- United States

- /

- Entertainment

- /

- NYSE:SE

3 Growth Companies With Insider Ownership Up To 19%

Reviewed by Simply Wall St

Over the last 7 days, the United States market has remained flat, yet it is up 12% over the past year with earnings expected to grow by 15% per annum in the coming years. In this environment, growth companies with significant insider ownership can be appealing as they often indicate strong confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Zapp Electric Vehicles Group (ZAPP.F) | 16.1% | 170.8% |

| Wallbox (WBX) | 15.4% | 75.8% |

| Super Micro Computer (SMCI) | 13.9% | 38.2% |

| Prairie Operating (PROP) | 34.6% | 92.4% |

| Niu Technologies (NIU) | 36% | 88.1% |

| FTC Solar (FTCI) | 28.3% | 62.5% |

| Enovix (ENVX) | 12.1% | 47% |

| Credo Technology Group Holding (CRDO) | 11.8% | 36.9% |

| Atour Lifestyle Holdings (ATAT) | 21.8% | 23.7% |

| Astera Labs (ALAB) | 12.9% | 44.4% |

Let's explore several standout options from the results in the screener.

trivago (TRVG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: trivago N.V., along with its subsidiaries, operates a hotel and accommodation search platform across various international markets, including the United States, Germany, and Japan, with a market cap of approximately $251.24 million.

Operations: The company's revenue is segmented as follows: Americas at €180.46 million, Rest of World at €98.45 million, and Developed Europe at €200.46 million.

Insider Ownership: 19.6%

trivago has shown promising growth potential, with earnings forecasted to grow significantly at 74.89% per year. It is trading at a substantial discount of 69.6% below its estimated fair value, indicating good relative value compared to peers. Despite high volatility in share price recently, the company expects mid-teens revenue growth for 2025 and aims for profitability within three years—outpacing average market growth projections. Recent insider activity remains stable with no substantial buying or selling reported.

- Dive into the specifics of trivago here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, trivago's share price might be too pessimistic.

loanDepot (LDI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: loanDepot, Inc. operates in the United States by originating, financing, selling, and servicing residential mortgage loans with a market cap of approximately $481.67 million.

Operations: The company's revenue is primarily derived from the originating, financing, and selling of mortgage loans, amounting to $1.09 billion.

Insider Ownership: 17.4%

loanDepot's recent inclusion in multiple Russell indices highlights its visibility among growth companies. Despite a net loss of US$21.9 million in Q1 2025, improved from the previous year, earnings are forecast to grow significantly at 109.88% annually. Revenue is expected to increase by 14.2% per year, outpacing the broader US market but below high-growth benchmarks. While insider trading has been stable with no significant activity reported recently, loanDepot trades at good value compared to peers and industry standards.

- Click to explore a detailed breakdown of our findings in loanDepot's earnings growth report.

- Our valuation report here indicates loanDepot may be undervalued.

Sea (SE)

Simply Wall St Growth Rating: ★★★★★☆

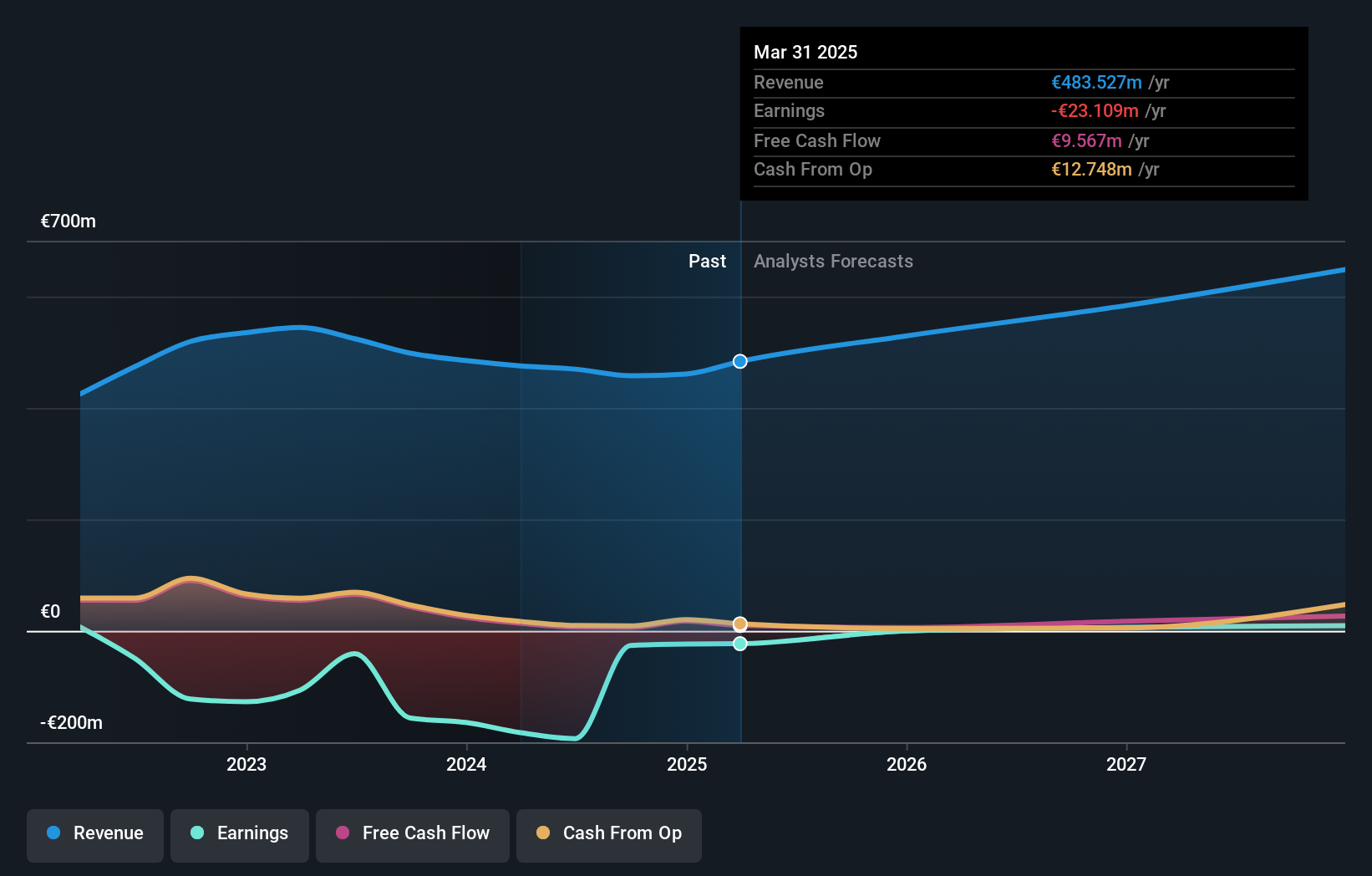

Overview: Sea Limited operates as a consumer internet company through its subsidiaries, providing services in Southeast Asia, Latin America, the rest of Asia, and internationally with a market cap of approximately $93.69 billion.

Operations: The company's revenue is primarily derived from its E-Commerce segment at $13.19 billion, followed by Digital Financial Services at $2.66 billion, and Digital Entertainment contributing $1.95 billion, with Other Services generating $131.44 million.

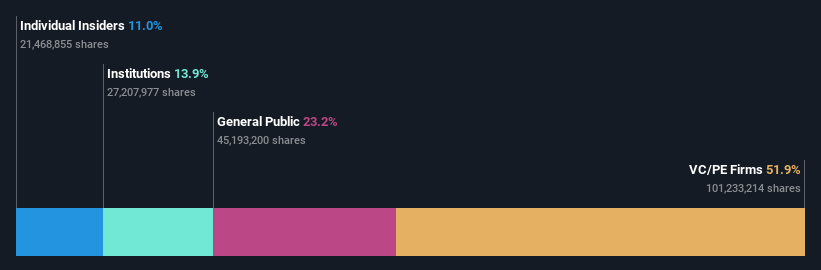

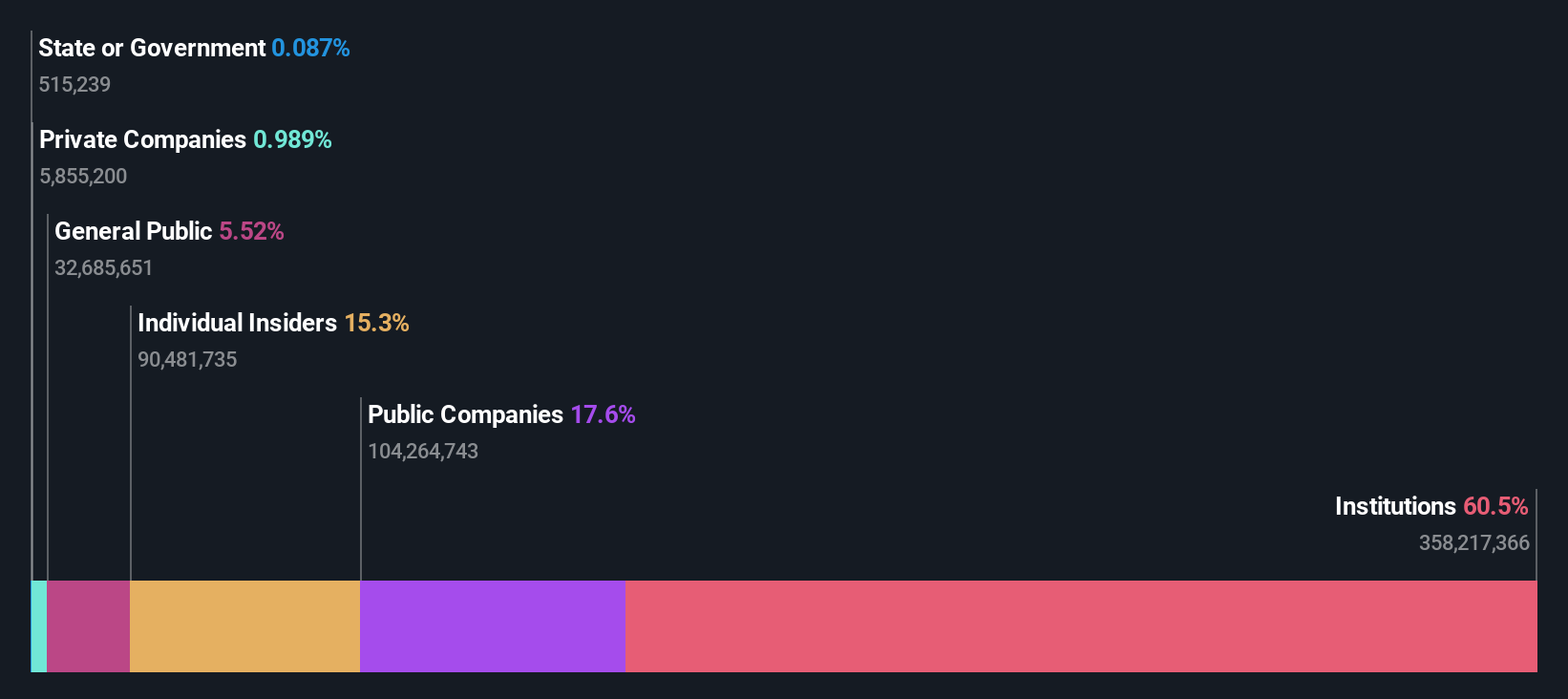

Insider Ownership: 15.3%

Sea Limited's recent earnings report shows strong growth with revenue reaching US$4.84 billion, up from US$3.73 billion, and net income swinging to US$403.05 million from a loss a year ago. Earnings are projected to grow significantly at 30.18% annually, outpacing the broader US market's 14.8%. Despite slower revenue growth at 14.6% per year compared to high-growth benchmarks, Sea trades below its estimated fair value with no recent insider trading activity noted.

- Take a closer look at Sea's potential here in our earnings growth report.

- Our expertly prepared valuation report Sea implies its share price may be too high.

Where To Now?

- Reveal the 194 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

- Ready For A Different Approach? We've found 18 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SE

Sea

Through its subsidiaries, operates as a consumer internet company in Southeast Asia, Latin America, the rest of Asia, and internationally.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives