- United States

- /

- Entertainment

- /

- NYSE:DIS

10% Down Exposure - How Disney's (NYSE:DIS) Stock Compares to Industry Peers

Key takeaways:

- Disney is estimated to grow TTM earnings by 53% to $4.13b by the end of FY 2022.

- The parks segment may surpass pre-2020 revenue, but media is still risky and hard to forecast.

- Looking at the 27.2x forward PE, Disney is 10% exposed to peer mean reversion.

The Walt Disney Company (NYSE:DIS) is trading at a 63x Price to Earnings, while dropping 50%+ from the March 2021 highs. The company is expected to start recovering this year, and in our analysis we will evaluate how much profit can investors expect, as well as what does that mean for Disney's stock price.

Segment Overview

Disney has two major revenue segments, parks and media. A good starting point for our analysis is to see how these segments have been performing, and what can investors expect in the future.

In the last 6 months, segment revenue was split 33% for parks and 67% for the media segment. While the media segment is currently on top, Disney parks has significant room to recover as people seek out physical entertainment experiences. Before the pandemic, Disney parks used to make $26.2b, and if the reopening trends continue, the company may surpass the highs within a few quarters.

In the last 6 months, Disney brought-in $13.9b in park revenues, while for the fiscal year 2021, they made $16.5b with parks. This shows in the last 6 months, the segment is picking up momentum and may become a stable profit driver for the company again.

The media segment is harder to estimate, and carries with it a higher level of risk because of the unpredictable nature of content success. In the last 6 months, Disney's media made $28.2b, which brings up the total half-year revenue at $42b. The success of this segment is dependent on the quality of content, the uptake of Disney+ streaming, as well as some high stakes moves like the 21centurey Fox acquisition in 2019. Some investors find it harder to trust that management will deliver, as there have been discussions about the lack of new and original content in production.

Future Estimates

In order to better understand how much can Disney grow in the future, we will use Wall Street's analysts' predictions for both the top and bottom line estimates.

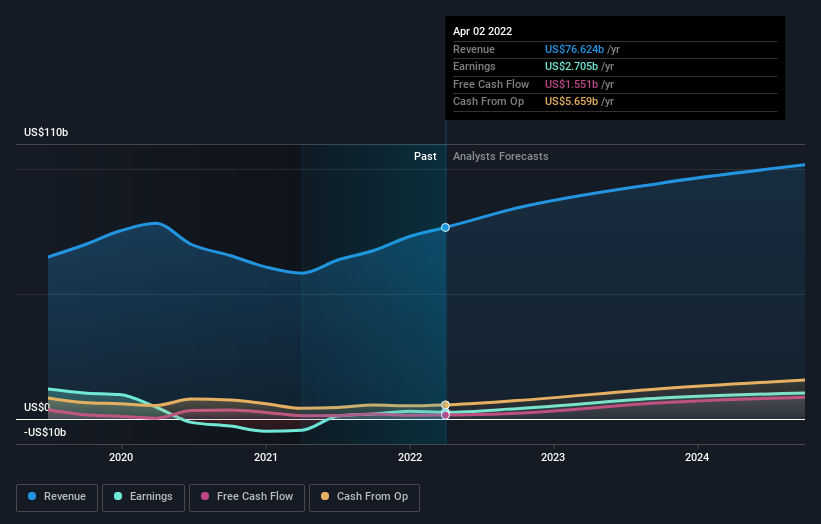

The company made revenues of $76.6b in the last 12 months, while profit has been slim at $2.7b. This means that the company has managed to recover revenues to pre-pandemic levels, but profitability has suffered. Historically, the profit margins for Disney pre-2020 were between 16% and 22.5%, which is something that bullish analysts are hoping to see recover in the future. However, that may be some years off, as analysts seem to forecast lower than historical margins in the next 3 years.

In the chart below, we can see the average analysts' expectations for Disney going to the end of 2024:

View our latest analysis for Walt Disney

The 28 analysts covering Walt Disney are predicting revenues of $84.4b in 2022, and $94.3b in 2023. Net income is expected to rise to $4.13 in 2022 and $8.4b in 2023 - this reflects a 4.9% and 8.9% profit margin respectively. While these are growing profits for Disney, they fall short of historical profit margins. This means that the company is re-engaged in growth investing, and it will likely be some time before the new projects mature and start making high returns.

While Disney has the infrastructure to pull this off, it seems that markets have switched from valuing the full future potential of the company, to focusing on next year's profits and letting the uncertainty play out before investing.

Disney's Pricing

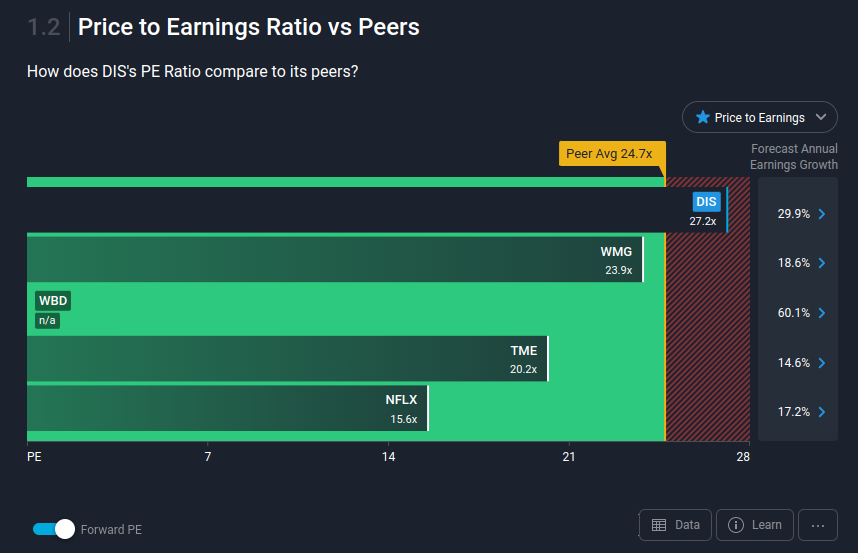

In order to get to a reasonable pricing for the company, we may choose to consider the forward PE instead of the trailing PE as a better metric of what the stock is worth. In that case, we see that Disney is trading at 27.2x relative to next year's forecasted earnings.

This pricing is more sensible than the 63.5x PE, and we can compare how the company stacks up against peers.

In the chart below, we see how the market prices industry peers:

The peer average for the media industry is 24.7x PE, while the whole industry average is not far from this at 23.6x PE. Investors can use these estimates to make a judgement on the possible exposure to mean reversion for Disney stock.

Conclusion

Using the peer average, we can see that even on a future earnings basis, Disney's pricing is some 10% above what peers seem to be trading. For investors, this means that if the market continues to price the company closer to short-term earnings instead of the full potential of the company's projects, then the price may not have "bottomed out yet".

Valuation is complex, but we're here to simplify it.

Discover if Walt Disney might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Goran Damchevski

Goran is an Equity Analyst and Writer at Simply Wall St with over 5 years of experience in financial analysis and company research. Goran previously worked in a seed-stage startup as a capital markets research analyst and product lead and developed a financial data platform for equity investors.

About NYSE:DIS

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives