- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

The Market Doesn't Like What It Sees From fuboTV Inc.'s (NYSE:FUBO) Revenues Yet As Shares Tumble 25%

fuboTV Inc. (NYSE:FUBO) shareholders won't be pleased to see that the share price has had a very rough month, dropping 25% and undoing the prior period's positive performance. For any long-term shareholders, the last month ends a year to forget by locking in a 58% share price decline.

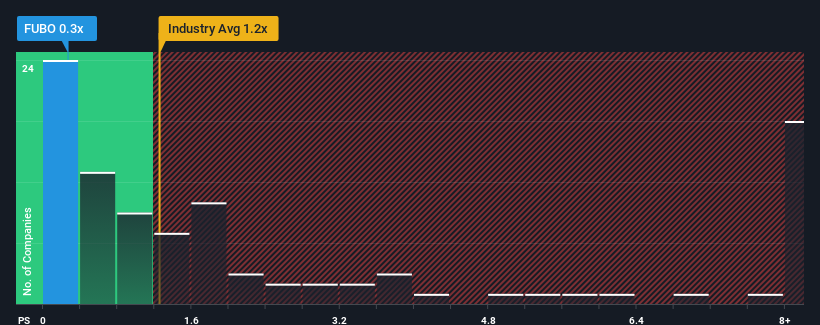

After such a large drop in price, it would be understandable if you think fuboTV is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.3x, considering almost half the companies in the United States' Interactive Media and Services industry have P/S ratios above 1.2x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for fuboTV

How Has fuboTV Performed Recently?

With revenue growth that's superior to most other companies of late, fuboTV has been doing relatively well. One possibility is that the P/S ratio is low because investors think this strong revenue performance might be less impressive moving forward. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on fuboTV.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, fuboTV would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that the company grew revenue by an impressive 24% last year. The strong recent performance means it was also able to grow revenue by 210% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 11% as estimated by the nine analysts watching the company. That's shaping up to be materially lower than the 14% growth forecast for the broader industry.

In light of this, it's understandable that fuboTV's P/S sits below the majority of other companies. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What We Can Learn From fuboTV's P/S?

fuboTV's recently weak share price has pulled its P/S back below other Interactive Media and Services companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of fuboTV's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Having said that, be aware fuboTV is showing 2 warning signs in our investment analysis, you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Undervalued with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026