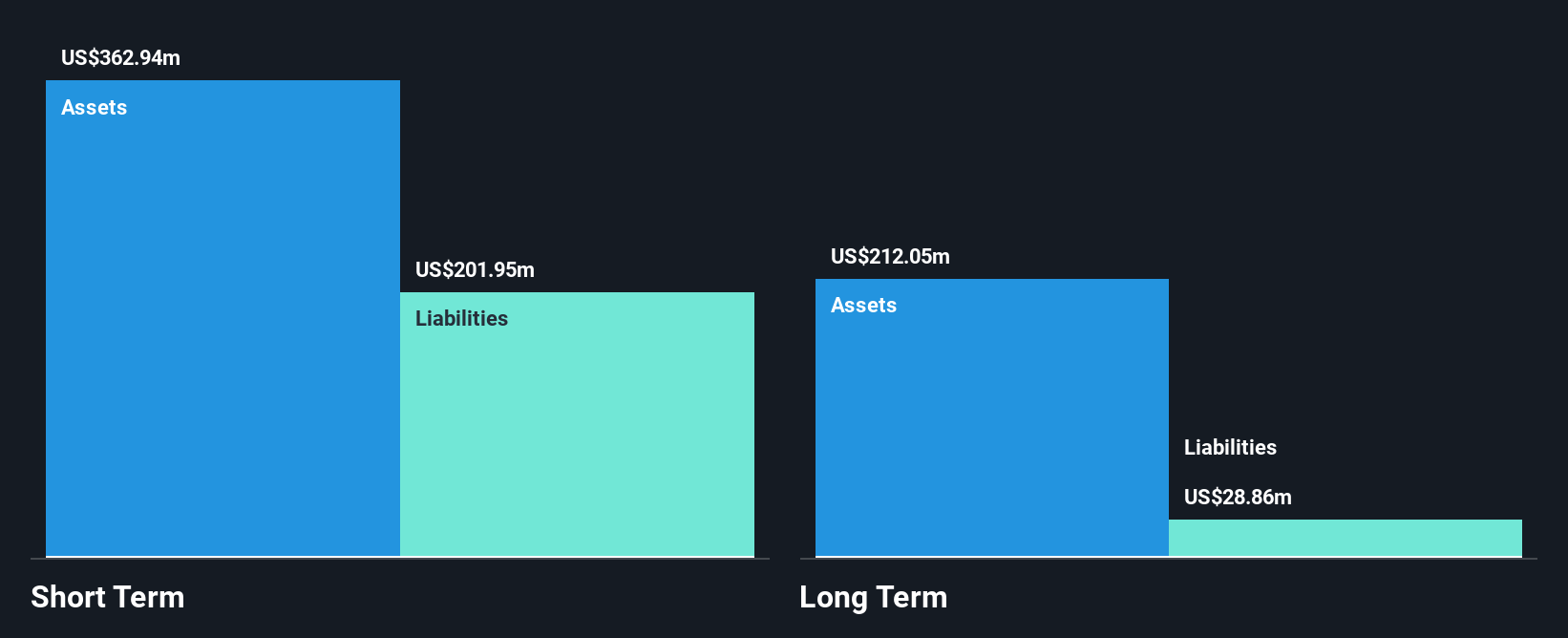

Clover Health Investments, with a market cap of approximately US$2 billion, remains unprofitable but has shown progress by reducing losses over the past five years. The company is debt-free and maintains strong asset coverage over its liabilities. Recent strategic moves include the appointment of Joseph Brand as COO to enhance operational efficiency and product offerings in New Jersey's Medicare Advantage market. Clover's revenue guidance for 2024 was revised upwards, reflecting potential growth in its insurance segment. Despite shareholder dilution and high share price volatility, Clover continues to focus on value-based care initiatives through technological advancements.

- Click to explore a detailed breakdown of our findings in Clover Health Investments' financial health report.

- Explore Clover Health Investments' analyst forecasts in our growth report.

Nextdoor Holdings (NYSE:KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network that connects neighbors, businesses, and public services both in the United States and internationally, with a market cap of approximately $927 million.

Operations: The company's revenue primarily comes from its Internet Information Providers segment, generating $228.09 million.

Market Cap: $926.98M

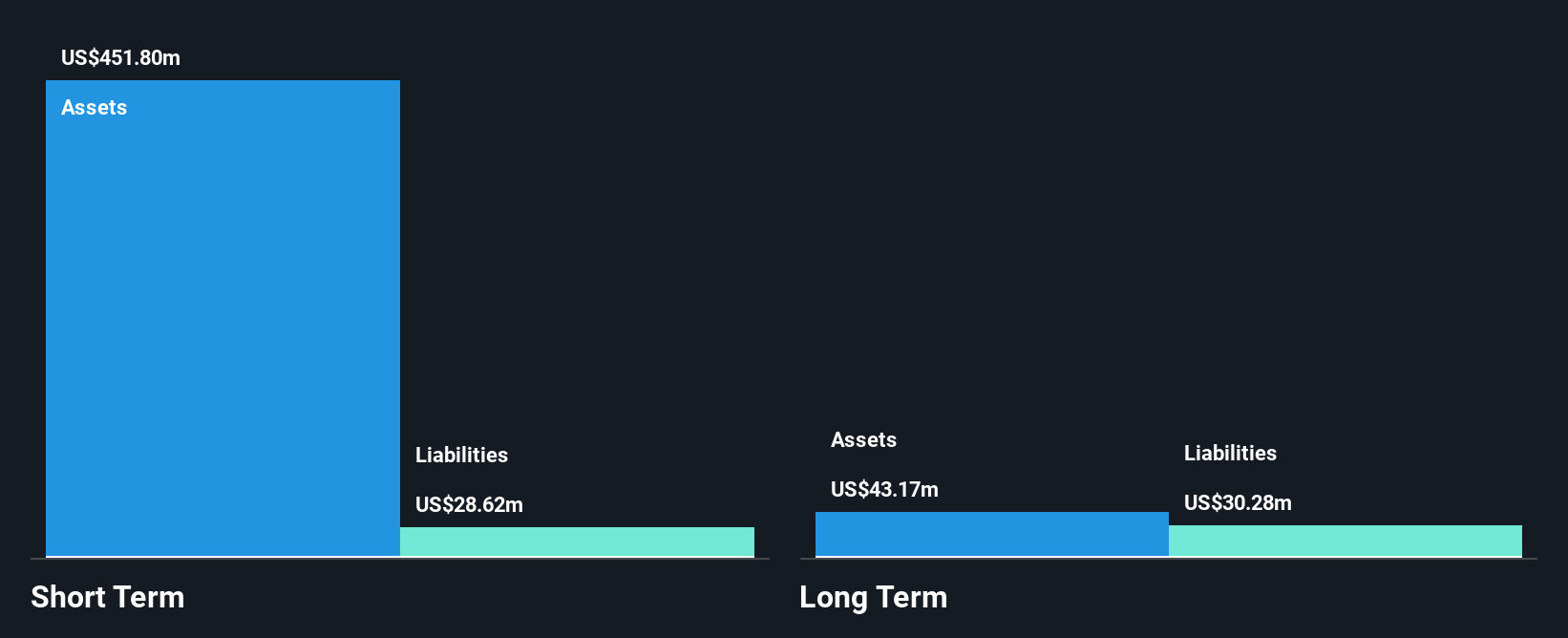

Nextdoor Holdings, with a market cap of US$927 million, is currently unprofitable but demonstrates potential through its revenue growth forecast of 11.28% annually. The company maintains a strong financial position with short-term assets of US$493.2 million exceeding liabilities and no debt over the past five years. Despite increasing losses, Nextdoor has completed significant share repurchases amounting to 11.8% under its buyback program, indicating confidence in its valuation—currently trading at 51.1% below estimated fair value—and future prospects as evidenced by recent conference presentations and strategic guidance updates for 2024 revenue growth.

- Click here to discover the nuances of Nextdoor Holdings with our detailed analytical financial health report.

- Assess Nextdoor Holdings' future earnings estimates with our detailed growth reports.

Make It Happen

- Discover the full array of 756 US Penny Stocks right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CLOV

Clover Health Investments

Provides medicare advantage plans in the United States.

Flawless balance sheet low.