- United States

- /

- Interactive Media and Services

- /

- NasdaqCM:SLE

Super League Gaming, Inc.'s (NASDAQ:SLGG) Subdued P/S Might Signal An Opportunity

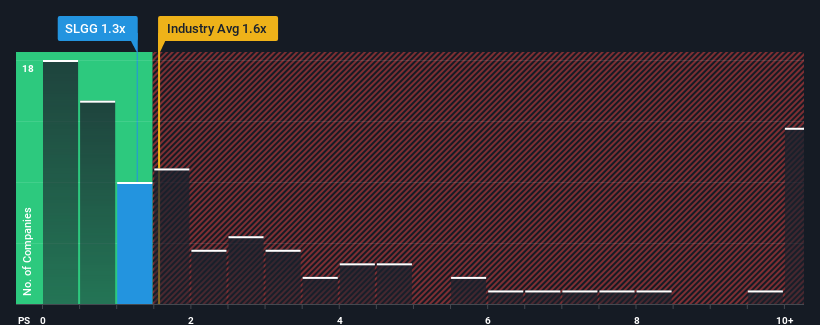

It's not a stretch to say that Super League Gaming, Inc.'s (NASDAQ:SLGG) price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" for companies in the Interactive Media and Services industry in the United States, where the median P/S ratio is around 1.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for Super League Gaming

What Does Super League Gaming's P/S Mean For Shareholders?

Super League Gaming certainly has been doing a good job lately as it's been growing revenue more than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Super League Gaming's future stacks up against the industry? In that case, our free report is a great place to start.How Is Super League Gaming's Revenue Growth Trending?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Super League Gaming's to be considered reasonable.

Taking a look back first, we see that the company grew revenue by an impressive 69% last year. Spectacularly, three year revenue growth has ballooned by several orders of magnitude, thanks in part to the last 12 months of revenue growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 55% during the coming year according to the dual analysts following the company. That's shaping up to be materially higher than the 5.9% growth forecast for the broader industry.

In light of this, it's curious that Super League Gaming's P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Super League Gaming's P/S?

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Looking at Super League Gaming's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Plus, you should also learn about these 4 warning signs we've spotted with Super League Gaming (including 1 which is significant).

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SLE

Super League Enterprise

Super League Enterprise, Inc. creates and publishes content and media solutions across immersive platforms in the United States and internationally.

Slight with mediocre balance sheet.