- United States

- /

- Aerospace & Defense

- /

- OTCPK:AERG

Rapid Micro Biosystems Leads 3 Exciting US Penny Stocks To Monitor

Reviewed by Simply Wall St

As the S&P 500 inches toward record highs and investors digest a wave of earnings reports, attention turns to smaller segments of the market that might offer unique opportunities. Penny stocks, though often considered a relic of past market eras, continue to represent potential growth avenues for those willing to explore lesser-known companies. By focusing on firms with robust financials and clear growth trajectories, investors can uncover promising opportunities in this niche segment.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88 | $6.38M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $120.63M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2798 | $10.12M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.99 | $90.69M | ★★★★★★ |

| North European Oil Royalty Trust (NYSE:NRT) | $4.82 | $45.59M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| BTCS (NasdaqCM:BTCS) | $2.95 | $53.09M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.52 | $26.96M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.882 | $81.84M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.61 | $396.15M | ★★★★☆☆ |

Click here to see the full list of 706 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Rapid Micro Biosystems (NasdaqCM:RPID)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Rapid Micro Biosystems, Inc. is a life sciences technology company that offers products for detecting microbial contamination in the pharmaceutical, medical device, and personal care manufacturing sectors globally, with a market cap of $130.39 million.

Operations: The company generates revenue of $26.17 million from its Systems and Related LIMS Connection Software, Consumables, and Services segment.

Market Cap: $130.39M

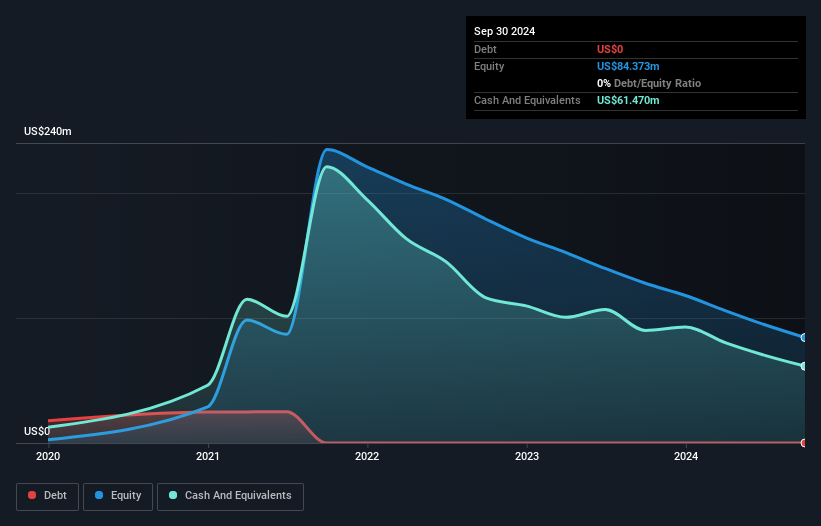

Rapid Micro Biosystems, Inc., with a market cap of US$130.39 million, is navigating the challenges of being unprofitable while experiencing increased losses over the past five years. Despite this, it has no debt and its short-term assets significantly exceed both short- and long-term liabilities. The company forecasts revenue growth of 18.45% annually and guides for a 25% increase in full-year 2024 revenue to US$28.1 million, indicating potential in its Systems and Related LIMS Connection Software segment. However, volatility remains high with a negative return on equity at -57.36%, reflecting ongoing profitability challenges.

- Dive into the specifics of Rapid Micro Biosystems here with our thorough balance sheet health report.

- Gain insights into Rapid Micro Biosystems' future direction by reviewing our growth report.

trivago (NasdaqGS:TRVG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: trivago N.V. operates a hotel and accommodation search platform across various international markets, including the United States, Germany, and Japan, with a market cap of approximately $211.62 million.

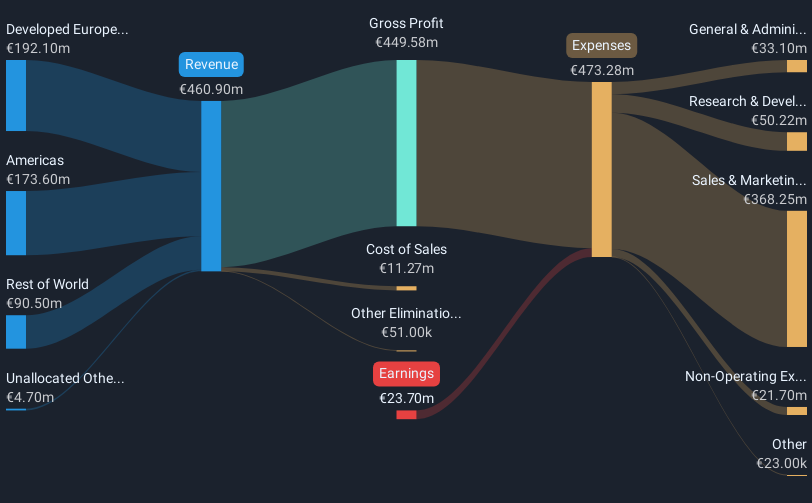

Operations: The company's revenue is derived from three primary segments: Developed Europe (€192.1 million), the Americas (€173.6 million), and the Rest of World (€90.5 million).

Market Cap: $211.62M

trivago N.V., with a market cap of approximately US$211.62 million, is navigating its unprofitable status while maintaining a strong cash runway for over three years, even with positive free cash flow. The company's recent earnings report showed revenue growth to €94.78 million in Q4 2024, up from €91.7 million the previous year, alongside an increase in net income to €5.06 million. Despite management changes and high share price volatility, trivago remains debt-free and trades at a significant discount to estimated fair value, suggesting potential upside if profitability improves.

- Unlock comprehensive insights into our analysis of trivago stock in this financial health report.

- Evaluate trivago's prospects by accessing our earnings growth report.

Applied Energetics (OTCPK:AERG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Applied Energetics, Inc. provides advanced optical and ultrashort pulse directed energy solutions for defense, national security, industrial, biomedical, and scientific sectors globally with a market cap of $217.71 million.

Operations: The company generates revenue through its Aerospace & Defense segment, which reported $2.53 million.

Market Cap: $217.71M

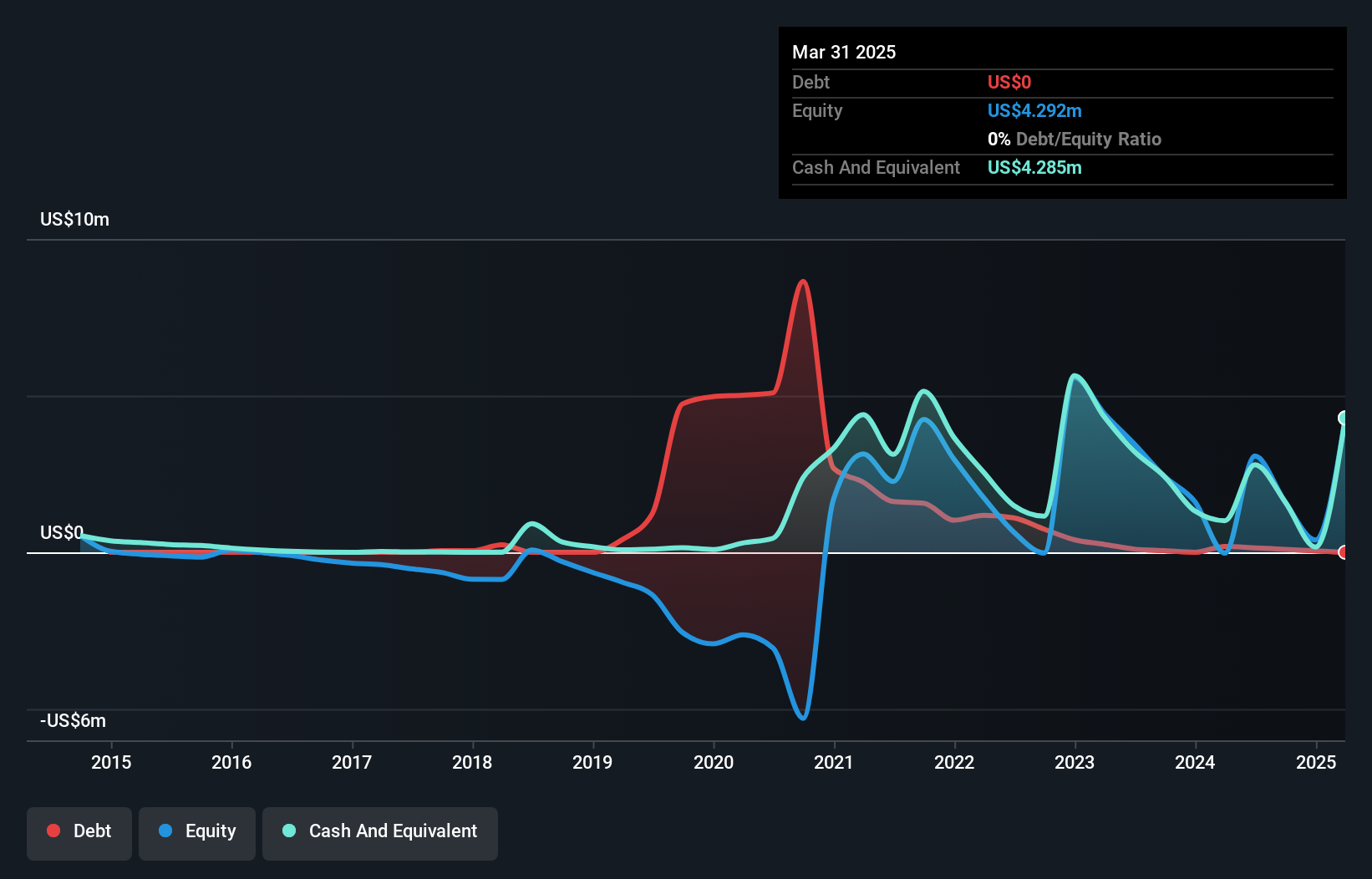

Applied Energetics, Inc., with a market cap of US$217.71 million, operates in the defense sector and is currently pre-revenue, reporting sales of US$1.66 million for the first nine months of 2024. The company has experienced leadership changes with Chris Donaghey appointed as CEO, bringing extensive industry expertise. Applied Energetics recently engaged in a strategic alliance with Kord Technologies to enhance its directed energy solutions and raised approximately US$4.8 million through private placements to bolster its financial position amidst high share price volatility and ongoing unprofitability challenges. Despite these hurdles, it maintains positive shareholder equity and manageable debt levels.

- Jump into the full analysis health report here for a deeper understanding of Applied Energetics.

- Gain insights into Applied Energetics' past trends and performance with our report on the company's historical track record.

Seize The Opportunity

- Reveal the 706 hidden gems among our US Penny Stocks screener with a single click here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OTCPK:AERG

Applied Energetics

Engages in the provision of advanced optical technologies and ultrashort pulse directed energy solutions utilizing dual-use laser and optical technologies to defense, national security, industrial, biomedical, and scientific customers worldwide.

Flawless balance sheet low.

Market Insights

Community Narratives