- United States

- /

- Media

- /

- NYSE:EVC

Entravision Communications (NYSE:EVC) Will Pay A Larger Dividend Than Last Year At $0.05

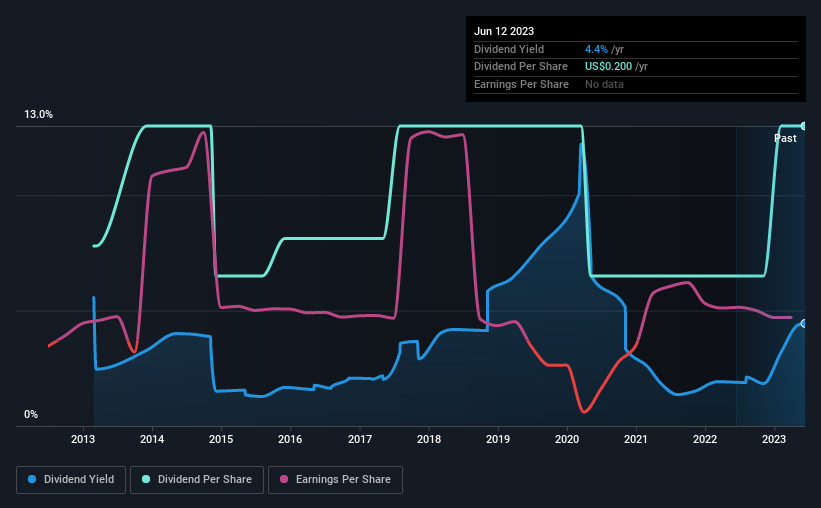

Entravision Communications Corporation (NYSE:EVC) has announced that it will be increasing its dividend from last year's comparable payment on the 30th of June to $0.05. This will take the annual payment to 4.4% of the stock price, which is above what most companies in the industry pay.

View our latest analysis for Entravision Communications

Entravision Communications' Earnings Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable. Based on the last payment, Entravision Communications was quite comfortably earning enough to cover the dividend. This indicates that quite a large proportion of earnings is being invested back into the business.

The next year is set to see EPS grow by 39.6%. If the dividend continues on this path, the payout ratio could be 53% by next year, which we think can be pretty sustainable going forward.

Entravision Communications Has A Solid Track Record

The company has a sustained record of paying dividends with very little fluctuation. The annual payment during the last 10 years was $0.12 in 2013, and the most recent fiscal year payment was $0.20. This implies that the company grew its distributions at a yearly rate of about 5.2% over that duration. The dividend has been growing very nicely for a number of years, and has given its shareholders some nice income in their portfolios.

Dividend Growth Potential Is Shaky

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. However, things aren't all that rosy. Entravision Communications' EPS has fallen by approximately 36% per year during the past five years. Such rapid declines definitely have the potential to constrain dividend payments if the trend continues into the future. However, the next year is actually looking up, with earnings set to rise. We would just wait until it becomes a pattern before getting too excited.

Our Thoughts On Entravision Communications' Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. With shrinking earnings, the company may see some issues maintaining the dividend even though they look pretty sustainable for now. The dividend looks okay, but there have been some issues in the past, so we would be a little bit cautious.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. As an example, we've identified 4 warning signs for Entravision Communications that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Entravision Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EVC

Entravision Communications

Owns and operates television and radio stations in the United States and internationally.

Moderate risk average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PRME remains a long shot but publication in the New England Journal of Medicine helps.

This one is all about the tax benefits

Estimated Share Price is $79.54 using the Buffett Value Calculation

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026