- United States

- /

- Entertainment

- /

- NYSE:EB

Little Excitement Around Eventbrite, Inc.'s (NYSE:EB) Revenues As Shares Take 30% Pounding

The Eventbrite, Inc. (NYSE:EB) share price has fared very poorly over the last month, falling by a substantial 30%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 57% loss during that time.

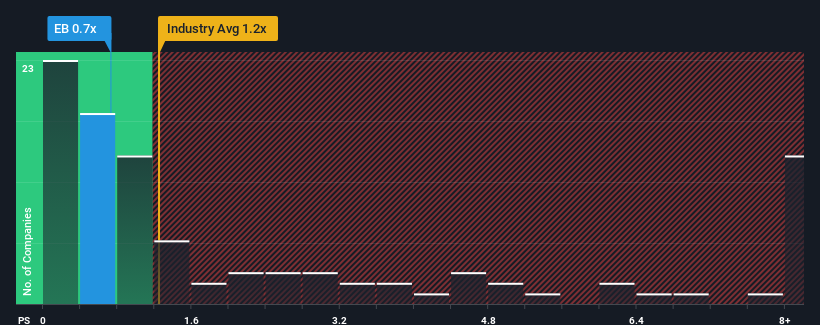

After such a large drop in price, Eventbrite may be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.7x, considering almost half of all companies in the Entertainment industry in the United States have P/S ratios greater than 1.3x and even P/S higher than 5x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

See our latest analysis for Eventbrite

How Has Eventbrite Performed Recently?

Eventbrite hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Want the full picture on analyst estimates for the company? Then our free report on Eventbrite will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The Low P/S?

In order to justify its P/S ratio, Eventbrite would need to produce sluggish growth that's trailing the industry.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Although pleasingly revenue has lifted 74% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, shareholders will be pleased, but also have some questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 5.4% per annum as estimated by the five analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 11% per year, which is noticeably more attractive.

With this in consideration, its clear as to why Eventbrite's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What We Can Learn From Eventbrite's P/S?

Eventbrite's P/S has taken a dip along with its share price. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Eventbrite's analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. The company will need a change of fortune to justify the P/S rising higher in the future.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Eventbrite that you should be aware of.

If you're unsure about the strength of Eventbrite's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Eventbrite might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:EB

Eventbrite

Operates a two-sided marketplace that provides self-service ticketing and marketing tools for event creators in the United States and internationally.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives