David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We can see that TechTarget, Inc. (NASDAQ:TTGT) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for TechTarget

What Is TechTarget's Net Debt?

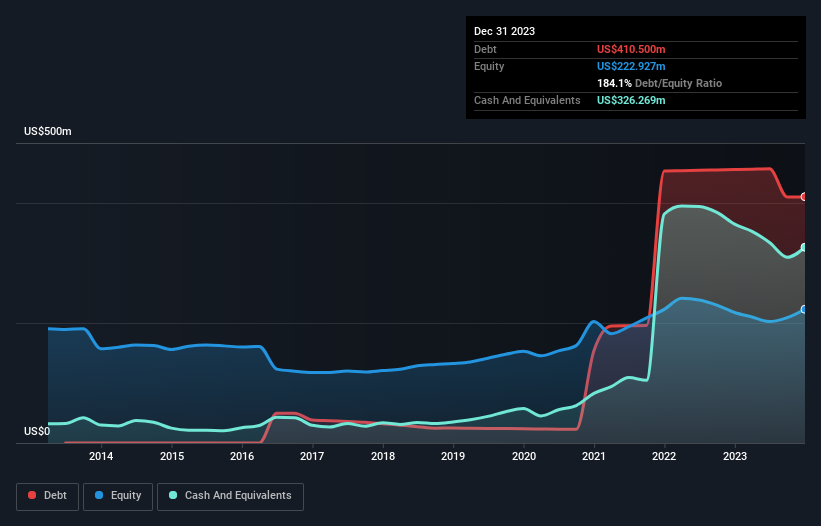

You can click the graphic below for the historical numbers, but it shows that TechTarget had US$410.5m of debt in December 2023, down from US$455.7m, one year before. However, it also had US$326.3m in cash, and so its net debt is US$84.2m.

How Healthy Is TechTarget's Balance Sheet?

The latest balance sheet data shows that TechTarget had liabilities of US$37.0m due within a year, and liabilities of US$440.0m falling due after that. Offsetting these obligations, it had cash of US$326.3m as well as receivables valued at US$39.2m due within 12 months. So its liabilities total US$111.5m more than the combination of its cash and short-term receivables.

Given TechTarget has a market capitalization of US$929.2m, it's hard to believe these liabilities pose much threat. However, we do think it is worth keeping an eye on its balance sheet strength, as it may change over time. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if TechTarget can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, TechTarget made a loss at the EBIT level, and saw its revenue drop to US$230m, which is a fall of 23%. That makes us nervous, to say the least.

Caveat Emptor

While TechTarget's falling revenue is about as heartwarming as a wet blanket, arguably its earnings before interest and tax (EBIT) loss is even less appealing. To be specific the EBIT loss came in at US$2.3m. When we look at that and recall the liabilities on its balance sheet, relative to cash, it seems unwise to us for the company to have any debt. So we think its balance sheet is a little strained, though not beyond repair. On the bright side, we note that trailing twelve month EBIT is worse than the free cash flow of US$58m and the profit of US$4.5m. So one might argue that there's still a chance it can get things on the right track. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with TechTarget , and understanding them should be part of your investment process.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if TechTarget might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:TTGT

TechTarget

Provides marketing and sales services that deliver business impact for business-to-business technology companies in North America and internationally.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives