- United States

- /

- Entertainment

- /

- NYSE:DIS

The Walt Disney Company (NYSE:DIS) Back on Track with Profitable Quarter from all Businesses

The Walt Disney Company (NYSE:DIS) released a strong set of results on Thursday, following a period of growing uncertainty. The company reported EPS, revenue and subscriber numbers that were all ahead of consensus estimates. Highlights from the results included:

- Adjusted EPS of $0.80, up from $0.08 a year ago, and $0.25 ahead of consensus.

- Revenue of $17 billion, compared to $11.7 billion a year ago.

- Disney+ total subscriber of 116 million compared to 114.5 million expected.

- Disney+ average revenue per user increased sequentially from $3.99 to $4.19 a month.

- Disney’s theme parks reported an operating profit of $356 million compared to a loss of $1.8 billion a year ago.

Disney’s share price has been drifting lower since March, following a 150% rally during the previous 12 months. The rally had two distinct phases. Between March and September last year, the share price was propelled higher by unexpectedly strong subscriber growth at Disney+. And then in November another rally began in anticipation of the reopening of cinemas and Disney’s theme parks, cruise lines and studios.

The rally came to an end when subscriber growth slowed more than expected during the first quarter this year. The resurgence of Covid-19 infections in the US in the last month has added to the level of uncertainty as it is bound to be affecting Disney’s ‘non-digital’ assets.

The latest set of results is for the period to the end of July, which is Disney’s fiscal third quarter. The good news for investors is that both Disney+ and the other businesses outperformed expectations. As we pointed out recently, Disney’s current valuation is dependent on Disney+ - but the company still needs to get its other businesses back to profitability.

See our latest analysis for Walt Disney

What's the opportunity in Walt Disney?

Our estimate of Disney's fair value prior to these results was around $220, which is 18% above the current price. That estimate was based on analyst forecasts, and those forecasts may very well be raised now.

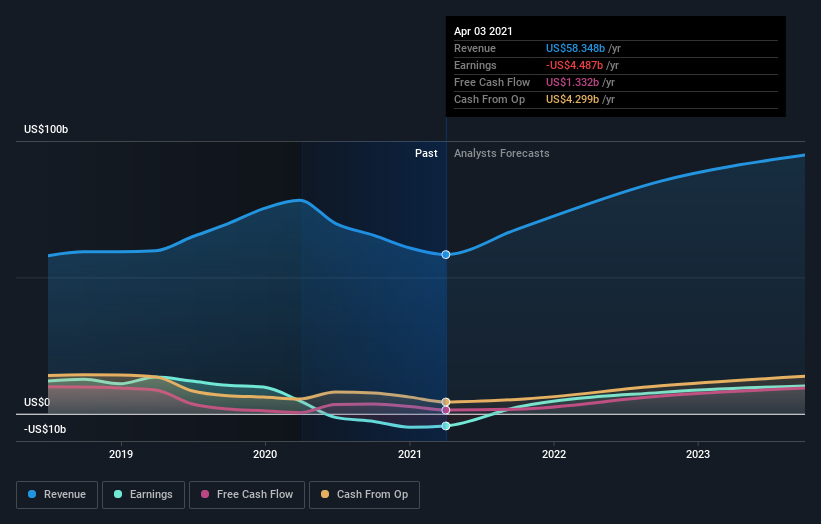

As you can see from the forecasts for revenue, earnings and cash flow, the third quarter was expected to be an inflection point for Disney - it’s just turned out to be slightly better than expected.

What this Means for Investors

Disney is expected to grow earnings at 37.5% over the next year, well ahead of the market's expected 14.5%. In addition, the increasing influence of Disney+ should improve the company’s margins and ROE.

There are two questions investors will now be asking. Firstly, how will the current wave of Covid-19 infections affect Disney? And secondly, might there be a better opportunity to invest in Disney later in the year? Disney has a fairly high beta, which means the stock moves more than the broader market. Any market volatility may offer potential investors a better entry point.

We would suggest keeping an eye on analyst forecasts in the next week, which will be updated on our free analysis for Walt Disney.

If you are no longer interested in Walt Disney, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.

About NYSE:DIS

Proven track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives