- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

Is FuboTV’s (FUBO) New Sports Streaming Service a Turning Point in Its Competitive Strategy?

Reviewed by Simply Wall St

- On September 2, 2025, FuboTV Inc. launched Fubo Sports, a standalone sports streaming service featuring 20+ sports and broadcast networks in select markets at an introductory price of US$45.99 for the first month and US$55.99 ongoing.

- This move marks Fubo's entry into the growing market for affordable, focused streaming bundles aimed at budget-conscious sports fans seeking flexible options outside of traditional cable.

- We'll assess how Fubo Sports' targeted bundle and pricing could influence the company's competitive edge and broader investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

fuboTV Investment Narrative Recap

To be a shareholder in fuboTV, you need to believe that the company can grow and retain a large, profitable user base of live sports streamers, despite intense competition and persistent content costs. The recent launch of Fubo Sports directly targets the budget-conscious sports viewer segment and could act as a catalyst to slow subscriber declines, though a single product launch might not materially change underlying risks from churn and margin pressure right away. The biggest short-term catalyst is broad adoption and successful upsell of this new bundle, while the largest immediate risk remains whether fuboTV can achieve and sustain profitability as content expenses and competition rise.

One relevant recent announcement is FuboTV’s expanded partnership with DAZN in Canada, broadening access to premium sports content for both platforms. This move aligns with the catalyst of expanding content partnerships to appeal to more sports fans, and supports Fubo’s efforts to boost ARPU through premium offerings, an important step in offsetting revenue headwinds and supporting its competitive positioning as a sports-first streaming provider.

Yet, in contrast to these new offerings, investor attention should remain fixed on the unresolved challenge of content rights fragmentation and what that means for…

Read the full narrative on fuboTV (it's free!)

fuboTV's narrative projects $1.8 billion revenue and $200.4 million earnings by 2028. This requires 3.8% yearly revenue growth and a $112.7 million earnings increase from $87.7 million today.

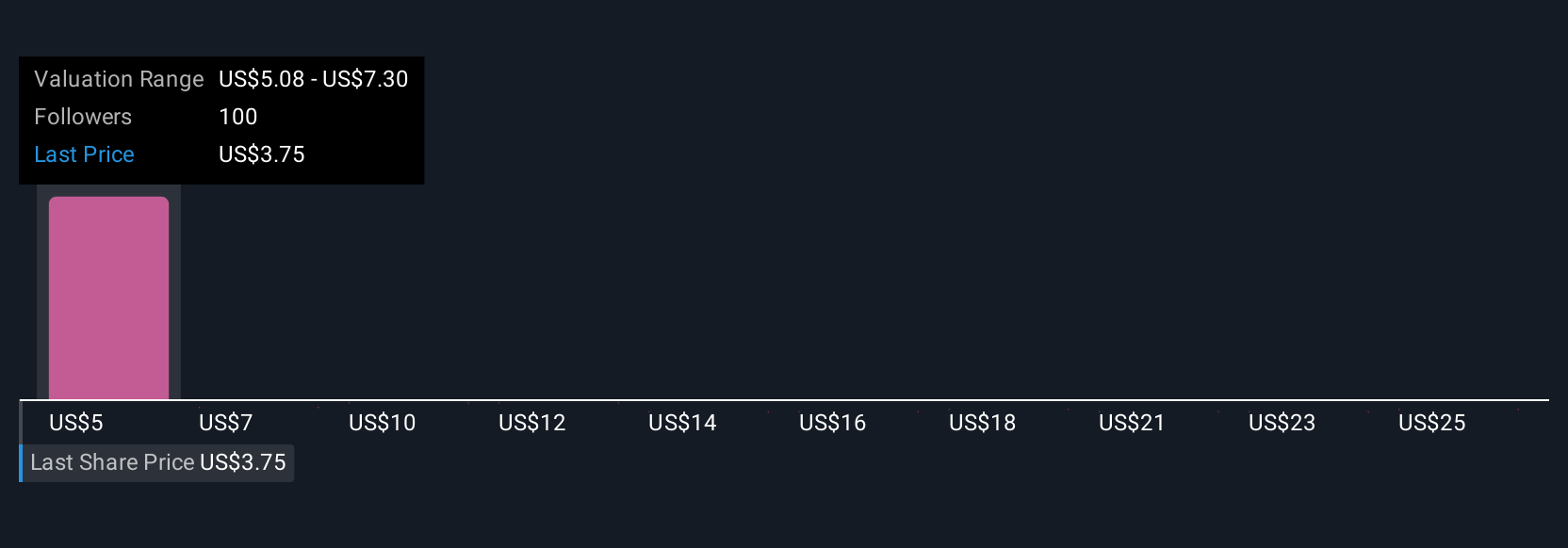

Uncover how fuboTV's forecasts yield a $4.50 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Seventeen fair value estimates from the Simply Wall St Community span US$4.11 to US$18.62 per share, illustrating notably divergent outlooks. While product launches may spur optimism, persistent risks around customer churn and margin pressures are shaping sharply different expectations for future performance.

Explore 17 other fair value estimates on fuboTV - why the stock might be worth over 4x more than the current price!

Build Your Own fuboTV Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your fuboTV research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free fuboTV research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate fuboTV's overall financial health at a glance.

Contemplating Other Strategies?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives