- United States

- /

- Media

- /

- NYSE:CCO

Clear Channel Outdoor Holdings, Inc.'s (NYSE:CCO) Price Is Right But Growth Is Lacking After Shares Rocket 38%

Clear Channel Outdoor Holdings, Inc. (NYSE:CCO) shareholders would be excited to see that the share price has had a great month, posting a 38% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 77%.

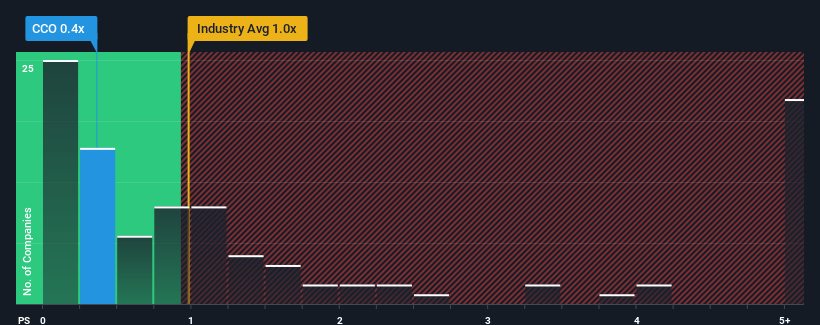

Although its price has surged higher, Clear Channel Outdoor Holdings may still be sending buy signals at present with its price-to-sales (or "P/S") ratio of 0.4x, considering almost half of all companies in the Media industry in the United States have P/S ratios greater than 1x and even P/S higher than 3x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

Check out our latest analysis for Clear Channel Outdoor Holdings

What Does Clear Channel Outdoor Holdings' P/S Mean For Shareholders?

With revenue growth that's superior to most other companies of late, Clear Channel Outdoor Holdings has been doing relatively well. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the share price, and thus the P/S ratio. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clear Channel Outdoor Holdings.Do Revenue Forecasts Match The Low P/S Ratio?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Clear Channel Outdoor Holdings' to be considered reasonable.

If we review the last year of revenue growth, the company posted a terrific increase of 15%. The latest three year period has also seen a 23% overall rise in revenue, aided extensively by its short-term performance. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 12% over the next year. With the industry predicted to deliver 29% growth, that's a disappointing outcome.

With this information, we are not surprised that Clear Channel Outdoor Holdings is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

The Bottom Line On Clear Channel Outdoor Holdings' P/S

Despite Clear Channel Outdoor Holdings' share price climbing recently, its P/S still lags most other companies. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Clear Channel Outdoor Holdings' analyst forecasts revealed that its outlook for shrinking revenue is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless there's material change, it's hard to envision a situation where the stock price will rise drastically.

And what about other risks? Every company has them, and we've spotted 2 warning signs for Clear Channel Outdoor Holdings (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CCO

Clear Channel Outdoor Holdings

Operates as an out-of-home advertising company in the United States and Singapore.

Undervalued very low.

Similar Companies

Market Insights

Community Narratives