- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:JOYY

JOYY (NASDAQ:YY) dips 9.2% this week as increasing losses might not be inspiring confidence among its investors

Taking the occasional loss comes part and parcel with investing on the stock market. And there's no doubt that JOYY Inc. (NASDAQ:YY) stock has had a really bad year. To wit the share price is down 57% in that time. To make matters worse, the returns over three years have also been really disappointing (the share price is 45% lower than three years ago). Shareholders have had an even rougher run lately, with the share price down 25% in the last 90 days. However, one could argue that the price has been influenced by the general market, which is down 16% in the same timeframe.

With the stock having lost 9.2% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

View our latest analysis for JOYY

JOYY isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last year JOYY saw its revenue grow by 37%. That's definitely a respectable growth rate. Unfortunately it seems investors wanted more, because the share price is down 57% in that time. It may well be that the business remains approximately on track, but its revenue growth has simply been delayed. For us it's important to consider when you think a company will become profitable, if you're basing your valuation on revenue.

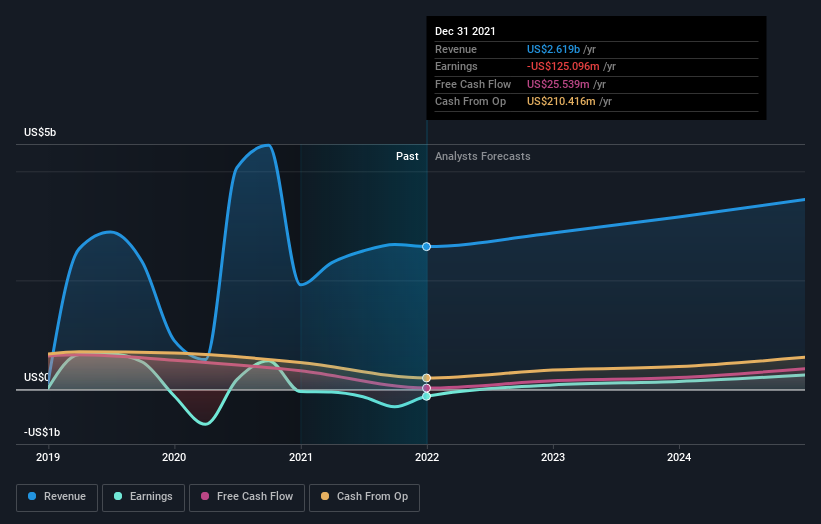

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

JOYY is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think JOYY will earn in the future (free analyst consensus estimates)

A Different Perspective

We regret to report that JOYY shareholders are down 56% for the year (even including dividends). Unfortunately, that's worse than the broader market decline of 9.8%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 2 warning signs for JOYY (1 can't be ignored!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:JOYY

JOYY

Engages in the provision of social product matrix and communication technology.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026