- United States

- /

- Entertainment

- /

- NYSE:IMAX

Could IMAX's (IMAX) Screening Disruption Reveal Deeper Risks in Its Premium Content Strategy?

Reviewed by Sasha Jovanovic

- IMAX's North American screenings of 'Kantara: Chapter 1' were recently canceled due to last-minute content delivery issues, while a new BTS concert film is scheduled for global IMAX release this November.

- This disruption highlights how IMAX's business is sensitive to operational hurdles in premium content delivery, which can affect its high-profile event-driven revenue streams and cinema partnerships.

- We'll explore how this interruption in IMAX's North American release slate could influence its long-term entertainment platform investment thesis.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

IMAX Investment Narrative Recap

For me, the core belief for owning IMAX stock comes down to conviction in persistent audience demand for premium, differentiated out-of-home entertainment and the company's ability to capitalize on major global event releases. The last-minute cancellation of North American IMAX screenings for 'Kantara: Chapter 1' does underline short-term vulnerabilities to operational hiccups, but does not appear to materially shift the largest current catalyst: steady growth in premium system installations driven by global studio partnerships. The biggest risk remains the unpredictability of blockbuster-dependent content pipelines, which can directly affect IMAX's revenue consistency and screen utilization rates.

Among IMAX's recent announcements, the continued global rollout of IMAX with Laser, such as the multi-site partnership expansions with Apple Cinemas, HOYTS, EVT, and Kinepolis, underscores the company's focus on network scale and technical innovation. This is particularly relevant in the context of content delivery disruptions, as extending the premium screen base broadens the revenue pool and aims to insulate against the risk of individual event setbacks.

In contrast, even though technology upgrades offer growth, the risk of studio pipeline volatility is something investors should not overlook if...

Read the full narrative on IMAX (it's free!)

IMAX's outlook projects $466.0 million in revenue and $74.0 million in earnings by 2028. This is based on a forecasted 8.7% annual revenue growth and a $41.2 million increase in earnings from the current $32.8 million.

Uncover how IMAX's forecasts yield a $34.36 fair value, in line with its current price.

Exploring Other Perspectives

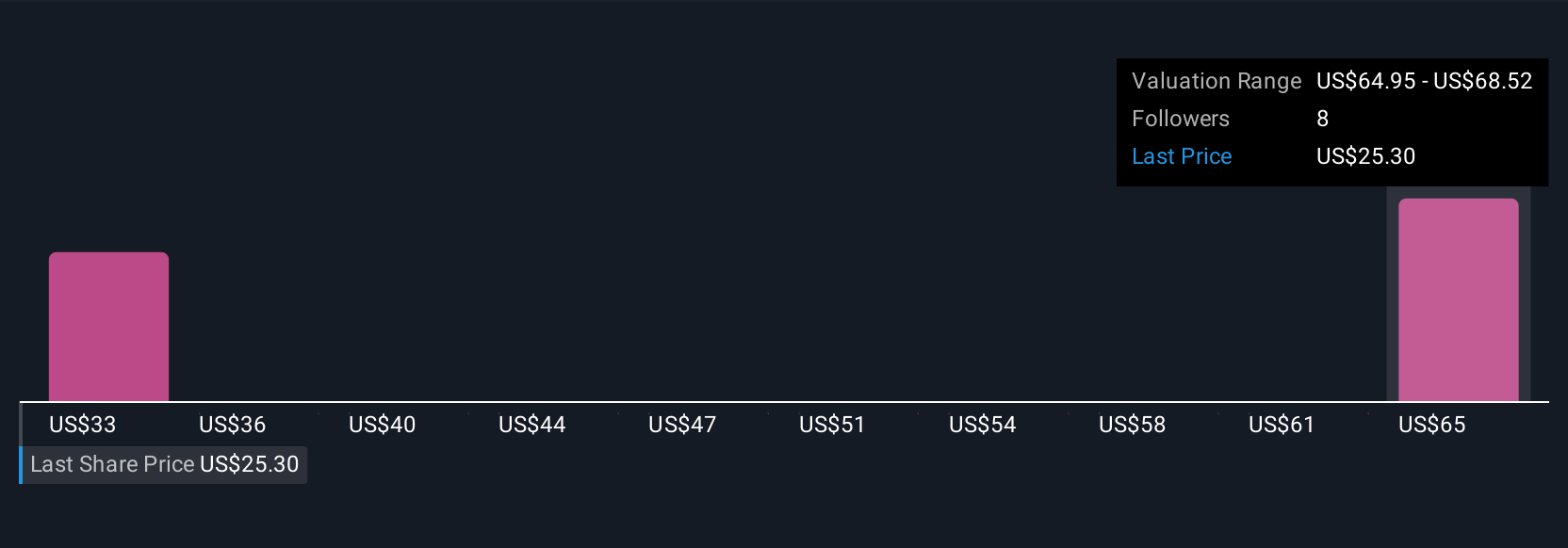

Simply Wall St Community members value IMAX between US$34.36 and US$58.13, based on two individual forecasts. These wide-ranging views sit against the backdrop of blockbuster pipeline volatility that could sway performance, urging you to review multiple perspectives before forming your outlook.

Explore 2 other fair value estimates on IMAX - why the stock might be worth as much as 72% more than the current price!

Build Your Own IMAX Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your IMAX research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free IMAX research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate IMAX's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IMAX

IMAX

Operates as a technology platform for entertainment and events in the United States, Greater China, rest of Asia, Western Europe, Canada, Latin America, and internationally.

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives