- United States

- /

- Entertainment

- /

- NYSE:DIS

Is Disney Still a Comeback Story After Streaming Restructuring and 43% DCF Upside?

Reviewed by Bailey Pemberton

- Wondering if Walt Disney at around $105 a share is still a comeback story or already priced for perfection? This breakdown will help you decide whether the Magic Kingdom is offering real value or just nostalgia.

- Despite a choppy ride, with the stock down 5.7% over the last month and 4.6% year to date, it is still up 16.7% over three years, a mix that leaves investors debating whether the next big move is up or down.

- Recent headlines have focused on Disney doubling down on streaming strategy, restructuring its entertainment and parks businesses, and pushing deeper into partnerships that blend content, sports, and experiences. These are moves that many investors see as critical to reigniting growth. At the same time, market chatter around asset sales, cost discipline, and long term franchise strength has stirred fresh views on what the company should actually be worth.

- On our framework, Disney currently scores a 6/6 valuation check score, suggesting it may be undervalued across all our key metrics. We will walk through multiple valuation approaches, then finish by looking at a more nuanced way to think about what this iconic business is really worth.

Approach 1: Walt Disney Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth today by projecting the cash it can generate in the future and discounting those cash flows back to today in dollar terms.

For Walt Disney, the latest twelve month Free Cash Flow is about $11.8 billion. Analysts provide detailed forecasts for the next few years, and Simply Wall St then extrapolates beyond that, giving projected Free Cash Flow of roughly $13.3 billion by 2030. Over the following years, cash flows are assumed to keep growing at moderating rates, consistent with a mature but still expanding entertainment franchise.

Using a 2 Stage Free Cash Flow to Equity model, these projected cash flows imply an intrinsic value of about $185.58 per share. With the stock trading around $105, the DCF suggests Walt Disney is roughly 43.0% undervalued. This indicates that the market may be underestimating the long term earnings power of the company.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Walt Disney is undervalued by 43.0%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Walt Disney Price vs Earnings

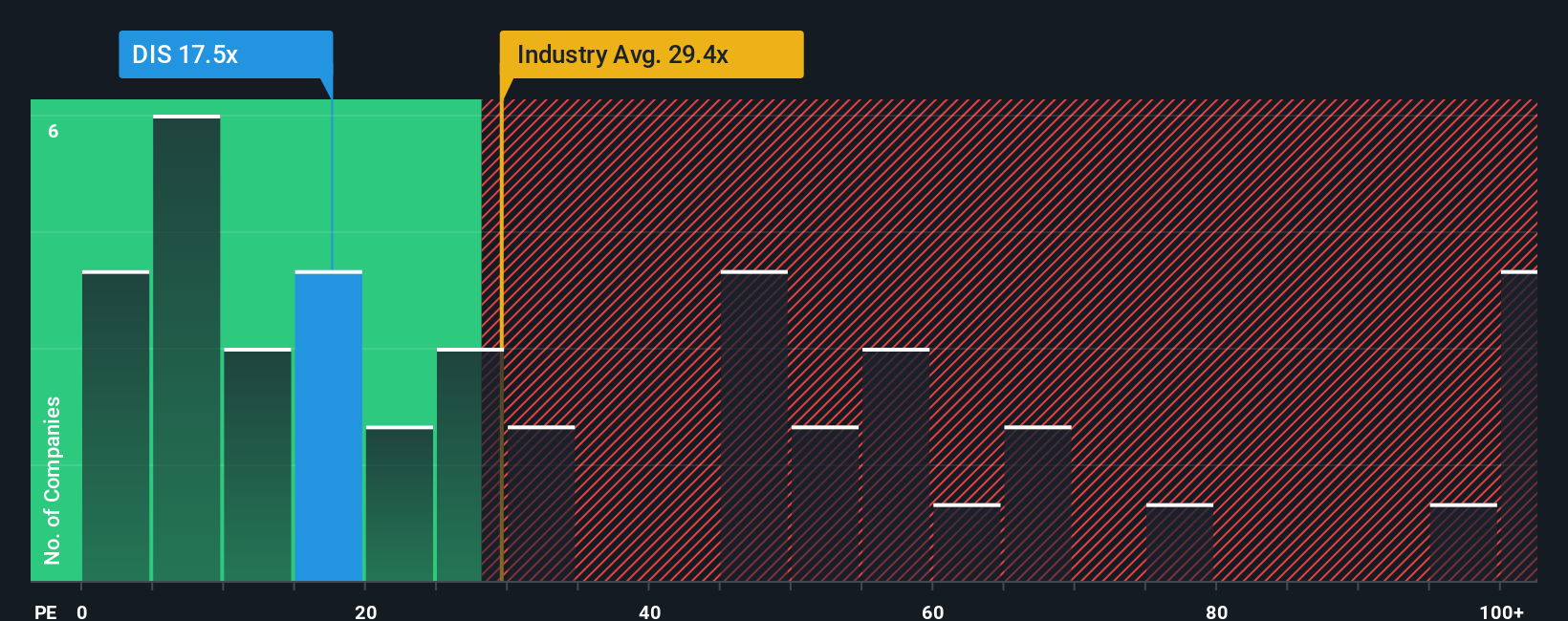

For a business that is profitable and expected to keep growing, the Price to Earnings, or PE, ratio is a practical way to judge whether the current share price makes sense. It reflects how many dollars investors are willing to pay today for each dollar of current earnings, which naturally ties back to expectations for future growth and the risks of achieving it.

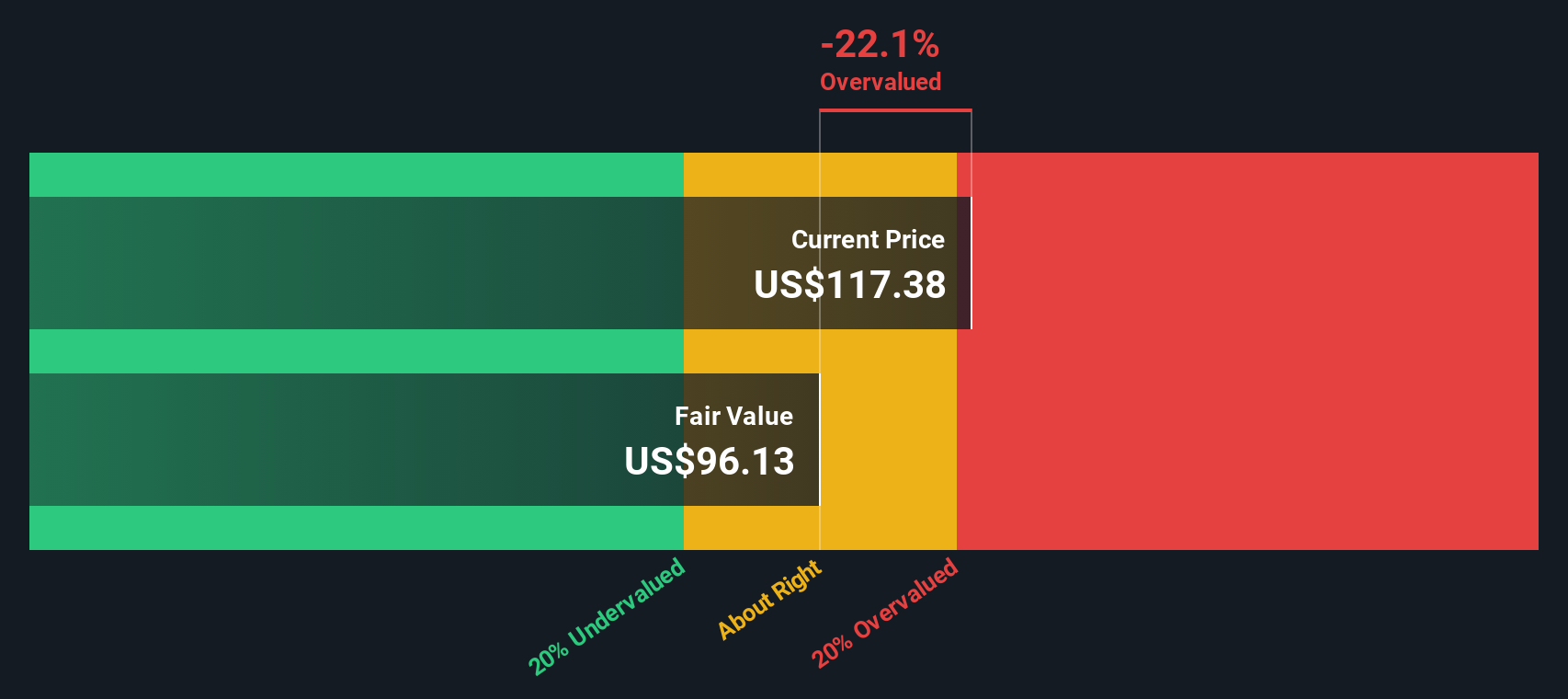

In general, faster growing and lower risk companies tend to have a higher PE, while slower or riskier businesses tend to trade on lower multiples. Walt Disney currently trades on a PE of about 15.2x. That is below the Entertainment industry average of roughly 20.9x and far below the broader peer group average of about 63.9x. This suggests the market is taking a more cautious stance on Disney than on many of its peers.

Simply Wall St also uses a proprietary Fair Ratio framework, which estimates what a justified PE should be after accounting for factors like Disney’s earnings growth outlook, profit margins, risk profile, industry, and market capitalization. This Fair PE Ratio for Disney is around 23.4x, comfortably above the current 15.2x. On this basis, the stock appears to be undervalued.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1443 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Walt Disney Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple way to connect your view of Disney’s future to clear numbers and a fair value estimate. A Narrative is your story for the company, captured as assumptions about how revenue, earnings, and profit margins might evolve over time, and then translated into a financial forecast and implied fair value. On Simply Wall St, millions of investors build and compare these Narratives on the Community page, making it easy to see how different viewpoints stack up against the current share price and to decide whether Disney looks like a buy, a hold, or a sell. Because Narratives are dynamically updated when new news, earnings, or guidance arrives, your view of fair value automatically stays in sync with fresh information. For example, one Disney Narrative on the platform currently sees fair value near $131.50 while another sits closer to $133.22, illustrating how two reasonable, data driven stories can still lead to slightly different price targets.

Do you think there's more to the story for Walt Disney? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:DIS

Walt Disney

Operates as an entertainment company in Americas, Europe, and the Asia Pacific.

Very undervalued with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026