- United States

- /

- Media

- /

- NYSE:DV

DoubleVerify (DV): Valuation Check After Naming Former TikTok Executive Stuart Flint to Lead EMEA Growth

Reviewed by Simply Wall St

DoubleVerify Holdings (DV) just named former TikTok Europe executive Stuart Flint as Managing Director for EMEA, signaling a fresh commercial push in a region that still represents a major growth runway.

See our latest analysis for DoubleVerify Holdings.

The hire comes at a time when DV’s $10.82 share price sits well below its highs, with a steep 90 day share price return of minus 29.05 percent and a three year total shareholder return of minus 56.09 percent. This suggests sentiment has cooled even as management leans into new growth initiatives.

If you like the structural growth angle in digital ads but want more ideas on your radar, now is a good moment to explore high growth tech and AI stocks as potential next wave beneficiaries.

With revenue still growing near double digits and shares trading at a hefty discount to analyst targets and intrinsic value estimates, the key question is whether DV is genuinely mispriced or if markets already anticipate its next leg of growth.

Most Popular Narrative Narrative: 22.3% Undervalued

With DoubleVerify Holdings' fair value estimate sitting meaningfully above the last close at $10.82, the most followed narrative frames today’s pricing as a sizable disconnect from long term fundamentals.

The increasing complexity of global digital ad spend and tightening regulatory/brand safety requirements continue to drive advertisers towards trusted, independent verification partners like DoubleVerify, positioning the company to capture incremental market share as the digital ad market grows, thereby supporting both topline revenue growth and margin durability.

Ongoing product suite innovation (e.g., Media AdVantage platform, DV Authentic AdVantage, AI driven Scibids optimization) and deepened platform integrations with major players (Meta, Google, The Trade Desk) are resulting in higher attach rates and cross selling, raising average revenue per customer and enhancing operating leverage, which is likely to positively impact net margins and EBITDA.

Want to see how steady double digit growth, rising margins, and a punchy future earnings multiple combine into that upside story? The full narrative unpacks the exact assumptions driving this valuation gap and why consensus thinks DV can grow into a premium earnings profile.

Result: Fair Value of $13.92 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside view could be challenged if platform partners tighten data access or if macro-driven ad budget cuts undercut DV’s recurring, programmatic-linked revenue.

Find out about the key risks to this DoubleVerify Holdings narrative.

Another Lens on Valuation

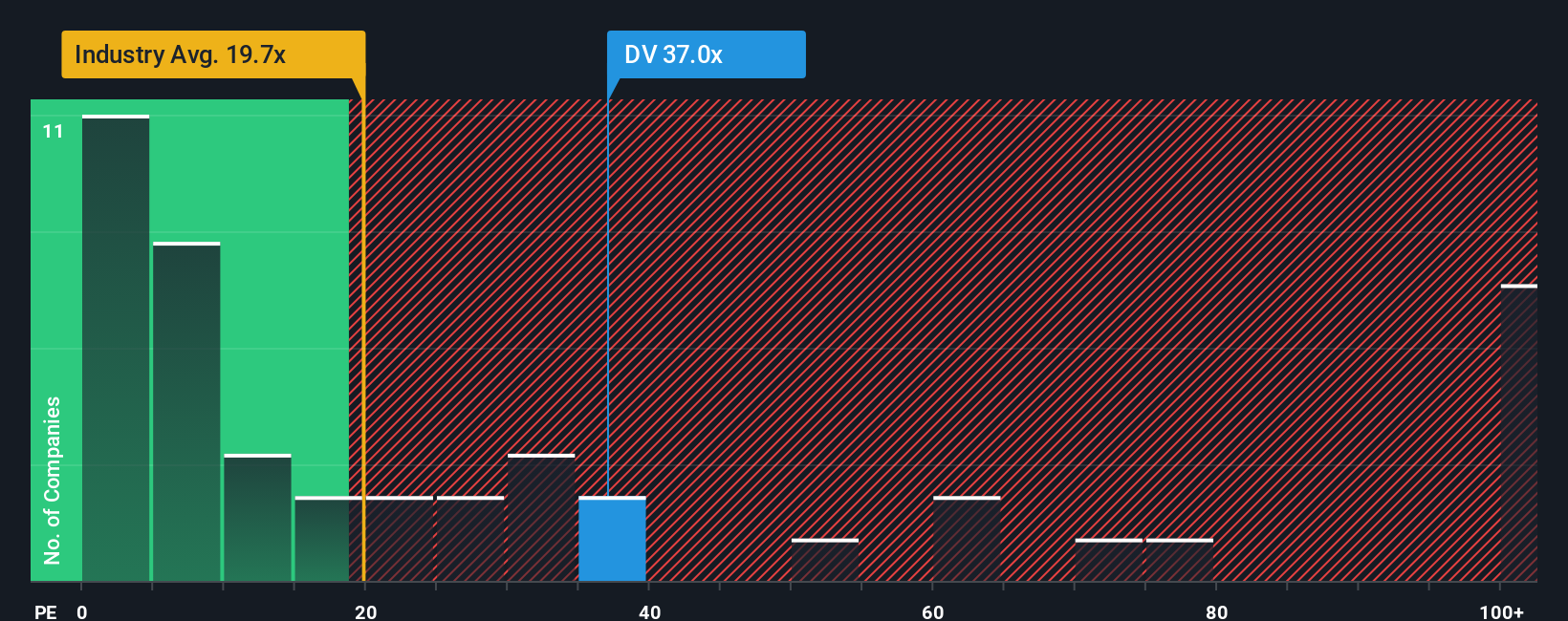

Step away from fair value models and DV suddenly looks pricey. At roughly 39 times earnings versus 15.4 times for the US Media industry, 36.7 times for peers, and a fair ratio of 21 times, the market is already baking in a lot of future success. This raises downside risk if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoubleVerify Holdings Narrative

If you are not aligned with this perspective or prefer to dive into the numbers yourself, you can craft a bespoke view in minutes: Do it your way.

A great starting point for your DoubleVerify Holdings research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, identify your next potential opportunities using the Simply Wall St Screener so you are not left watching the winners from the sidelines.

- Capitalize on market mispricing by scanning these 908 undervalued stocks based on cash flows that currently trade below their estimated intrinsic value yet still carry solid fundamentals.

- Ride powerful innovation trends by targeting these 26 AI penny stocks positioned at the forefront of automation, machine learning, and real time data intelligence.

- Strengthen your income stream by focusing on these 14 dividend stocks with yields > 3% that pair attractive yields with the capacity to sustain and grow payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DV

DoubleVerify Holdings

Provides media effectiveness platforms in the United States and internationally.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026