- United States

- /

- Interactive Media and Services

- /

- NYSE:FUBO

FuboTV (FUBO) Valuation in Focus Following Multi-Year Canadian Partnership With DAZN

Reviewed by Simply Wall St

fuboTV (NYSE:FUBO) is making headlines after announcing a multi-year partnership with DAZN in Canada, building on their U.S. agreement. This deal means DAZN subscribers in Canada will now get bundled access to Fubo Sports Network. FuboTV’s audience will also be able to access DAZN’s premium live sports content. This move could help grow Fubo’s reach, deepen its content lineup, and increase the appeal of cord-cutting for sports fans in both countries.

The market’s response has shown some optimism, with shares up about 3% in the last session, pushing this year’s return to over 147%. This reflects a significant recovery from past lows, though there has been volatility. Just last month, shares fell 5% as investors considered last week’s lawsuit headlines along with the DAZN news. However, looking at a three-year record that remains modestly negative, the stock’s recent momentum seems to be driven more by new developments than by long-term fundamentals for the time being.

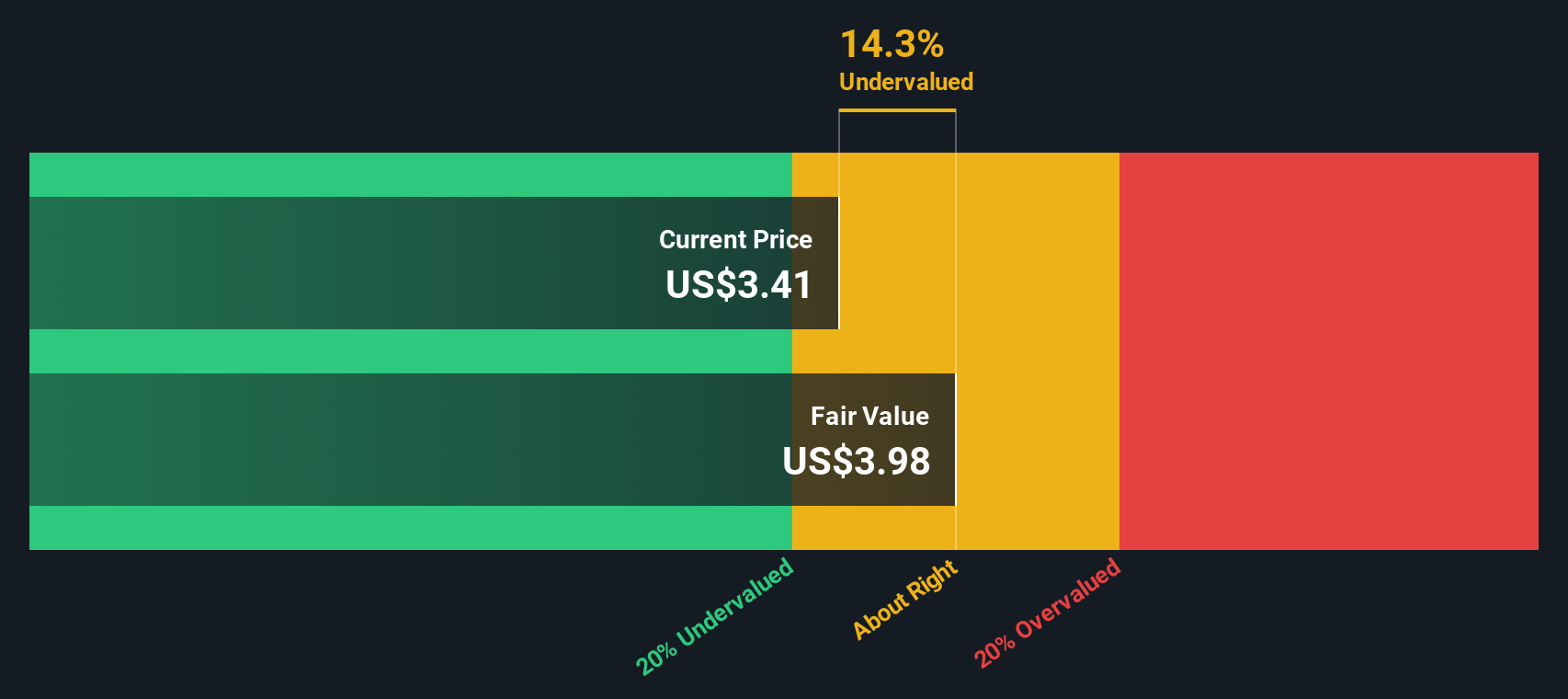

After this year’s surge, the question remains whether FuboTV is being overlooked by the market or if its future growth is already fully reflected in the current price.

Most Popular Narrative: 22% Undervalued

According to community narrative, fuboTV is currently trading at a significant discount to its estimated fair value, with analysts expecting a higher price based on forward-looking catalysts and margin potential.

“Progress towards positive adjusted EBITDA and margin expansion, as demonstrated by recent quarter profitability, reflects ongoing operational efficiencies and cost discipline. This lays the foundation for improved net margins and long-term earnings growth.”

Curious what’s fueling this hefty undervaluation narrative? It’s not just the latest headlines. The story centers on ambitious profit margin shifts, bold revenue forecasts, and a reimagined multiple that could reshape the company’s future price. Want to know which crucial assumptions are moving the math? The real drivers behind this target might surprise you. Read the full community narrative to uncover the surprising details.

Result: Fair Value of $4.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent subscriber declines and ongoing cash burn could diminish long-term confidence in fuboTV's ability to achieve sustainable growth.

Find out about the key risks to this fuboTV narrative.Another View: DCF Model Checks the Numbers

Taking a fresh look, our DCF model also suggests the stock could be trading below its fair value. However, the result depends on growth and margin assumptions. Which method tells a more reliable story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out fuboTV for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own fuboTV Narrative

If you see things differently or want to dig deeper into the numbers yourself, you can craft your own perspective on fuboTV in just a few minutes. do it your way.

A great starting point for your fuboTV research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Now is an ideal time to branch out and put your capital to work in strategies you may have overlooked. Give yourself the advantage with these proven stock ideas tailored to different investment goals:

- Secure reliable income streams by checking out dividend stocks with yields over 3% through dividend stocks with yields > 3%.

- Tap into tomorrow's technology by exploring quantum computing leaders using quantum computing stocks.

- Capitalize on the AI revolution in healthcare by investigating companies pushing boundaries with healthcare AI stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if fuboTV might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:FUBO

fuboTV

Operates a live TV streaming platform for live sports, news, and entertainment content in the United States and internationally.

Good value with acceptable track record.

Similar Companies

Market Insights

Community Narratives