- United States

- /

- Entertainment

- /

- NasdaqGS:WBD

Investors Aren't Buying Warner Bros. Discovery, Inc.'s (NASDAQ:WBD) Revenues

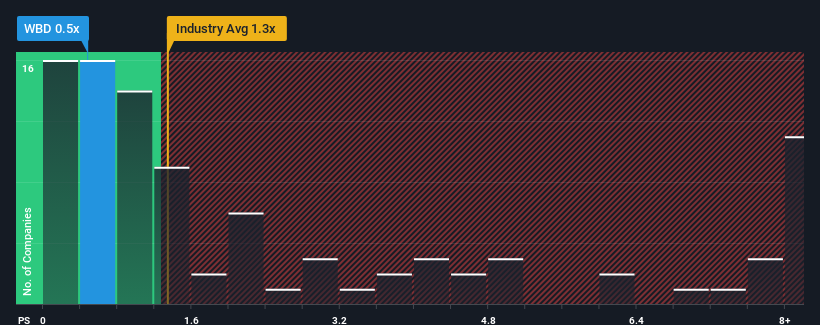

You may think that with a price-to-sales (or "P/S") ratio of 0.5x Warner Bros. Discovery, Inc. (NASDAQ:WBD) is a stock worth checking out, seeing as almost half of all the Entertainment companies in the United States have P/S ratios greater than 1.3x and even P/S higher than 5x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for Warner Bros. Discovery

How Warner Bros. Discovery Has Been Performing

Warner Bros. Discovery could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Warner Bros. Discovery.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Warner Bros. Discovery would need to produce sluggish growth that's trailing the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.9%. Still, the latest three year period has seen an excellent 276% overall rise in revenue, in spite of its unsatisfying short-term performance. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 1.9% per annum over the next three years. That's shaping up to be materially lower than the 9.9% per annum growth forecast for the broader industry.

With this information, we can see why Warner Bros. Discovery is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

What Does Warner Bros. Discovery's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As expected, our analysis of Warner Bros. Discovery's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for Warner Bros. Discovery with six simple checks on some of these key factors.

If you're unsure about the strength of Warner Bros. Discovery's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Warner Bros. Discovery might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:WBD

Warner Bros. Discovery

Operates as a media and entertainment company worldwide.

Undervalued with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives