- United States

- /

- Interactive Media and Services

- /

- NYSE:CARS

Investors Give Cars.com Inc. (NYSE:CARS) Shares A 35% Hiding

The Cars.com Inc. (NYSE:CARS) share price has fared very poorly over the last month, falling by a substantial 35%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 34% share price drop.

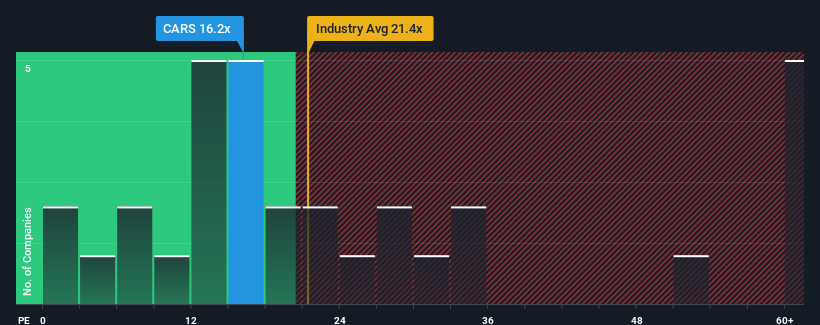

In spite of the heavy fall in price, it's still not a stretch to say that Cars.com's price-to-earnings (or "P/E") ratio of 16.2x right now seems quite "middle-of-the-road" compared to the market in the United States, where the median P/E ratio is around 18x. While this might not raise any eyebrows, if the P/E ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Cars.com hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. One possibility is that the P/E is moderate because investors think this poor earnings performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

See our latest analysis for Cars.com

Does Growth Match The P/E?

Cars.com's P/E ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 59%. However, a few very strong years before that means that it was still able to grow EPS by an impressive 374% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 27% each year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 11% per annum, which is noticeably less attractive.

In light of this, it's curious that Cars.com's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Bottom Line On Cars.com's P/E

Following Cars.com's share price tumble, its P/E is now hanging on to the median market P/E. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

Our examination of Cars.com's analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about these 3 warning signs we've spotted with Cars.com (including 1 which can't be ignored).

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:CARS

Cars.com

An audience-driven technology company, provides solutions for the automotive industry in the United States.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives