- United States

- /

- Media

- /

- NasdaqGM:TTD

Trade Desk (TTD): Reassessing Valuation After a Steep Share Price Reset

Reviewed by Simply Wall St

Trade Desk (TTD) has been grinding lower, with the stock down about 67% year to date and roughly 26% in the past 3 months, despite double digit revenue and profit growth.

See our latest analysis for Trade Desk.

That slide has wiped out much of the prior multi year gains, with the 1 year total shareholder return now around negative 72 percent and even the 5 year total shareholder return sitting near negative 58 percent. This is a sign that sentiment and momentum have clearly faded even as fundamentals keep improving.

If Trade Desk’s reset has you rethinking your exposure to digital advertising, this could be a useful moment to scout high growth tech and AI stocks that might be better aligned with your risk and growth appetite.

With shares now trading at a steep discount to analyst targets, even as revenues and profits keep climbing, has the selloff left Trade Desk meaningfully undervalued, or is the market already discounting a much slower growth runway?

Most Popular Narrative Narrative: 38.1% Undervalued

Compared with Trade Desk’s last close at $38.61, the most popular narrative’s fair value estimate of $62.33 implies a sizeable upside and sets an ambitious roadmap for future performance.

The full rollout and high adoption of the new AI-powered Kokai platform, including new tools like Deal Desk and supply chain innovation (OpenPath, Sincera integration), is already leading to >20% better campaign performance and causing existing clients to increase spend at a much faster rate. As the remaining clients transition and the product matures, this should drive step function increases in platform efficiency, gross margin, and average revenue per client.

Curious how this valuation leans so heavily on faster earnings, richer margins, and a punchy future multiple, even after target cuts? The narrative reveals the full playbook.

Result: Fair Value of $62.33 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, concentrated reliance on large brands and CTV, alongside fierce competition from walled gardens, could quickly derail the optimistic upside case.

Find out about the key risks to this Trade Desk narrative.

Another Angle on Valuation

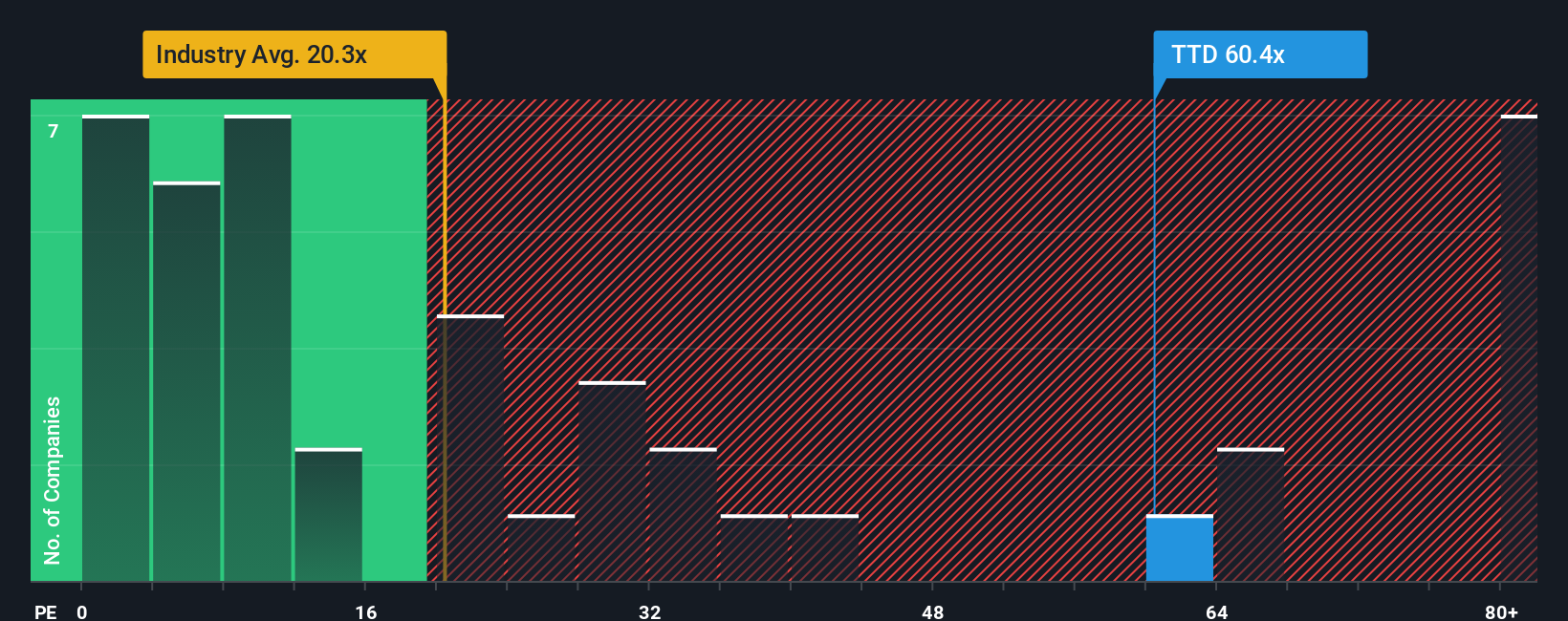

While narratives lean on future earnings and rich multiples, our DCF model paints a starker picture. It suggests Trade Desk is actually expensive at a P/E of 42.6 times, versus a fair ratio closer to 26.3 times and an industry average near 15.5 times. Could the market still be overpaying for growth that may not fully arrive?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Trade Desk Narrative

If this perspective does not fully match your view, you can dive into the numbers yourself and craft a complete narrative in minutes, Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Trade Desk.

Ready for your next investing move?

Do not stop at one stock when a world of opportunities is a click away. Use the Simply Wall Street Screener now to uncover fresh ideas.

- Capitalize on mispriced quality by reviewing these 912 undervalued stocks based on cash flows built on strong cash flow potential and robust fundamentals.

- Explore machine learning innovation with these 25 AI penny stocks positioned to benefit from accelerating enterprise and consumer adoption.

- Strengthen your income strategy through these 14 dividend stocks with yields > 3% offering attractive yields plus room for stable, long term growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026