- United States

- /

- Biotech

- /

- NasdaqGS:CRBU

Discovering RF Industries And 2 Other Promising Penny Stocks

Reviewed by Simply Wall St

The market has stayed flat over the past seven days, yet it is up 9.9% over the past year, with earnings forecasted to grow by 15% annually. In such a landscape, identifying stocks with strong financials becomes crucial for investors seeking value and growth opportunities. Penny stocks, despite their somewhat outdated name, continue to be relevant as they often represent smaller or newer companies that can offer significant potential when backed by solid fundamentals.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Imperial Petroleum (IMPP) | $3.57 | $122.52M | ✅ 4 ⚠️ 1 View Analysis > |

| New Horizon Aircraft (HOVR) | $2.27 | $71.56M | ✅ 4 ⚠️ 5 View Analysis > |

| Waterdrop (WDH) | $1.34 | $473.78M | ✅ 4 ⚠️ 0 View Analysis > |

| Greenland Technologies Holding (GTEC) | $2.11 | $37.22M | ✅ 2 ⚠️ 5 View Analysis > |

| WM Technology (MAPS) | $1.07 | $174.9M | ✅ 4 ⚠️ 1 View Analysis > |

| Perfect (PERF) | $2.02 | $206.75M | ✅ 3 ⚠️ 0 View Analysis > |

| Flexible Solutions International (FSI) | $4.42 | $55.14M | ✅ 1 ⚠️ 2 View Analysis > |

| BAB (BABB) | $0.84176 | $6.05M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.78 | $86.74M | ✅ 3 ⚠️ 2 View Analysis > |

| TETRA Technologies (TTI) | $3.74 | $512.33M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 716 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

RF Industries (RFIL)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: RF Industries, Ltd. designs, manufactures, and markets interconnect products and systems globally with a market cap of $47.69 million.

Operations: Revenue segments for the company are not reported.

Market Cap: $47.69M

RF Industries, with a market cap of US$47.69 million, has shown some financial resilience despite being unprofitable. The company reported an increase in sales to US$18.91 million for the second quarter of 2025, up from US$16.11 million the previous year, and reduced its net loss significantly from US$4.29 million to US$0.245 million over the same period. Its management and board are experienced with average tenures of 4.9 and 6 years respectively, while short-term assets comfortably cover both short- and long-term liabilities, indicating sound liquidity management amidst ongoing challenges in achieving profitability.

- Dive into the specifics of RF Industries here with our thorough balance sheet health report.

- Gain insights into RF Industries' future direction by reviewing our growth report.

Caribou Biosciences (CRBU)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Caribou Biosciences, Inc. is a clinical-stage biopharmaceutical company focused on developing genome-edited allogeneic cell therapies for hematologic malignancies and autoimmune diseases, with a market cap of approximately $107.89 million.

Operations: The company's revenue primarily comes from its efforts in developing a pipeline of allogeneic CAR-T and CAR-NK cell therapies, generating $9.92 million.

Market Cap: $107.89M

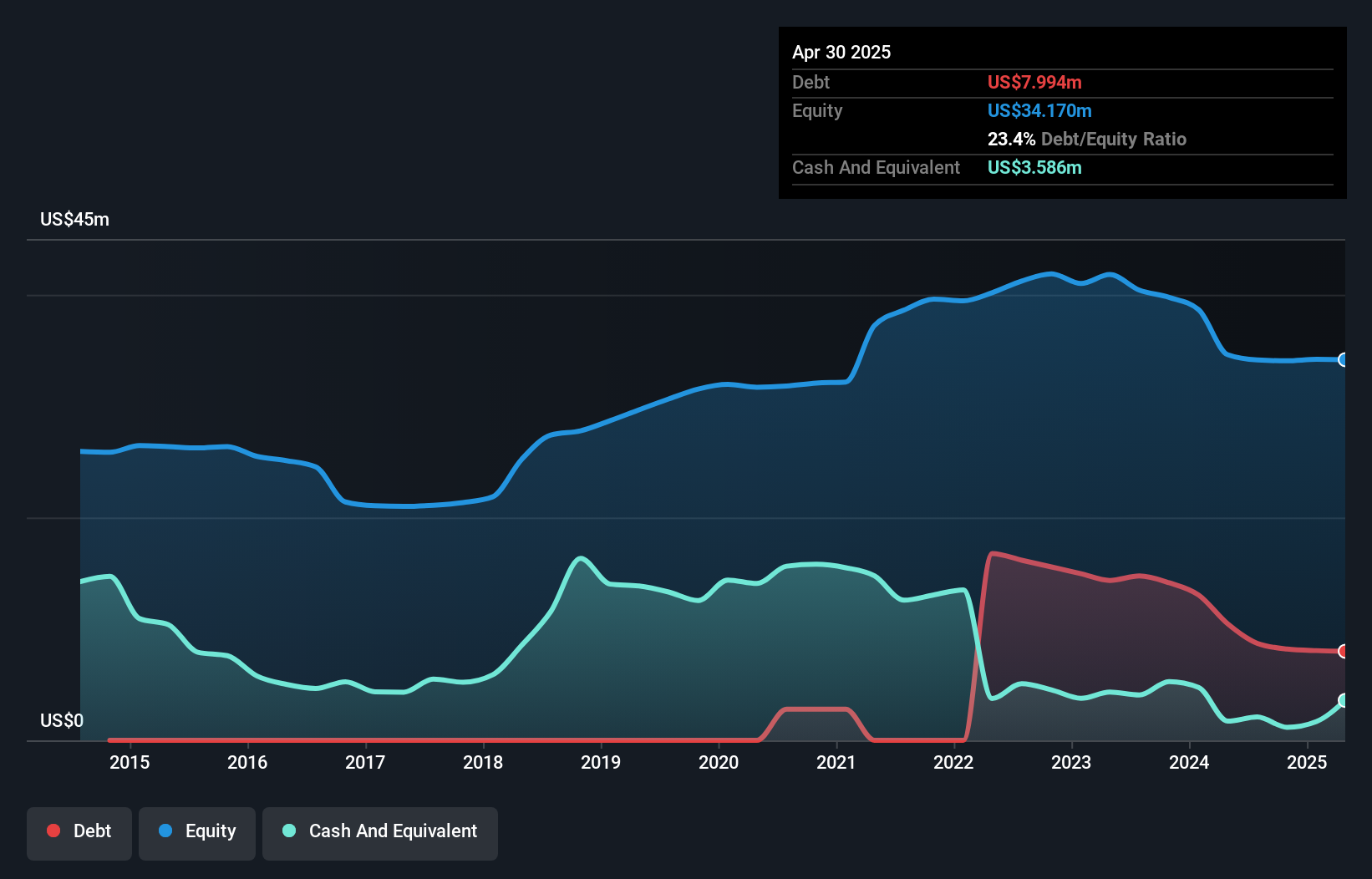

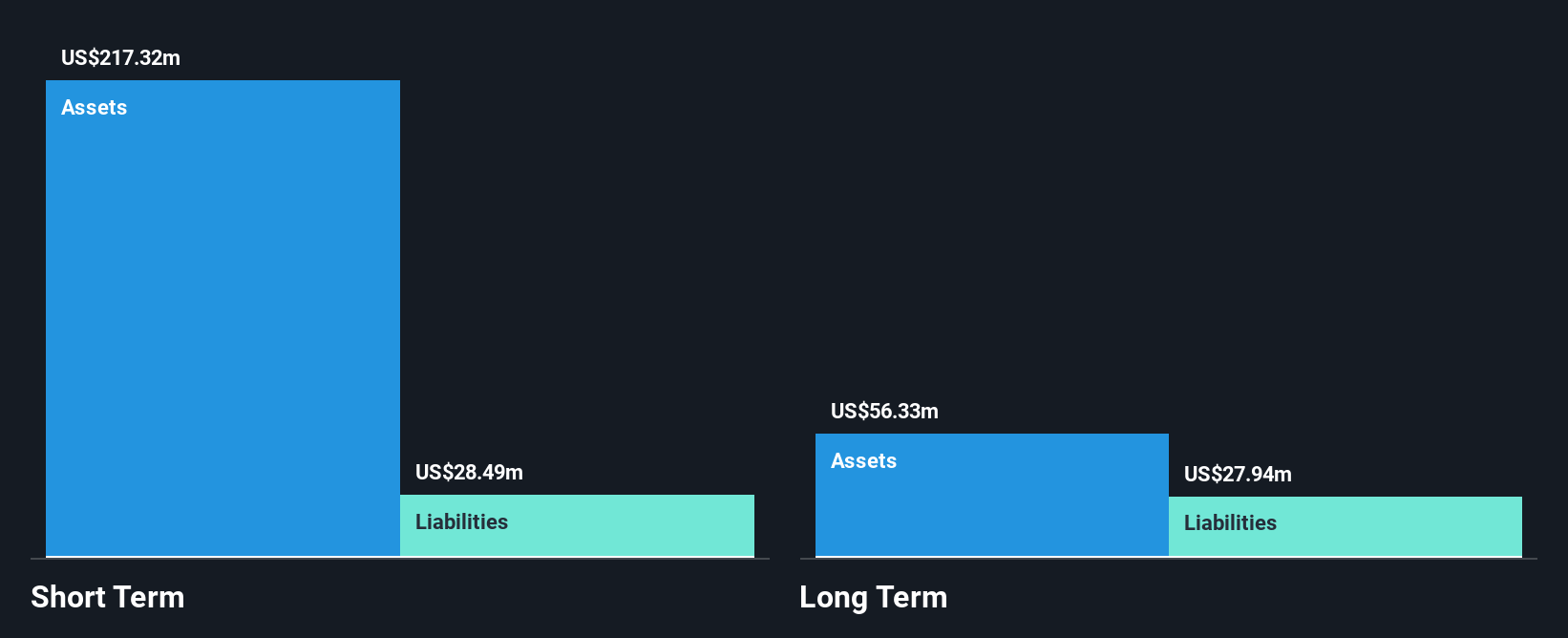

Caribou Biosciences, with a market cap of US$107.89 million, remains unprofitable but is focused on developing its allogeneic cell therapy pipeline. Despite reporting a net loss of US$39.99 million in Q1 2025, the company has no debt and possesses short-term assets totaling US$217.3 million that exceed its liabilities, ensuring liquidity stability. Recent strategic moves include a reverse stock split amendment and a follow-on equity offering for US$100 million to bolster financial flexibility. The company's cash runway extends over a year with ongoing cost reductions aimed at extending it further into late 2027 amidst volatile share prices.

- Get an in-depth perspective on Caribou Biosciences' performance by reading our balance sheet health report here.

- Understand Caribou Biosciences' earnings outlook by examining our growth report.

Nextdoor Holdings (KIND)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nextdoor Holdings, Inc. operates a neighborhood network that connects neighbors, businesses, and public agencies in the United States and internationally, with a market cap of approximately $619.79 million.

Operations: The company generates $248.31 million in revenue from its Internet Information Providers segment.

Market Cap: $619.79M

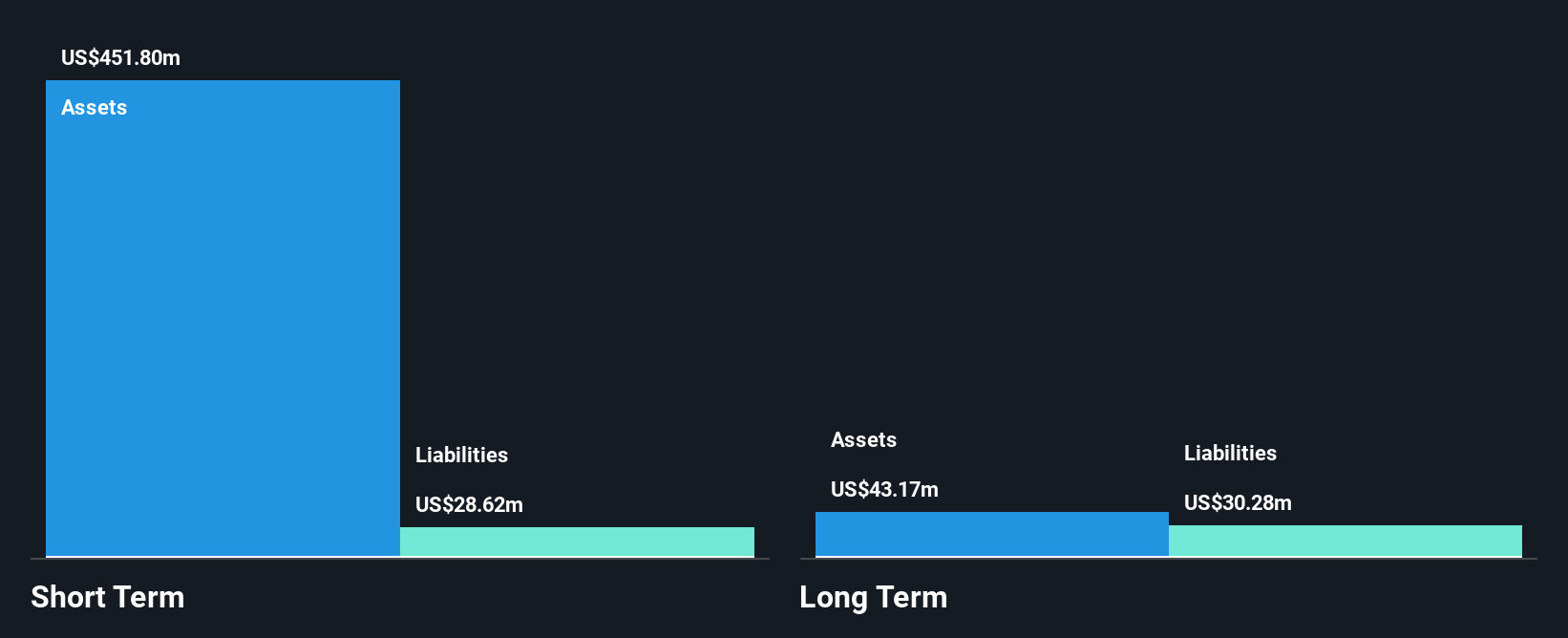

Nextdoor Holdings, with a market cap of US$619.79 million, reported Q1 2025 sales of US$54.18 million, slightly up from the previous year. Despite a net loss reduction to US$21.95 million, profitability remains elusive and is not anticipated within three years. The company benefits from strong liquidity with short-term assets of US$451.8 million surpassing liabilities and remains debt-free for five years. Recent strategic initiatives include a significant share buyback program and partnerships to enhance platform engagement, notably with schools through Class Intercom integration, aiming to leverage its 45 million weekly active users for growth opportunities amidst stable volatility.

- Jump into the full analysis health report here for a deeper understanding of Nextdoor Holdings.

- Explore Nextdoor Holdings' analyst forecasts in our growth report.

Taking Advantage

- Click through to start exploring the rest of the 713 US Penny Stocks now.

- Interested In Other Possibilities? Rare earth metals are the new gold rush. Find out which 24 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:CRBU

Caribou Biosciences

A clinical-stage biopharmaceutical company, engages in the development of genome-edited allogeneic cell therapies for the treatment of hematologic malignancies and autoimmune diseases in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives