- United States

- /

- Entertainment

- /

- OTCPK:YVRL.F

Is Liquid Media Group (NASDAQ:YVR) Weighed On By Its Debt Load?

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Liquid Media Group Ltd. (NASDAQ:YVR) does carry debt. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Liquid Media Group

How Much Debt Does Liquid Media Group Carry?

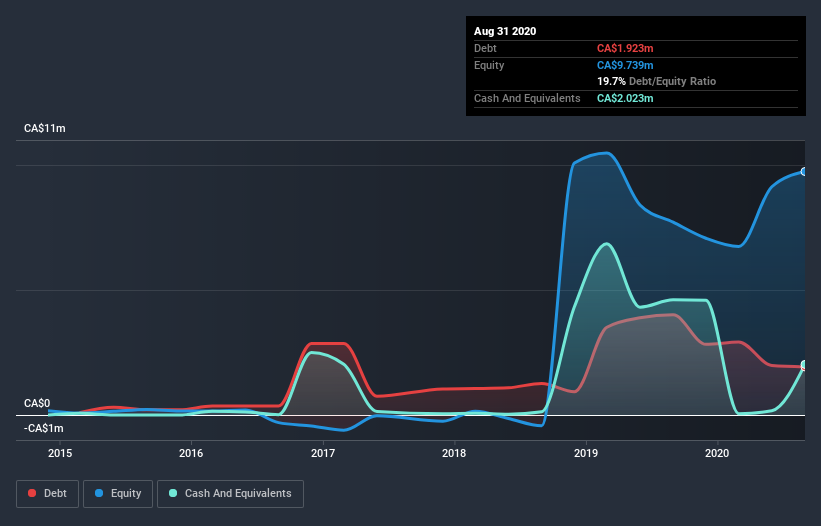

The image below, which you can click on for greater detail, shows that Liquid Media Group had debt of CA$1.92m at the end of August 2020, a reduction from CA$4.01m over a year. But on the other hand it also has CA$2.02m in cash, leading to a CA$99.3k net cash position.

How Healthy Is Liquid Media Group's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Liquid Media Group had liabilities of CA$3.38m due within 12 months and no liabilities due beyond that. On the other hand, it had cash of CA$2.02m and CA$197.9k worth of receivables due within a year. So it has liabilities totalling CA$1.16m more than its cash and near-term receivables, combined.

Given Liquid Media Group has a market capitalization of CA$21.1m, it's hard to believe these liabilities pose much threat. Having said that, it's clear that we should continue to monitor its balance sheet, lest it change for the worse. Despite its noteworthy liabilities, Liquid Media Group boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Liquid Media Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Given it has no significant operating revenue at the moment, shareholders will be hoping Liquid Media Group can make progress and gain better traction for the business, before it runs low on cash.

So How Risky Is Liquid Media Group?

By their very nature companies that are losing money are more risky than those with a long history of profitability. And we do note that Liquid Media Group had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through CA$10m of cash and made a loss of CA$6.5m. With only CA$99.3k on the balance sheet, it would appear that its going to need to raise capital again soon. The good news for shareholders is that Liquid Media Group has dazzling revenue growth, so there's a very good chance it can boost its free cash flow in the years to come. High growth pre-profit companies may well be risky, but they can also offer great rewards. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. Consider for instance, the ever-present spectre of investment risk. We've identified 5 warning signs with Liquid Media Group (at least 4 which can't be ignored) , and understanding them should be part of your investment process.

At the end of the day, it's often better to focus on companies that are free from net debt. You can access our special list of such companies (all with a track record of profit growth). It's free.

If you decide to trade Liquid Media Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About OTCPK:YVRL.F

Liquid Media Group

Provides business solutions empowering independent TV and content creators to package, finance, deliver, and monetize their intellectual property worldwide.

Low risk with weak fundamentals.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026