- United States

- /

- Hospitality

- /

- NasdaqGS:SABR

Insider Buying Highlights 3 Undervalued Small Caps In None Region

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields, which have put pressure on equities, particularly small-cap stocks. The S&P 600 Index for small caps has faced challenges as expectations for a slower Federal Reserve rate-cutting cycle emerged amidst tepid economic growth reported in the Fed's Beige Book. In this environment, identifying promising small-cap stocks often involves looking at companies where insider buying may signal confidence in their potential value and resilience despite broader market pressures.

Top 10 Undervalued Small Caps With Insider Buying

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Trican Well Service | 6.7x | 0.8x | 24.83% | ★★★★★★ |

| Columbus McKinnon | 20.2x | 0.9x | 44.37% | ★★★★★★ |

| Bytes Technology Group | 21.7x | 5.5x | 13.18% | ★★★★★☆ |

| Franklin Financial Services | 10.3x | 2.0x | 31.50% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -45.30% | ★★★★☆☆ |

| Marlowe | NA | 0.7x | 41.86% | ★★★★☆☆ |

| HighPeak Energy | 10.9x | 1.4x | 40.72% | ★★★★☆☆ |

| Robert Walters | 43.8x | 0.3x | 39.56% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Orion Group Holdings | NA | 0.3x | -96.12% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

Sabre (NasdaqGS:SABR)

Simply Wall St Value Rating: ★★★☆☆☆

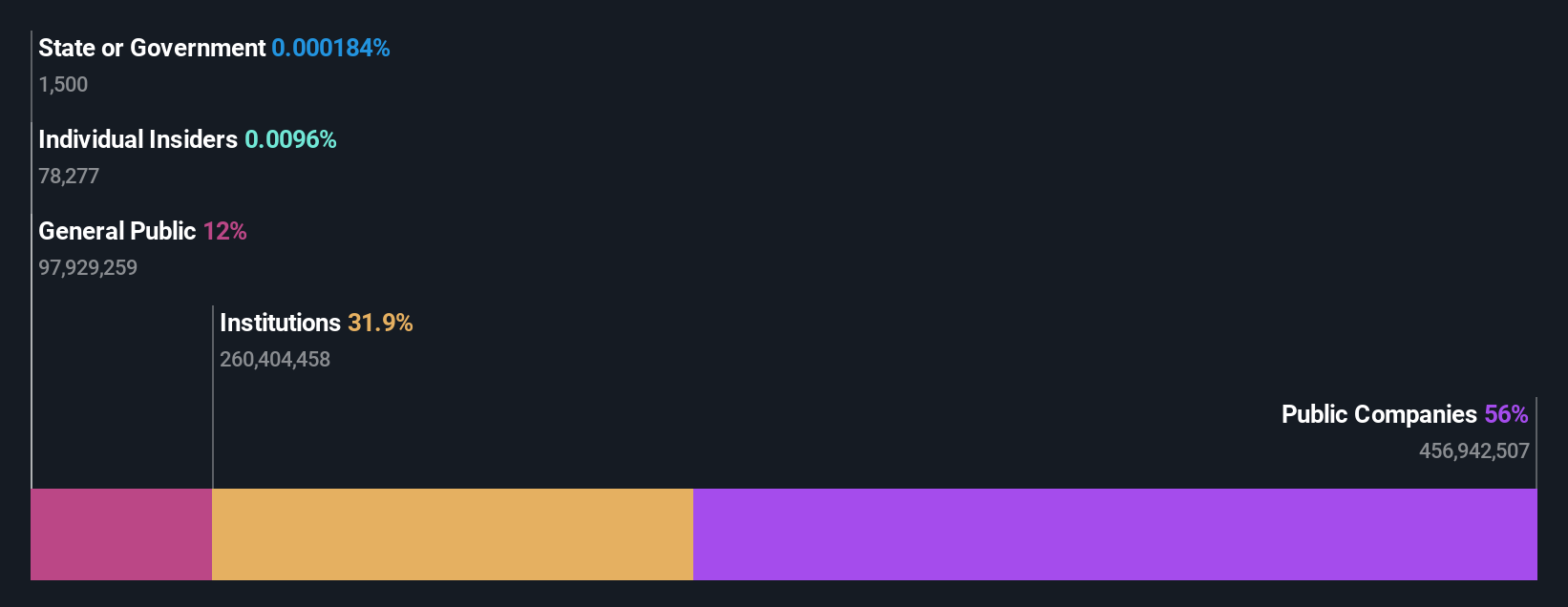

Overview: Sabre is a technology company that provides software and services to the travel and hospitality industries, with a market capitalization of approximately $1.52 billion.

Operations: Sabre's revenue primarily comes from its Travel Solutions and Hospitality Solutions segments, generating $2.70 billion and $315.74 million, respectively. The company has experienced fluctuations in its gross profit margin, which reached 59.47% in the most recent period. Operating expenses have varied over time but remain a significant component of overall costs, with research and development being a notable expenditure area.

PE: -3.5x

Sabre Corporation, a small-cap stock, is gaining traction with recent strategic agreements and technological advancements. Their new distribution deal with Premier Inn expands content access for travel buyers, enhancing booking efficiency through their GDS platform. The company's insider confidence is evident from share purchases in the past year, reflecting potential optimism about future prospects. Despite reporting a net loss of US$141 million for the first half of 2024, Sabre's innovative partnerships and technology-driven solutions suggest promising growth opportunities ahead.

- Delve into the full analysis valuation report here for a deeper understanding of Sabre.

Assess Sabre's past performance with our detailed historical performance reports.

Paradeep Phosphates (NSEI:PARADEEP)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Paradeep Phosphates is a leading fertilizer company in India, primarily engaged in the manufacturing and sale of complex fertilizers, with a market capitalization of ₹56.31 billion.

Operations: Paradeep Phosphates generates revenue primarily from its sales, with cost of goods sold (COGS) being a significant expense. The company's gross profit margin has seen fluctuations, peaking at 31.77% in March 2017 and reaching 26.37% in September 2024. Operating expenses also play a major role in the financial structure, impacting net income margins over the periods analyzed.

PE: 22.9x

Paradeep Phosphates, a smaller company in the fertilizer sector, has shown promising financial performance with a net income of INR 2.3 billion for the six months ending September 2024, compared to a loss last year. Insider confidence is evident as they have been purchasing shares recently. Despite regulatory challenges and environment-related penalties totaling INR 4 million, the company remains focused on growth with earnings projected to rise by over 27% annually.

- Dive into the specifics of Paradeep Phosphates here with our thorough valuation report.

Gain insights into Paradeep Phosphates' past trends and performance with our Past report.

Nolato (OM:NOLA B)

Simply Wall St Value Rating: ★★★☆☆☆

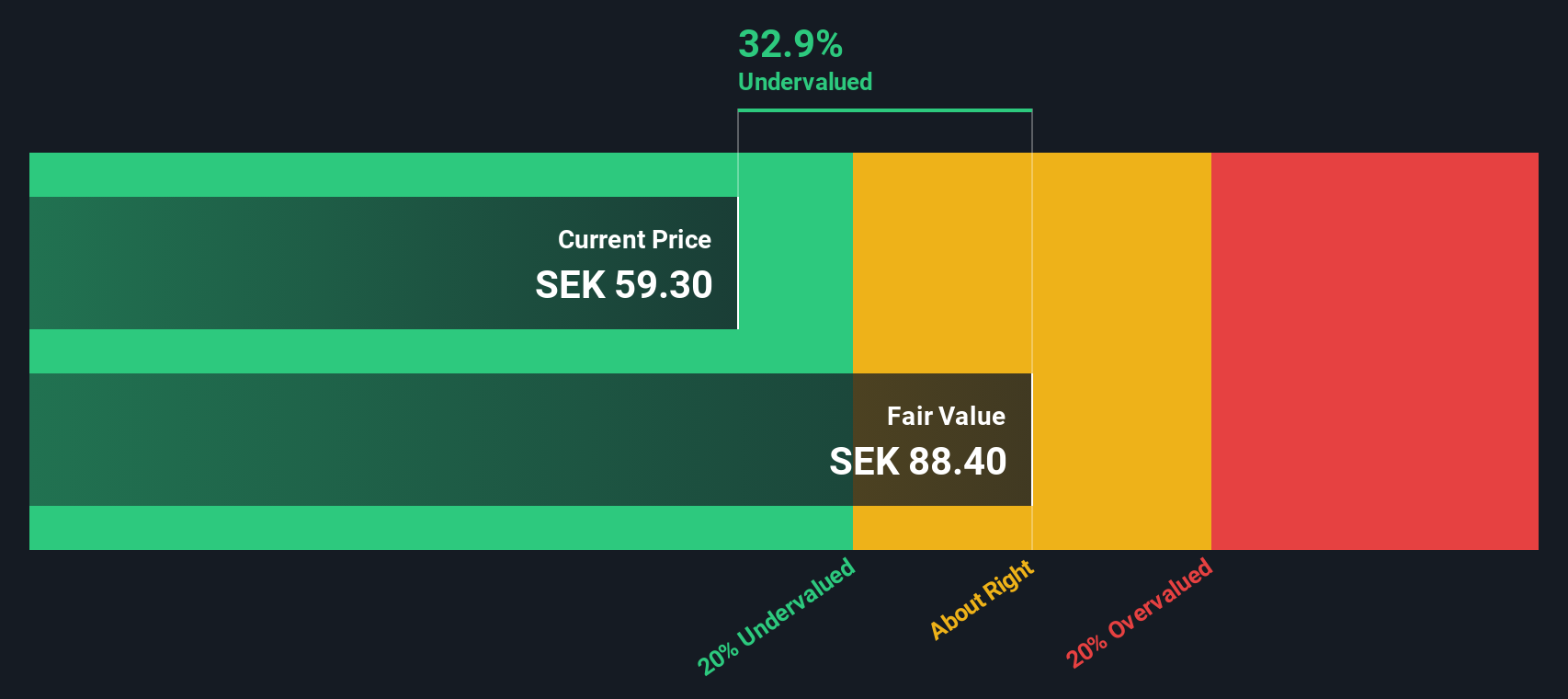

Overview: Nolato is a Swedish company specializing in developing and manufacturing polymer product systems for various industries, with a market cap of SEK 15.25 billion.

Operations: Nolato's revenue streams primarily include Medical Solutions, contributing SEK 5.38 billion, with adjustments of SEK 4.17 billion affecting the overall figures. The company's gross profit margin has varied over time, reaching a recent high of 16.36% in September 2024 from a low of 13.19% in March 2023, indicating fluctuations in profitability relative to revenue and cost management dynamics across different periods.

PE: 27.0x

Nolato's recent financial performance highlights its potential as an undervalued investment. In Q3 2024, the company reported a net income of SEK 164 million, up from SEK 69 million the previous year, with earnings per share rising to SEK 0.61 from SEK 0.26. Despite relying on higher-risk external borrowing for funding, insider confidence is evident with notable share purchases in recent months. Earnings are projected to grow annually by nearly 20%, suggesting promising prospects for investors considering small companies with growth potential in their portfolio.

- Navigate through the intricacies of Nolato with our comprehensive valuation report here.

Gain insights into Nolato's historical performance by reviewing our past performance report.

Where To Now?

- Embark on your investment journey to our 193 Undervalued Small Caps With Insider Buying selection here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SABR

Sabre

Operates as a software and technology company for travel industry in the United States, Europe, Asia-Pacific, and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives