- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

Will Tripadvisor’s (TRIP) SEO Traffic Decline Test the Durability of Its Brand Advantage?

Reviewed by Sasha Jovanovic

- Tripadvisor recently announced its annual Travelers' Choice Awards, celebrating the world's top 25 casual restaurants based on 2024 user reviews, with Pizzeria Arrivederci in Paris taking the top spot and Bodegas Mezquita Céspedes in Spain earning the overall prize during the company's 25th anniversary.

- While Tripadvisor received widespread positive attention for elevating global dining destinations, concerns have emerged over a reported 33% decline in organic search visits due to growing competition from AI-powered search technologies.

- We'll examine how the sharp drop in SEO-driven traffic could reshape Tripadvisor's investment narrative and long-term growth prospects.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Tripadvisor Investment Narrative Recap

To be a shareholder in Tripadvisor, you have to believe in the power of its brand and user-generated content to drive global travel discovery, even as search engines and AI platforms erode its organic traffic. While the recent Travelers' Choice Awards brought widespread attention to Tripadvisor, the 33% drop in SEO-driven traffic exemplifies the most significant short-term risk to both revenue stability and future growth. Nevertheless, the current headlines do not materially shift Tripadvisor's key near-term catalyst: expansion in high-margin experiences segments like Viator, but heighten the risk tied to traffic sources.

Of Tripadvisor’s recent updates, the ongoing share repurchase program stands out; the company has bought back nearly 4% of its shares this year, a move that may signal confidence in longer-term value creation. For investors following the stock closely, this commitment joins the launch of new content platforms and reflects ongoing efforts to respond to shifting digital trends while trying to steady earnings and margin growth. However, in contrast to reassuring buybacks, the real investor risk continues to be...

Read the full narrative on Tripadvisor (it's free!)

Tripadvisor's narrative projects $2.3 billion revenue and $144.6 million earnings by 2028. This requires 7.1% yearly revenue growth and a $79.6 million earnings increase from $65.0 million today.

Uncover how Tripadvisor's forecasts yield a $18.16 fair value, a 14% upside to its current price.

Exploring Other Perspectives

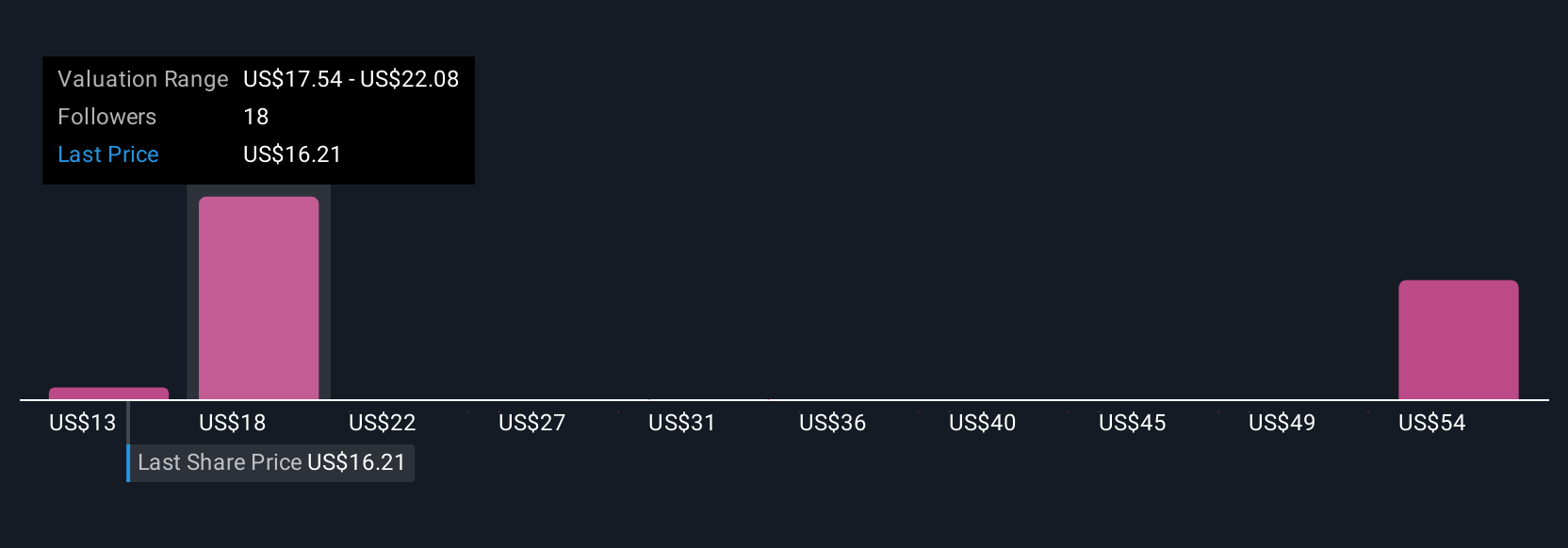

Eight members of the Simply Wall St Community have published fair value estimates for Tripadvisor ranging from US$13.50 to US$54.26 per share. These diverse views come at a time when organic traffic headwinds are intensifying, reminding you that market participants weigh both upside potential and traffic-related risks quite differently, explore several viewpoints before making up your mind.

Explore 8 other fair value estimates on Tripadvisor - why the stock might be worth 16% less than the current price!

Build Your Own Tripadvisor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tripadvisor research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tripadvisor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tripadvisor's overall financial health at a glance.

Want Some Alternatives?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives