- United States

- /

- Entertainment

- /

- NasdaqGS:TTWO

Is Take-Two’s Blockbuster Launch Buzz Justifying Its Current Share Price?

Reviewed by Bailey Pemberton

- Wondering if Take-Two Interactive Software is a bargain or overpriced at today’s levels? You’re not the only one watching closely as the stock continues to draw attention from both value hunters and growth fans.

- The share price has risen 1.3% over the last week but dipped 4.2% in the past month. Year-to-date gains of 33.1% and a strong 31.3% return over 12 months show there has been no shortage of action.

- Recent headlines highlight industry buzz surrounding blockbuster game launches and reports of high-profile acquisitions in the gaming sector. These stories have added fuel to investor expectations, prompting fresh moves in Take-Two’s share price as the company stays in the spotlight.

- Take-Two currently scores 0 out of 6 on our undervaluation checks. The conventional analysis leaves questions on the table, so let’s dig into the main valuation methods, and stick around because we will cover a smarter way to think about value at the end.

Take-Two Interactive Software scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Take-Two Interactive Software Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates how much a company is worth today based on the future cash it is expected to generate, with those future amounts adjusted for time and risk. In essence, it extrapolates future cash flows and brings them back to today's value using a discount rate.

For Take-Two Interactive Software, the latest-12-month Free Cash Flow (FCF) totaled approximately $182 million. Analysts have projected substantial annual growth, expecting FCF to rise to $2.52 billion by 2030, based on both direct analyst forecasts and further projections by Simply Wall St. These robust forecasts highlight optimism around the company's capacity to generate cash in coming years.

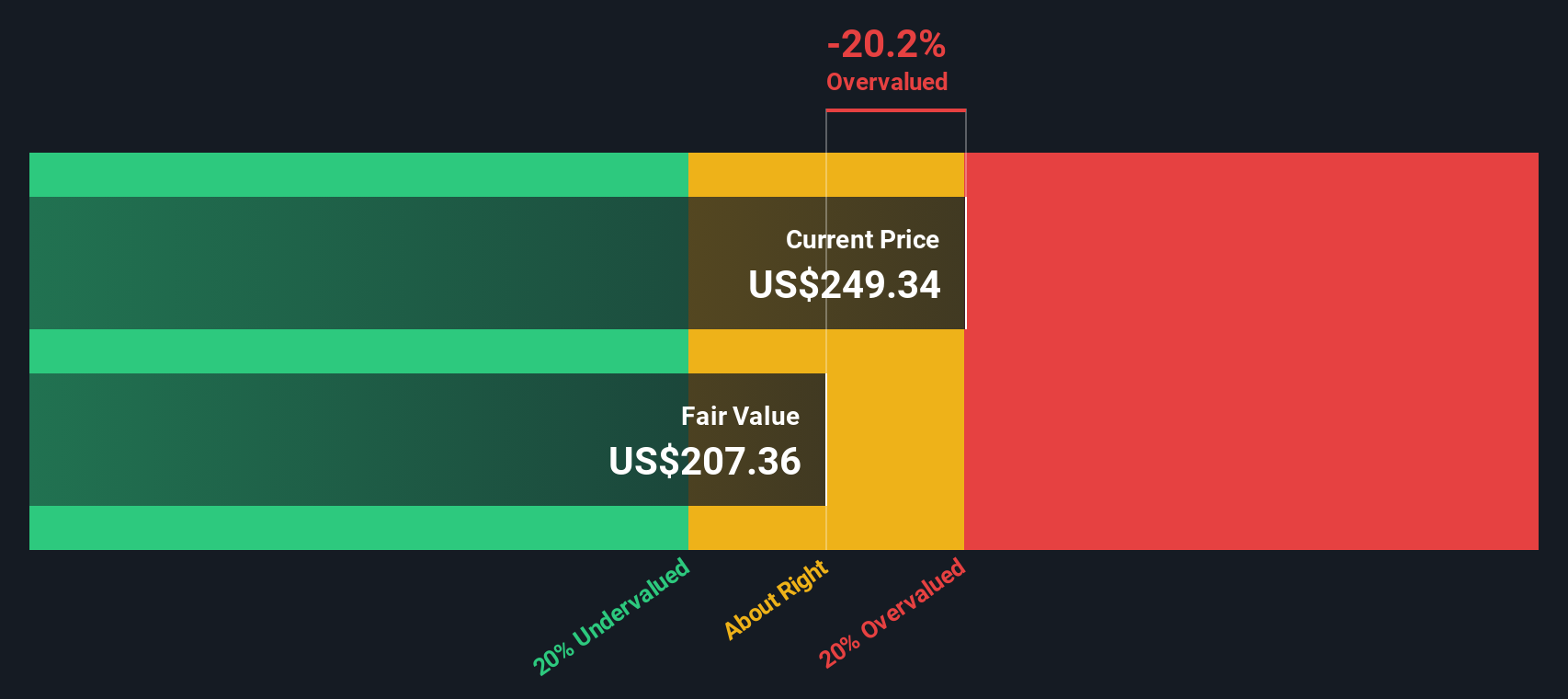

Despite these projections, the DCF model points to a fair value of $207.46 per share. Currently, the market price stands about 17.4% above this estimated intrinsic value. In practical terms, the stock is viewed as overvalued on a cash flow basis at today's price.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Take-Two Interactive Software may be overvalued by 17.4%. Discover 927 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Take-Two Interactive Software Price vs Sales

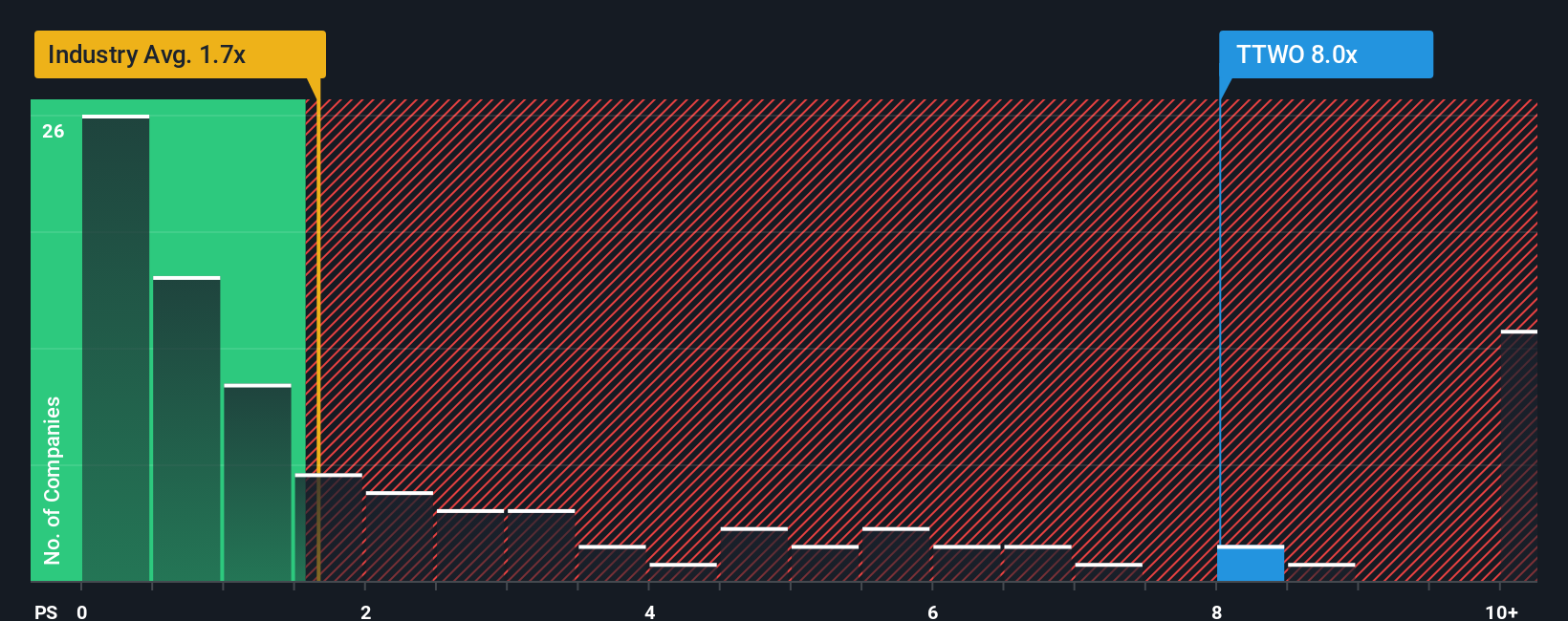

For companies like Take-Two Interactive Software, which are still in the process of translating robust revenue growth into consistent profitability, the Price-to-Sales (P/S) ratio is often the valuation metric of choice. This ratio is particularly useful for businesses that invest heavily in growth or endure volatile earnings, as it provides a straightforward way to compare the company's stock price to its total sales.

Growth expectations and business risks play a critical role in determining what qualifies as a reasonable P/S ratio. Companies with rapid growth prospects and stable operations can warrant higher multiples. Those facing uncertainty or slower sales trajectories typically trade at lower ratios.

Currently, Take-Two trades at a P/S ratio of 7.24x. This stands out when compared to the entertainment industry average of 1.34x and the peer group average of 5.90x. Simply Wall St’s proprietary “Fair Ratio” model, which adjusts for Take-Two’s expected sales growth, profit margins, industry, risks, and market cap, calculates a fair P/S multiple of 5.13x. This approach is more comprehensive than traditional benchmark comparisons, as it considers the full spectrum of factors that drive long-term stock value, not just peer or industry performance.

With the actual P/S multiple exceeding the Fair Ratio by a notable margin, Take-Two Interactive Software’s shares appear overvalued according to this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Take-Two Interactive Software Narrative

Earlier, we mentioned that there is a better way to understand valuation. Let us introduce you to Narratives.

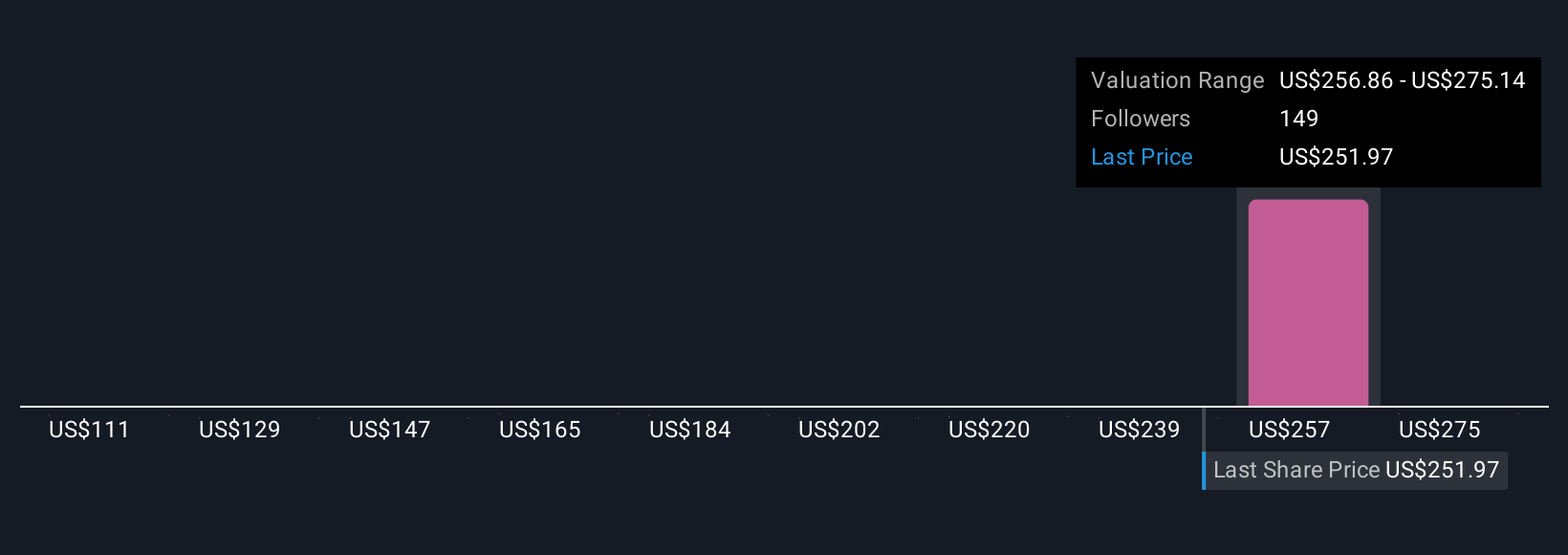

A Narrative is your unique perspective on a company, connecting the story you believe about its future with specific financial forecasts and fair value estimates. Instead of just looking at the numbers in isolation, a Narrative blends your expectations for future revenue, earnings, and profit margins with what you think the company can achieve and why.

Narratives link a company’s story, such as Take-Two’s franchise launches or risks from shifting gamer behavior, to a financial forecast and ultimately a fair value estimate. On Simply Wall St’s Community page, millions of investors share and update their Narratives, making it an accessible way for anyone to frame their investment thinking and compare against the market.

This approach helps you decide whether to buy or sell by highlighting where your fair value view differs from the current market price, and it updates automatically as new news or earnings are released.

For example, some investors’ Narratives for Take-Two see record franchise launches and a strong content pipeline justifying fair values as high as $285, while others worry about rising costs and shifting gamer preferences, resulting in fair values as low as $150. This demonstrates how Narratives capture the full range of informed perspectives.

Do you think there's more to the story for Take-Two Interactive Software? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Take-Two Interactive Software might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TTWO

Take-Two Interactive Software

Develops, publishes, and markets interactive entertainment solutions for consumers worldwide.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

The "Sleeping Giant" Stumbles, Then Wakes Up

Swiped Left by Wall Street: The BMBL Rebound Trade

Duolingo (DUOL): Why A 20% Drop Might Be The Entry Point We've Been Waiting For

Recently Updated Narratives

The Real Power Behind Alphabet’s Growth

RELX: The Quiet Compounder Powering Law, Science, and Risk Intelligence

Why CVS’s Valuation Signals Opportunity

Popular Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026