- United States

- /

- Entertainment

- /

- NYSE:IMAX

IMAX (IMAX): Assessing Valuation as 'Sinners' Re-Release Renews Buzz and Analysts Highlight Box Office Rebound

Reviewed by Simply Wall St

IMAX (IMAX) is getting extra buzz this Halloween as the acclaimed film “Sinners” returns to select IMAX theaters from October 30 through November 5. This comes as the award season heats up and box office momentum is expected to build.

See our latest analysis for IMAX.

IMAX has been gaining momentum, with its latest $32.05 share price building on a wave of renewed attention from successful movie events like the “Sinners” re-release and positive forecasts for a year-end box office comeback. Investors who stuck around have been rewarded: IMAX delivered an impressive 55.8% total shareholder return over the past year, and a remarkable 173.7% total return over five years, signaling confidence in both its short-term buzz and longer-term outlook.

Curious about what’s energizing other media and entertainment stocks? Now could be the perfect moment to broaden your perspective and uncover fast growing stocks with high insider ownership.

But with shares up sharply and Wall Street projecting more growth ahead, does IMAX still have room to run or is the excitement already built into the price? Could this be a hidden buying opportunity, or has the market already priced in future gains?

Most Popular Narrative: 12.1% Undervalued

With IMAX’s last close at $32.05 and the narrative’s fair value set at $36.45, the gap suggests investors may be overlooking upside potential. Market excitement is building, but what is really beneath the surface?

“Analysts are assuming IMAX's revenue will grow by 8.7% annually over the next 3 years. Analysts assume that profit margins will increase from 9.0% today to 15.9% in 3 years time.”

Want to know the growth blueprint behind this high valuation? The key element of this narrative is bold earnings acceleration and a future profit multiple often seen in market leaders. Curious how much profit expansion and revenue ramp-up are locked into these expectations? The real driver may surprise you. Discover the story behind the price target.

Result: Fair Value of $36.45 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifting consumer habits and reliance on blockbuster releases could challenge the sustainability of IMAX’s recent strong performance and growth outlook.

Find out about the key risks to this IMAX narrative.

Another View: What About the Price-to-Earnings Ratio?

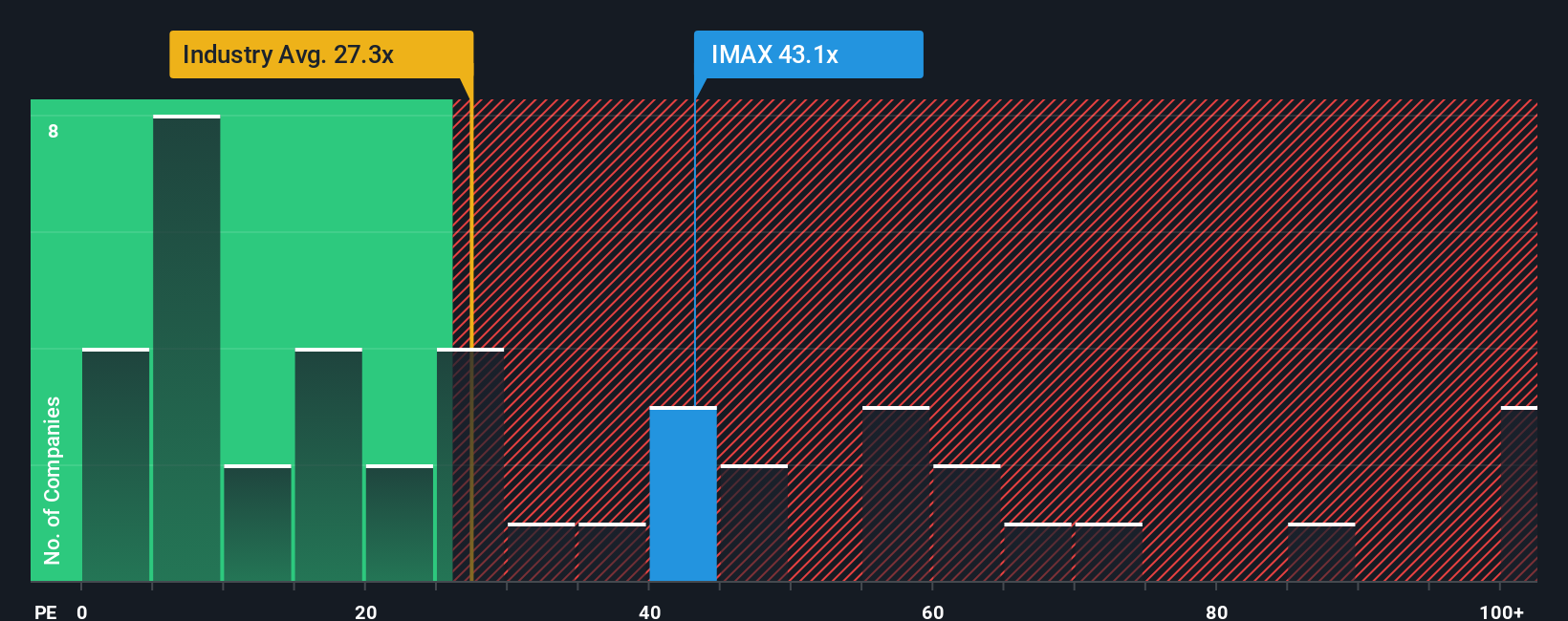

While some see IMAX as undervalued based on future potential, its current price-to-earnings ratio of 52.6x stands well above the US Entertainment industry average (26.4x) and the fair ratio of 24x. This means that, on this measure, IMAX is priced for sustained, robust earnings growth, which leaves little margin for error if momentum slows. Could this optimism be overdone, or is the market seeing something others have missed?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own IMAX Narrative

If you think there’s more to this story or want to dig deeper, jump in and build your own view in minutes: Do it your way.

A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Don’t let standout opportunities pass you by. Use the Simply Wall Street Screener to find stocks shaping tomorrow’s winners with targeted, expert-driven approaches.

- Snap up potential bargains by reviewing these 877 undervalued stocks based on cash flows and target companies trading below their intrinsic value before everyone else catches on.

- Tap into the growth surge of top healthcare innovators through these 33 healthcare AI stocks, which highlights companies making strides in medical technology and artificial intelligence.

- Capitalize on lucrative returns by sifting through these 17 dividend stocks with yields > 3%, a selection of companies rewarding shareholders with robust, above-average yields.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives