- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:TRIP

Even after rising 3.1% this past week, Tripadvisor (NASDAQ:TRIP) shareholders are still down 48% over the past five years

The main aim of stock picking is to find the market-beating stocks. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term Tripadvisor, Inc. (NASDAQ:TRIP) shareholders for doubting their decision to hold, with the stock down 53% over a half decade. And some of the more recent buyers are probably worried, too, with the stock falling 29% in the last year. Even worse, it's down 10% in about a month, which isn't fun at all.

The recent uptick of 3.1% could be a positive sign of things to come, so let's take a look at historical fundamentals.

See our latest analysis for Tripadvisor

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During five years of share price growth, Tripadvisor moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 11% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

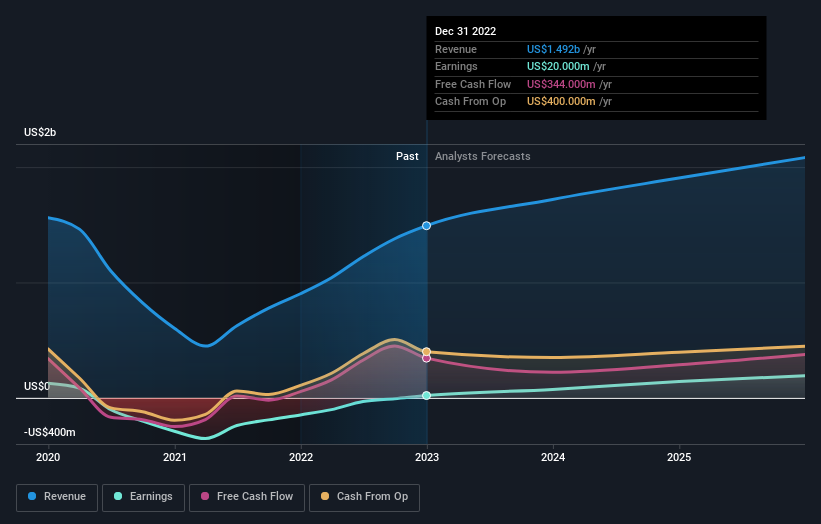

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Tripadvisor is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Tripadvisor will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Tripadvisor's total shareholder return (TSR) and its share price change, which we've covered above. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Tripadvisor hasn't been paying dividends, but its TSR of -48% exceeds its share price return of -53%, implying it has either spun-off a business, or raised capital at a discount; thereby providing additional value to shareholders.

A Different Perspective

We regret to report that Tripadvisor shareholders are down 29% for the year. Unfortunately, that's worse than the broader market decline of 11%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 8% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Tripadvisor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:TRIP

Tripadvisor

TripAdvisor, Inc., an online travel company, engages in the provision of travel guidance products and services worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives