- United States

- /

- Entertainment

- /

- NYSE:DIS

Walt Disney (NYSE:DIS) Holds AGM As Shares Remain Flat At 1%

Reviewed by Simply Wall St

Following the recent annual general meeting, where Walt Disney (NYSE:DIS) shareholders approved a proposal to report on advertising risks but declined those concerning climate and corporate equality, Disney's stock moved by 0.83% last week. During the same period, U.S. markets, including the S&P 500 and Nasdaq, slightly rebounded but more notably climbed overall. While Disney's change was flat in comparison to the broader market's 1.8% weekly rise, its performance reflects a period of market recovery and expansion. Market momentum from broader economic factors overshadowed company-specific developments, showing Disney's steady position amidst fluctuating conditions.

Buy, Hold or Sell Walt Disney? View our complete analysis and fair value estimate and you decide.

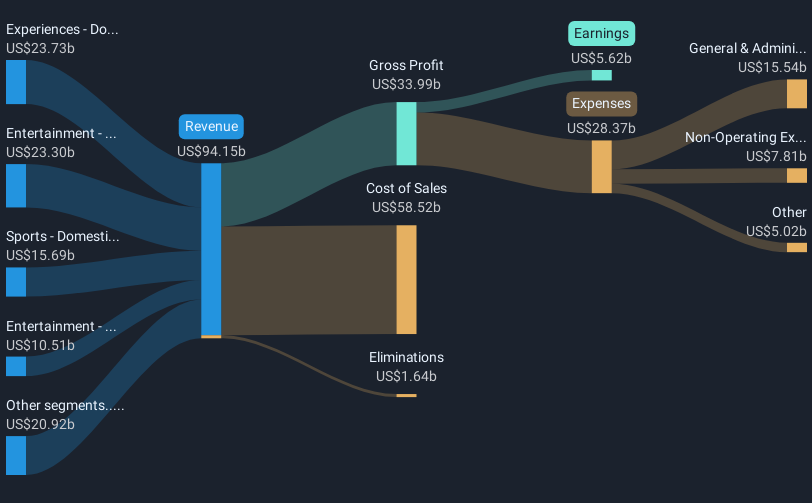

Over the past five years, Walt Disney's total shareholder return stood at 1.62%, reflecting challenges alongside growth initiatives. Market fluctuations affected the broader entertainment industry, while Disney pursued platform enhancements and AI initiatives to bolster streaming profitability across Disney+, ESPN, and Hulu. The emphasis on cost-cutting and strategic investments in experiences and sports broadcasting contributed to positive revenue growth. In 2024, Disney increased its dividend by a substantial 33%, signaling commitment to returning value to shareholders, alongside significant share buybacks totaling US$3.8 billion from the February 2024 program.

Despite broad initiatives, Disney underperformed both the US market and entertainment industry over the past year, trailing benchmarks that saw 10.2% and 36.1% returns, respectively. The year 2025 shows Disney engaging in merger discussions with Reliance Industries regarding its DTH business, aiming to potentially increase its market presence in India. Overall, Disney's approach underscores a period of managing headwinds while executing on various opportunities for potential future gains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Walt Disney, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives