- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

The Market is Overreacting to Take-Two Interactive Software's (NASDAQ:TTWO) Delays

It is no secret that Take-Two Interactive Software, Inc. (NASDAQ: TTWO)fell out of the market's favor in 2021. After a steep run in 2020, it has been continuously declining, with every rally met with selling pressure.

Yet, given the fundamentals, the market might be too eager to "sell the news" at the moment.

See our latest analysis for Take-Two Interactive Software

Latest Developments

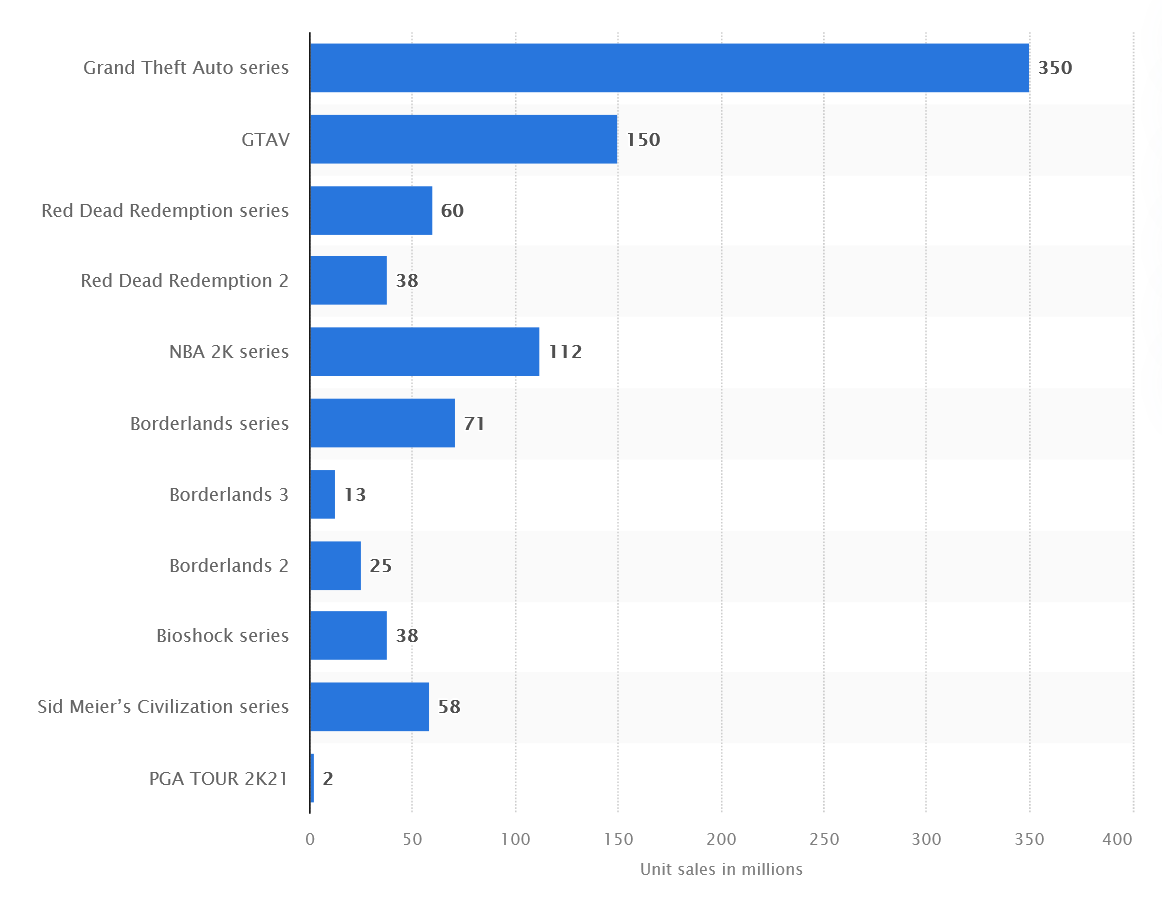

The company recently announced NBA 2K22, the latest video game simulation in the NBA2K video game series. In total, over 2 decades, this series achieved sales of over 112 million copies, belonging to one of the most successful game franchises of all time.

Meanwhile, Rockstar Games is delaying the Grand Theft Auto V, and Grand Theft Auto Online updates from November 11 to March 2022. However, this didn't prompt the company to change the guidance for the fiscal year.

Although there is still no news about the next installment of the Grand Theft Auto franchise, the sheer success of the last game guarantees there will be one. Yet, as games grow more complex, the gaps between the game releases have been growing. For example, it took 5 years and 5 months between GTA IV and GTA V, but it has already been 8 years since GTA V without even announcing the next installment.

What's the opportunity in Take-Two Interactive Software?

After the decline, it seems like Take-Two Interactive Software is trading at a reasonably cheap price. The valuation model shows that the intrinsic value for the stock is $199.70, but it is currently trading at US$149 on the share market, meaning that there are still opportunities.

What's more interesting is that Take-Two Interactive Software's share price is theoretically relatively stable, which could mean two things: firstly, it may take the share price a while to move to its intrinsic value, and secondly, there may be fewer chances to buy low in the future once it reaches that value. This is because the stock is less volatile than the broader market, given its low beta.

What does the future of Take-Two Interactive Software look like?

Future outlook is an important aspect when you're buying a stock, especially if you are an investor looking for growth in your portfolio. Buying a great company with a robust outlook at a cheap price is always a good investment, so let's also take a look at the company's future expectations.

Though in the case of Take-Two Interactive Software, it is expected to deliver a negative earnings growth of -1.2%, which doesn't help build up its investment thesis. It appears that risk of future uncertainty is high, at least in the near term.

What this means for you:

While the company looks out of favor, it is mainly due to delays and reluctance to announce the next big thing. However, even with the largest "cash-cows" currently in the mature or late market phase, the operating cash flow still marked solid increases in the last two years.

Furthermore, the company has no debt, and it is sitting on almost US$2.5b in cash - an excellent foundation for the next big thing. Overall, this situation mandates further analysis as the company might be undervalued in between the cycles of one of the most popular video game franchises of all time.

Are you a shareholder? Although TTWO is currently undervalued, the negative outlook does bring on some uncertainty, which equates to higher risk. Consider whether you want to increase your portfolio exposure to TTWO, or whether diversifying into another stock may be a better move for your total risk and return.

Are you a potential investor? If you've been keeping an eye on TTWO for a while but are hesitant about leaping, We recommend you dig deeper into the stock. Given its current undervaluation, now is a great time to make a decision. But keep in mind the risks that come with negative growth prospects in the future.

With this in mind, we wouldn't consider investing in a stock unless we thoroughly understand the risks. Case in point: We've spotted 1 warning sign for Take-Two Interactive Software you should be aware of.

If you are no longer interested in Take-Two Interactive Software, you can use our free platform to see our list of over 50 other stocks with a high growth potential.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Stjepan Kalinic and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Stjepan Kalinic

Stjepan is a writer and an analyst covering equity markets. As a former multi-asset analyst, he prefers to look beyond the surface and uncover ideas that might not be on retail investors' radar. You can find his research all over the internet, including Simply Wall St News, Yahoo Finance, Benzinga, Vincent, and Barron's.

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential very low.