- United States

- /

- Media

- /

- NasdaqGM:TTD

How Investors May Respond To Trade Desk (TTD) Gaining Intuit SMB First-Party Data Access

Reviewed by Sasha Jovanovic

- In November 2025, Intuit announced that its SMB MediaLabs first-party small and mid-market business audience segments are now available on The Trade Desk platform, giving advertisers privacy-conscious access to millions of verified U.S. SMB decision-makers across connected TV, audio, display, and digital out-of-home channels via LiveRamp.

- This integration addresses advertisers’ long-standing difficulty in accurately reaching high-value SMB buyers by replacing fragmented, outdated third-party data with aggregated, de-identified first-party insights that can materially improve targeting efficiency and campaign relevance.

- Next, we’ll examine how ARK’s sizeable Trade Desk purchase, following this Intuit data integration, could influence the company’s investment narrative.

AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Trade Desk Investment Narrative Recap

To own Trade Desk, you need to believe that independent, data driven advertising on the open internet will keep attracting budget despite pressure from the big walled gardens. The Intuit SMB MediaLabs integration supports the core catalyst around better first party data and measurable ROI, but it does not materially change the nearer term risk from Amazon and Google’s growing programmatic strength or recent pricing concessions Trade Desk has started offering to agencies.

In that context, ARK’s sizeable Trade Desk purchase after the Intuit news stands out as the most relevant recent development. It highlights how some investors are leaning into the Kokai and first party data story right as the company faces share losses to Amazon, mixed guidance and leadership turnover, all of which could shape how quickly those catalysts show up in the numbers.

Yet beneath the promise of better targeting and AI driven campaigns, investors should still be aware of the growing competitive pressure from walled gardens and Trade Desk’s recent shift on pricing...

Read the full narrative on Trade Desk (it's free!)

Trade Desk's narrative projects $4.3 billion revenue and $823.2 million earnings by 2028. This requires 17.1% yearly revenue growth and an earnings increase of about $406 million from $417.2 million today.

Uncover how Trade Desk's forecasts yield a $62.33 fair value, a 56% upside to its current price.

Exploring Other Perspectives

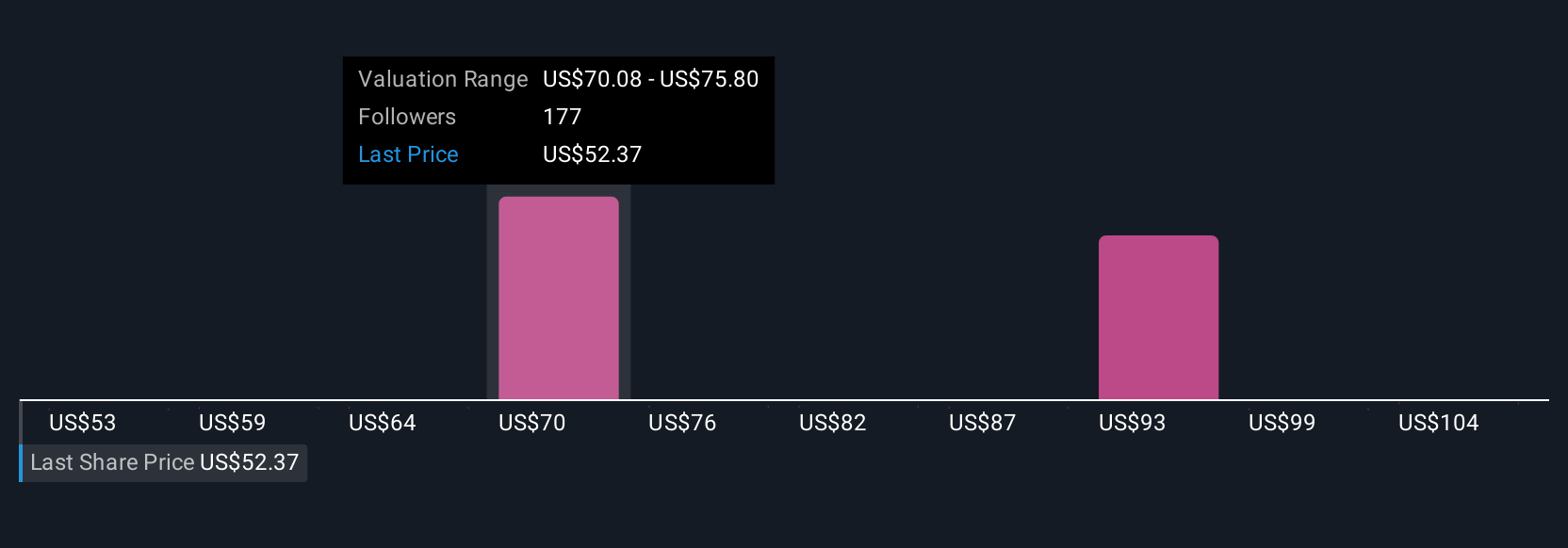

Thirty eight members of the Simply Wall St Community now value Trade Desk between US$39.48 and US$111.31 per share, reflecting very different expectations. Against that diversity, the key question is whether Trade Desk’s push into richer first party data and Kokai driven performance can offset the competitive and concentration risks outlined above and what that might mean for future operating momentum.

Explore 38 other fair value estimates on Trade Desk - why the stock might be worth over 2x more than the current price!

Build Your Own Trade Desk Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Trade Desk research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Trade Desk research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Trade Desk's overall financial health at a glance.

No Opportunity In Trade Desk?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trade Desk might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TTD

Trade Desk

Operates as a technology company in the United States and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026