- United States

- /

- Communications

- /

- NasdaqGS:ITRN

Exploring Dividend Stocks For Enhanced Portfolio In May 2024

Reviewed by Simply Wall St

Over the past year, the United States stock market has experienced a significant uptick, rising 25%, though it has remained flat in the last week. In this context of expected earnings growth and stable recent performance, dividend stocks stand out as potentially appealing for investors looking to generate regular income while participating in market gains.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Columbia Banking System (NasdaqGS:COLB) | 7.86% | ★★★★★★ |

| Resources Connection (NasdaqGS:RGP) | 5.13% | ★★★★★★ |

| Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.04% | ★★★★★★ |

| Regions Financial (NYSE:RF) | 5.15% | ★★★★★★ |

| Citizens Financial Group (NYSE:CFG) | 4.91% | ★★★★★★ |

| Dillard's (NYSE:DDS) | 4.71% | ★★★★★★ |

| CompX International (NYSEAM:CIX) | 4.98% | ★★★★★★ |

| Ennis (NYSE:EBF) | 4.86% | ★★★★★★ |

| First Bancorp (NasdaqGS:FNLC) | 5.98% | ★★★★★☆ |

| Franklin Financial Services (NasdaqCM:FRAF) | 4.94% | ★★★★★☆ |

Click here to see the full list of 214 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

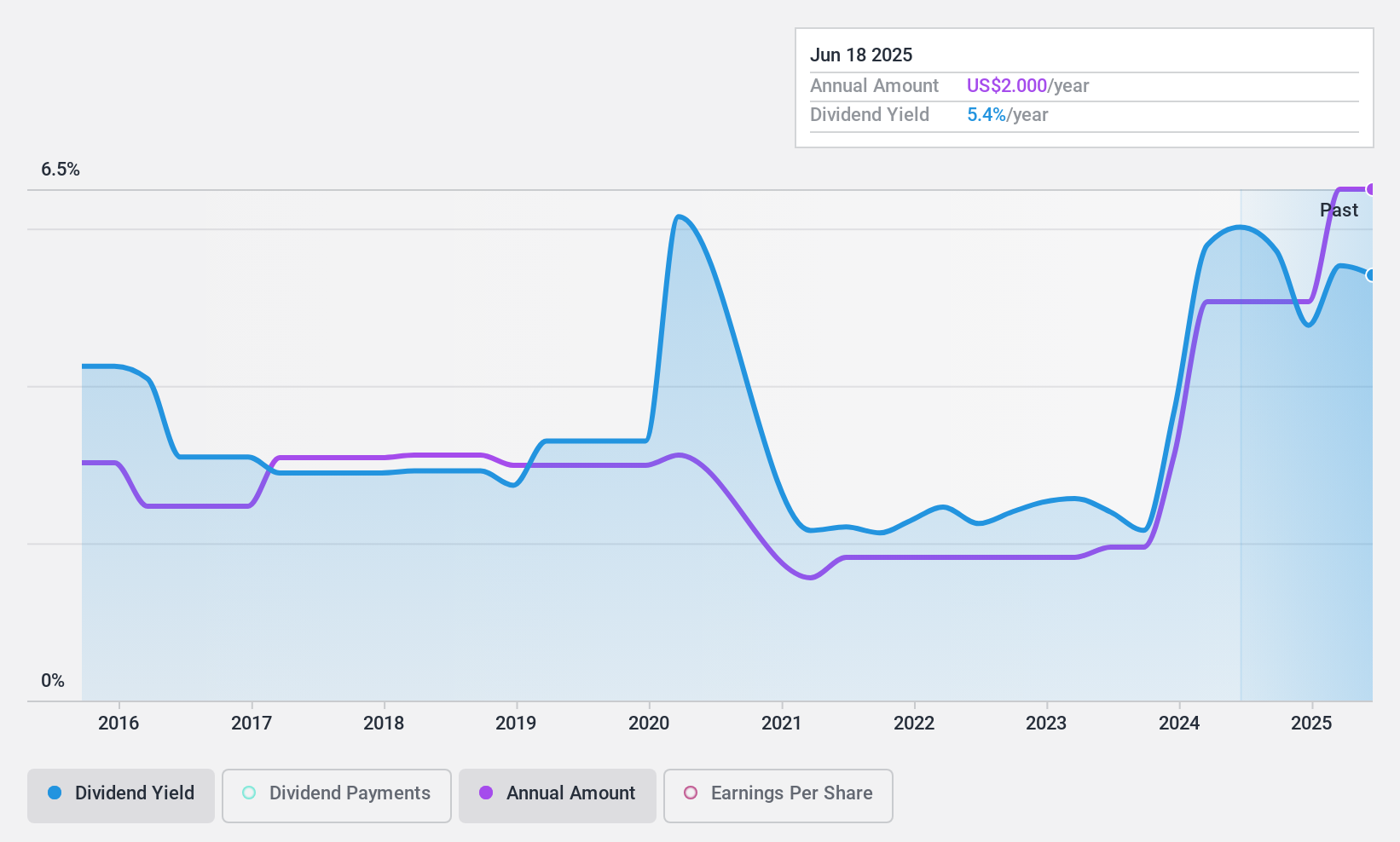

Ituran Location and Control (NasdaqGS:ITRN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ituran Location and Control Ltd. offers location-based telematics services and machine-to-machine products, with a market capitalization of approximately $551.65 million.

Operations: Ituran Location and Control Ltd. generates its revenue primarily through location-based telematics services and machine-to-machine products.

Dividend Yield: 5.7%

Ituran Location and Control Ltd. recently affirmed a quarterly dividend of US$0.39 per share, reflecting a commitment to shareholder returns despite a 25% tax deduction on payouts. The company's financial health is underscored by its first quarter revenue of US$85.03 million and net income of US$13.04 million, both showing an increase from the previous year. With a payout ratio at 31.2% and cash payout ratio at 54.7%, the dividends appear sustainable, supported by consistent earnings growth and positive cash flow coverage, although historical dividend reliability has been questioned due to past volatility in payments.

- Dive into the specifics of Ituran Location and Control here with our thorough dividend report.

- The valuation report we've compiled suggests that Ituran Location and Control's current price could be quite moderate.

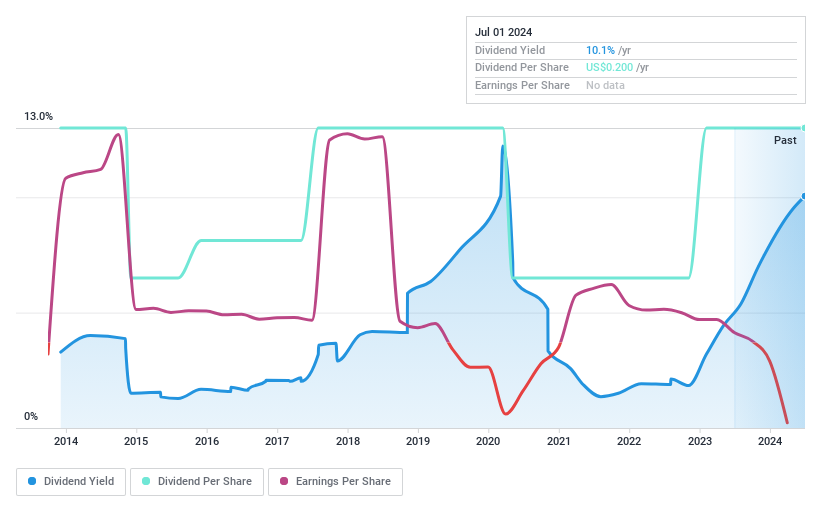

Entravision Communications (NYSE:EVC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Entravision Communications Corporation is a global advertising solutions, media, and technology company with a market capitalization of approximately $192.91 million.

Operations: Entravision Communications Corporation generates its revenue from three primary sources: audio, which brought in $52.39 million, digital at $973.74 million, and television contributing $119.17 million.

Dividend Yield: 9.4%

Entravision Communications offers a high dividend yield of 9.39%, ranking in the top 25% of US dividend payers. However, this attractive yield comes with concerns: the dividends are not supported by earnings or profit, as the company is currently unprofitable and dividends are not covered by earnings. On a positive note, with a cash payout ratio of 37%, the dividends are well-covered by cash flows, suggesting some level of sustainability despite broader financial challenges. Recent executive changes could signal strategic shifts but have yet to address underlying profitability issues.

- Click here and access our complete dividend analysis report to understand the dynamics of Entravision Communications.

- In light of our recent valuation report, it seems possible that Entravision Communications is trading behind its estimated value.

GeoPark (NYSE:GPRK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: GeoPark Limited is an oil and natural gas exploration and production company with operations in countries including Chile, Colombia, Brazil, Argentina, and Ecuador, boasting a market capitalization of approximately $566.40 million.

Operations: GeoPark Limited generates its revenue primarily from the oil and gas exploration and production segment, totaling approximately $741.59 million.

Dividend Yield: 5.3%

GeoPark Limited reported a slight increase in net income to US$30.2 million for Q1 2024, despite a revenue drop to US$167.4 million from US$182.5 million the previous year. The company recently raised its quarterly dividend to $0.147 per share, totaling approximately US$7.5 million, payable in June 2024. GeoPark's dividends are well-covered by earnings with a payout ratio of 26.2% and by cash flows with a cash payout ratio of 32.2%. However, its dividend history over the past five years has been marked by volatility and inconsistency.

- Take a closer look at GeoPark's potential here in our dividend report.

- Our valuation report here indicates GeoPark may be undervalued.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 211 more companies for you to explore.Click here to unveil our expertly curated list of 214 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ITRN

Ituran Location and Control

Provides location based telematics services and machine-to-machine telematics products.

Flawless balance sheet, undervalued and pays a dividend.