- United States

- /

- Auto Components

- /

- NasdaqGS:SLDP

Marqeta And 2 Other Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The market has climbed 5.3% in the last 7 days, showing a robust upward trend with a 12% increase over the past year and earnings forecasted to grow by 14% annually. While penny stocks may seem like a term from another era, they continue to offer intriguing opportunities for investors seeking growth at lower price points, particularly when these stocks are backed by strong financials. This article explores several penny stocks that stand out for their potential and financial strength in today's market landscape.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Safe Bulkers (NYSE:SB) | $3.61 | $372.2M | ✅ 3 ⚠️ 3 View Analysis > |

| IDenta (OTCPK:IDTA) | $0.75 | $3.03M | ✅ 2 ⚠️ 3 View Analysis > |

| Tuya (NYSE:TUYA) | $2.71 | $1.54B | ✅ 3 ⚠️ 3 View Analysis > |

| WM Technology (NasdaqGS:MAPS) | $1.14 | $188.36M | ✅ 4 ⚠️ 1 View Analysis > |

| Flexible Solutions International (NYSEAM:FSI) | $4.44 | $56.66M | ✅ 4 ⚠️ 2 View Analysis > |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.66 | $91.2M | ✅ 3 ⚠️ 2 View Analysis > |

| BAB (OTCPK:BABB) | $0.84 | $5.96M | ✅ 2 ⚠️ 3 View Analysis > |

| Dingdong (Cayman) (NYSE:DDL) | $2.37 | $518.62M | ✅ 4 ⚠️ 0 View Analysis > |

| Lifetime Brands (NasdaqGS:LCUT) | $3.315 | $81.59M | ✅ 3 ⚠️ 2 View Analysis > |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.935 | $81.31M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 756 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Marqeta (NasdaqGS:MQ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Marqeta, Inc. operates a cloud-based open API platform for card issuing and transaction processing services and has a market cap of approximately $2.18 billion.

Operations: The company generates revenue from its services to financial companies, amounting to $528.10 million.

Market Cap: $2.18B

Marqeta, Inc. has recently reported a net loss reduction to US$8.26 million for Q1 2025, down from US$36.06 million the previous year, while achieving sales of US$139.07 million. The company operates debt-free and has sufficient short-term assets to cover liabilities, indicating financial stability despite a forecasted earnings decline over the next three years. Marqeta's platform continues to attract clients like Perpay and Spendesk, highlighting its appeal in modern credit solutions and spend management services. Recent executive changes may affect strategic direction as Marqeta navigates its growth trajectory amidst market challenges.

- Click here and access our complete financial health analysis report to understand the dynamics of Marqeta.

- Learn about Marqeta's future growth trajectory here.

Solid Power (NasdaqGS:SLDP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Solid Power, Inc. focuses on developing solid-state battery technologies for electric vehicles and other markets in the United States, with a market cap of approximately $256.49 million.

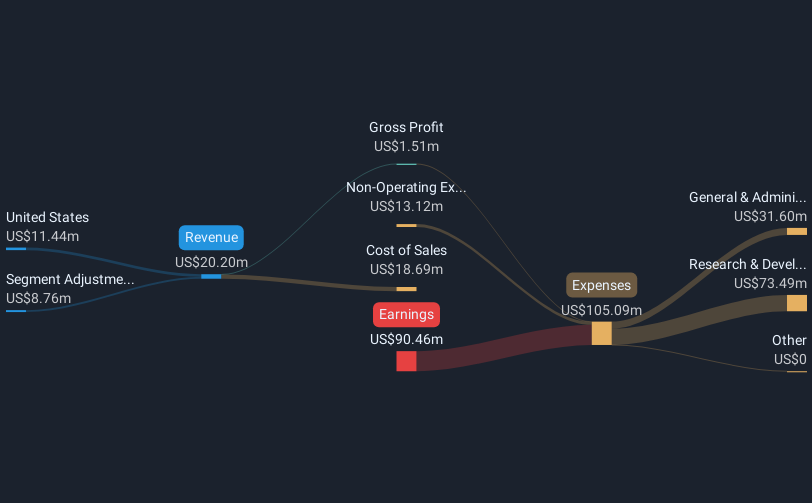

Operations: The company's revenue is primarily derived from its Auto Parts & Accessories segment, amounting to $20.20 million.

Market Cap: $256.49M

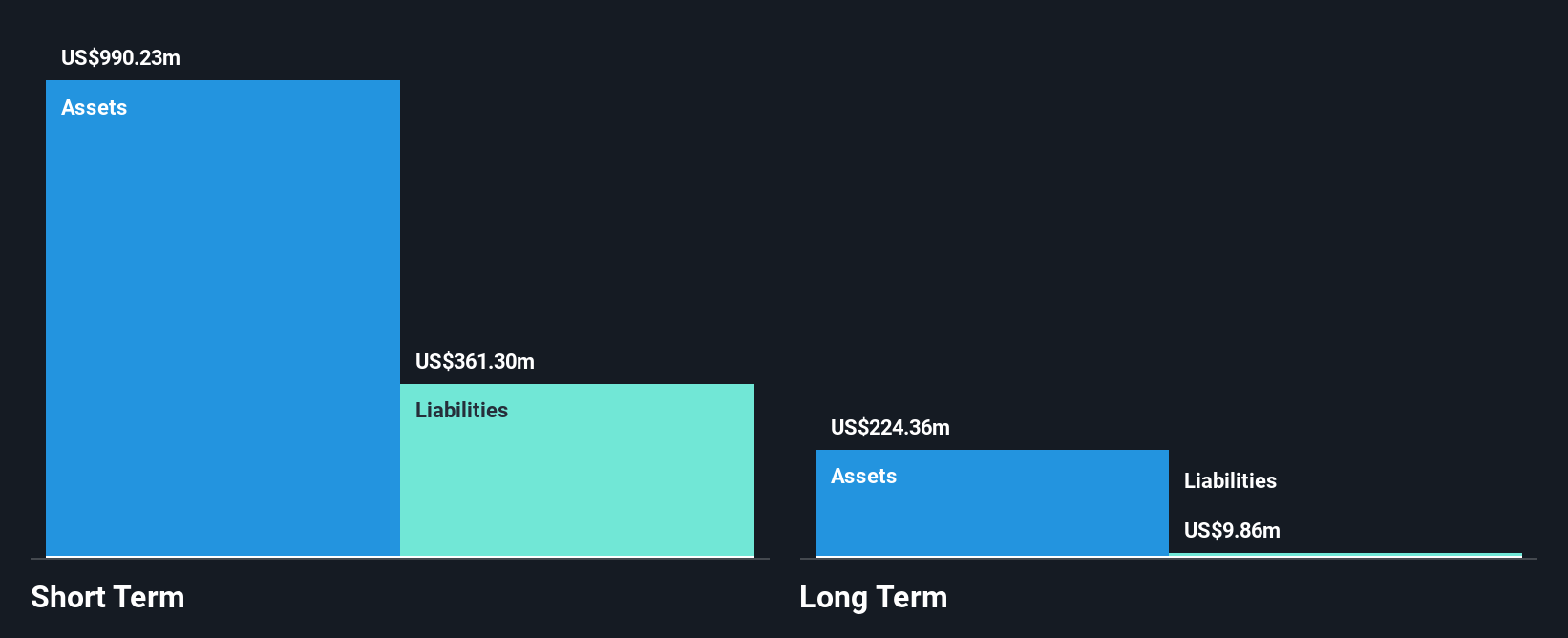

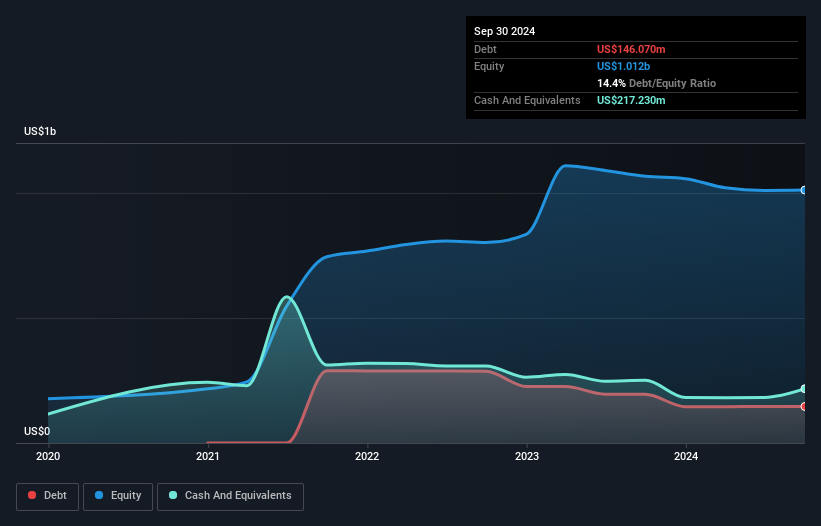

Solid Power, Inc. recently reported Q1 2025 sales of US$6.02 million, slightly up from the previous year, with a net loss reduction to US$15.15 million. The company remains unprofitable and is not expected to achieve profitability in the next three years despite revenue forecasts indicating growth. Solid Power's financial position is bolstered by short-term assets exceeding liabilities and no debt burden, providing a cash runway exceeding three years at current free cash flow rates. The management team has limited experience, potentially impacting strategic execution as they focus on developing solid-state battery technologies amidst industry challenges.

- Click here to discover the nuances of Solid Power with our detailed analytical financial health report.

- Assess Solid Power's future earnings estimates with our detailed growth reports.

Taboola.com (NasdaqGS:TBLA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Taboola.com Ltd. operates an artificial intelligence-based algorithmic engine platform across various countries including Israel, the United States, and the United Kingdom, with a market cap of approximately $1.10 billion.

Operations: Taboola.com Ltd. has not reported any specific revenue segments.

Market Cap: $1.1B

Taboola.com Ltd. has shown resilience in the penny stock arena with a market cap of US$1.10 billion, reflecting its strategic partnerships and financial maneuvers. The company reported Q1 2025 earnings with sales of US$427.49 million, narrowing its net loss to US$8.75 million from the previous year, signaling improved financial health. Taboola's recent partnership with Samsung and an extended alliance with Gannett Co., Inc., alongside a new $270 million revolving credit facility, enhance its operational flexibility and market reach. Despite low return on equity at 1.4%, Taboola's cash flow covers debt well, supporting ongoing growth initiatives.

- Get an in-depth perspective on Taboola.com's performance by reading our balance sheet health report here.

- Review our growth performance report to gain insights into Taboola.com's future.

Taking Advantage

- Dive into all 756 of the US Penny Stocks we have identified here.

- Interested In Other Possibilities? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SLDP

Solid Power

Develops solid-state battery technologies for the electric vehicles (EV) and other markets in the United States.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives