- United States

- /

- Interactive Media and Services

- /

- NYSE:CARS

Why Investors Shouldn't Be Surprised By Cars.com Inc.'s (NYSE:CARS) 26% Share Price Surge

Cars.com Inc. (NYSE:CARS) shareholders would be excited to see that the share price has had a great month, posting a 26% gain and recovering from prior weakness. While recent buyers may be laughing, long-term holders might not be as pleased since the recent gain only brings the stock back to where it started a year ago.

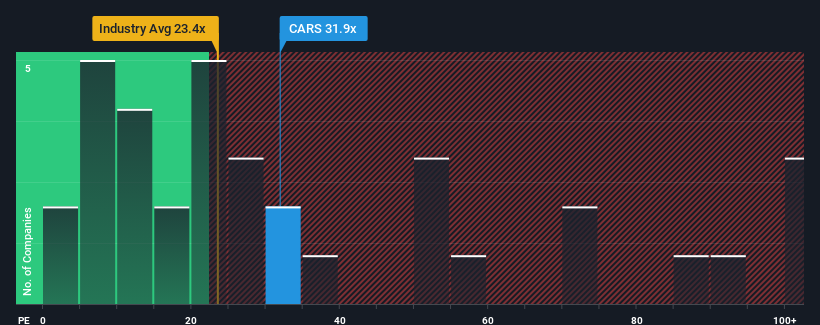

After such a large jump in price, Cars.com may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 31.9x, since almost half of all companies in the United States have P/E ratios under 19x and even P/E's lower than 11x are not unusual. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Cars.com hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is high because investors think this poor earnings performance will turn the corner. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Cars.com

What Are Growth Metrics Telling Us About The High P/E?

Cars.com's P/E ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the market.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 67%. Even so, admirably EPS has lifted 98% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to climb by 30% per annum during the coming three years according to the seven analysts following the company. That's shaping up to be materially higher than the 11% per year growth forecast for the broader market.

In light of this, it's understandable that Cars.com's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Final Word

Shares in Cars.com have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

As we suspected, our examination of Cars.com's analyst forecasts revealed that its superior earnings outlook is contributing to its high P/E. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 3 warning signs with Cars.com (at least 1 which is significant), and understanding them should be part of your investment process.

If you're unsure about the strength of Cars.com's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CARS

Cars.com

An audience-driven technology company, provides solutions for the automotive industry in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives